You don’t need QE2 now: Sargen

“The evidence today suggests we don’t need [QE2],” said Nicholas Sargen, chief investment officer at Fort Washington Investment Advisors on Bloomberg TV.

Sargen said economic growth is strong enough to ward off fears of deflation, which was a major reason that the Federal Reserve went ahead with its controversial $600-billion program of quantitative easing (QE2) in the first place.

Unlike the growth witnessed during the fourth quarter of 2009 (which was fueled by inventory building), the current economic expansion is more balanced, consisting of consumer spending, business spending on equipment, and exports.

Moreover, President Obama’s $900 billion tax plan -- which extends the Bush tax cuts for all incomes for two years, extends the unemployment insurance benefits for an additional 13 months, and cuts payroll taxes – is essentially a fiscal stimulus that will boost the economy in the near-term.

Some economists actually thought a major reason that QE2 was necessary in the first place was because U.S. fiscal authorities, pressured by forces in the country opposed to increased government spending, could not stimulate an economy that needed government support. The burden of averting deflation and a double-dip recession, then, naturally fell on the Fed.

Now that Obama is able to strike a deal with the Republicans and push through a stimulus package, the Fed no longer has that burden – and perhaps QE2 is no longer so necessary.

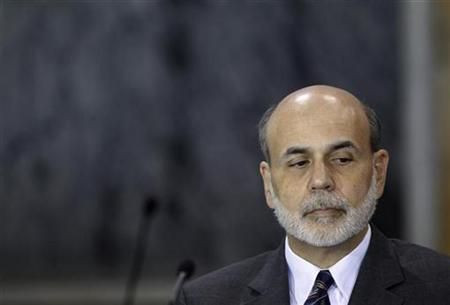

Nevertheless, Fed officials so far seem to be committed to carrying out QE2. Sargen said this makes him all the more confident that deflation won’t happen because Fed chairman Ben Bernanke won’t allow it in the unlikely event that such pressures begin to materialize.

Email Hao Li at hao.li@ibtimes.com

© Copyright IBTimes 2025. All rights reserved.