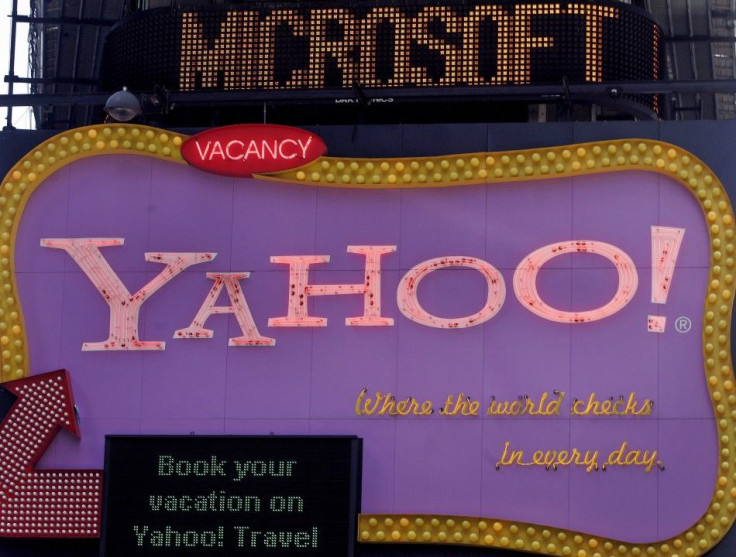

Yahoo Surges 10% on Reports of Renewed Microsoft Bid

Shares of Yahoo! Inc. (NYSE: YHOO) soared 10.10 percent on Wednesday on a report that Microsoft Corp. (Nasdaq: MSFT) is among potential suitors considering making a bid for the beleaguered search engine company, according to a Reuters report.

In 2008, Microsoft tried -- and spectacularly failed -- to buy Yahoo at a price of $33 per share, which valued the company at about $47.5 billion. Yahoo now has a market cap of about $20 billion and is trading at just under $16 per share.

According to other reports, there may be a host of other bidders for Yahoo as well, including private equity firms Providence Equity Partners, Hellman & Friedman and Silver Lake Partners; Chinese e-commerce company Alibaba (in which Yahoo has a stake) and Russian technology investment firm DST Global.

However, the Reuters report also indicated that top brass at Microsoft is divided over the prospect of seeking to acquire Yahoo – one group apparently believes such a deal would destroy AOL, while another faction doesn’t think Microsoft should commit billions of dollars to a company with low-growth.

One unnamed Microsoft executive told Reuters: Yahoo's value hasn't grown in years, and some executives feel we should buy something that is more forward-looking.”

Yahoo announced last month it was exploring strategic options with potential partners and also retained Goldman Sachs and Allen & Co. to serve as advisers for any such deal.

Robert Phillips, managing principal at Spectrum Management in Indianapolis, Ind. told the International Business Times that Yahoo would probably be better off selling off pieces of itself rather than submit to a takeover in whole.

He noted that the company’s most attractive assets are its stakes in the fast-growing Yahoo Japan (35 percent owned by Yahoo), the dominant search company in Japan; and China-based internet firm Alibaba Group (43 percent owned by Yahoo).

© Copyright IBTimes 2024. All rights reserved.