After Pfizer-Allergan Deal, Global Mergers And Acquisitions Hit Record $3.8 Trillion

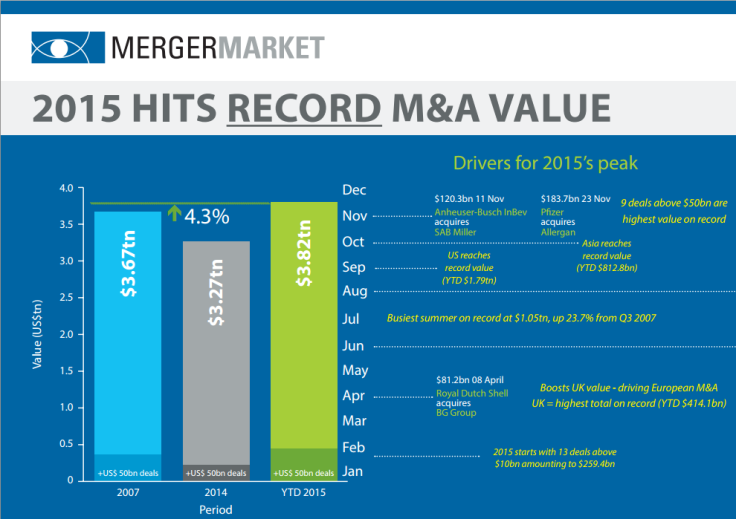

The $160 billion mega-merger of Pfizer and Allergan announced Monday didn’t just set a record for pharma combinations. The transaction also pushed the total value of global dealmaking to an all-time record, edging past the high set during the previous market peak in 2007 to top $3.8 trillion for the year.

That landmark, calculated by analysts at Mergermarket, comes as multinational corporations scramble to capitalize on historically low interest rates and a market hungry for corporate debt.

Global dealmaking so far this year has risen 17 percent above of the totals for 2014. Health and pharmaceuticals lead other industries, with more than $550 billion in mergers and acquisitions recorded so far in 2015. Many of these deals have consisted of large pharma players acquiring promising companies rather than expanding into new areas of research and development.

The consumer sector also has seen a spate of transactions, with $463 billion in deals this year, dominated by the “megabrew” merger of SABMiller and AB InBev. The deal is expected to yield the world’s largest brewing company, controlling at least 30 percent of the global beer market.

Also stoking the dealmaking boom is the growing number of companies that have undergone inversions, combinations undertaken in order to relocate to lower-tax jurisdictions. That was a major motivation for Pfizer’s deal with Allergan, which would bring the combined company to Ireland and save Pfizer more than $20 billion in existing tax liabilities.

Analysts expect the pace of deals to continue in coming months, as the Federal Reserve gears up to raise benchmark interest rates for the first time in nearly nine years.

© Copyright IBTimes 2025. All rights reserved.