Worldwide PC Shipments Decline 11 Percent In Q2 2013, Apple Underperforms Overall US Market

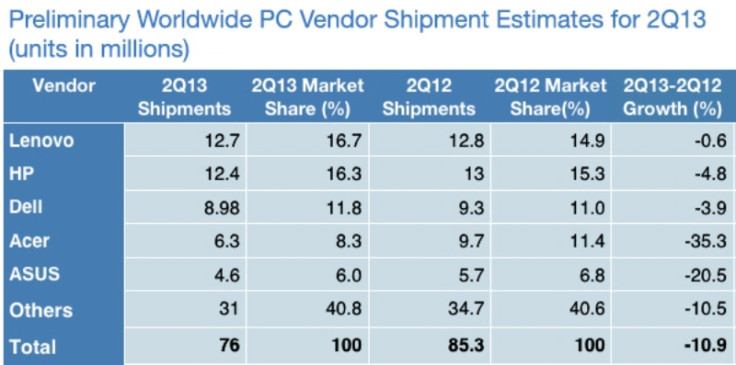

Worldwide shipments of personal computers, or PCs, slid to 76 million units in the second quarter of 2013, a 10.9 percent decline from the same period last year, a new Gartner report said on Wednesday, adding that it was the fifth consecutive quarter of declining shipments in the PC segment.

During the three-month period ending in June, all regions experienced a year-on-year decline, with the Asia-Pacific market showing five consecutive quarters of decline in shipments, while the Europe/Middle East/Asia market registered its second consecutive double-digit fall.

“We are seeing the PC market reduction directly tied to the shrinking installed base of PCs, as inexpensive tablets displace the low-end machines used primarily for consumption in mature and developed markets,” Mikako Kitagawa, principal analyst at Gartner, said in a statement on Wednesday.

“In emerging markets, inexpensive tablets have become the first computing device for many people, who at best are deferring the purchase of a PC. This is also accounting for the collapse of the mini notebook market.”

Lenovo (HKG:0992) grabbed the top position with only a small gain in market share over previous year's leader HP (NYSE:HPQ), which came in second. While Lenovo accounted for 16.7 percent of the global PC market, HP claimed 16.3 percent of the entire market.

Dell’s (NASDAQ:DELL) shipments declined compared to a year ago, but its second quarter results showed a smaller decline than what was seen over the past several quarters.

Take a look at the table here:

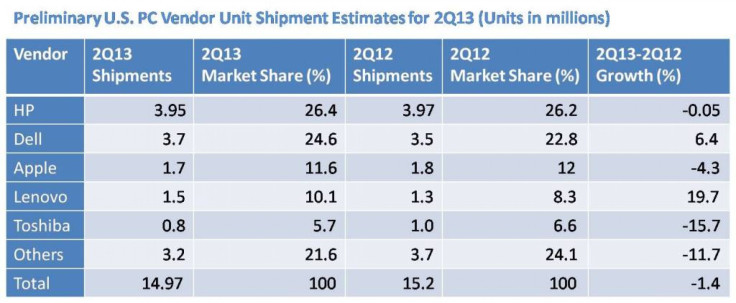

In the U.S. market, PC shipments totaled 15 million units in the second quarter of 2013, a 1.4 percent decline from the second quarter of 2012. This decline was less than the past seven quarters, and Gartner claimed that the market grew 8.5 percent quarter-on-quarter.

“Our preliminary results indicate that this reduced market decline was attributed to solid growth in the professional market,” Kitagawa said. “Three of the major professional PC suppliers, HP, Dell and Lenovo, all registered better than U.S. average growth rate. The end of Windows XP support potentially drove the remaining PC refresh in the U.S. professional market.”

HP took the top position with 26.4 percent of the market, despite suffering a slight decline of 0.5 percent year-over-year. Dell was the only manufacturer among the top three companies to show positive growth rate for the second quarter. The company accounted for 24.6 percent of the U.S. PC market, with a 6.4 percent growth on shipments of 3.7 million units.

Apple (NASDAQ:AAPL) stood third with 11.6 percent of the U.S. market. The company shipped 1.7 million Macs for the quarter, down 4.3 percent compared to the same quarter in 2012. It is worth mentioning here that iPads were not counted as PCs in the report by Gartner.

Take a look at the figures here:

© Copyright IBTimes 2024. All rights reserved.