Alibaba (BABA) Youku Todou Deal Is Another Big Content Bet To Build An Ecosystem To Rival Amazon, Netflix

If you’re having trouble wrapping your head around what it means that Alibaba Group will buy out the Chinese video website Youku Tudou for about $3.6 billion, think of it like this: China’s Amazon buying China’s YouTube, just six months after making a multimillion-dollar investment in China’s Paramount Pictures, all to head Netflix off at the pass.

It’s a bit of an oversimplification: Youku is one of several enormous video sites in China, and Alibaba doesn’t hold inventory the way Amazon does – but the takeaway is the same: Digital video is exploding in China, and Alibaba is making a big investment to ensure it get a major share of that growth.

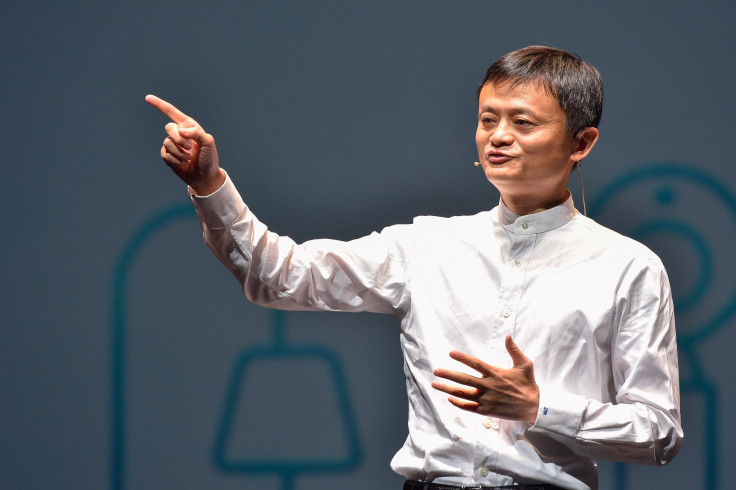

“I’ve always admired what [Youku founder Victor Koo] has built,” Alibaba Group Executive Chairman Jack Ma said in a statement released Friday. “A closer partnership with Youku will give us the opportunity to support Victor and his leadership team to fulfill the dream of building the leading digital entertainment platform in China.”

The $3.6 billion Alibaba is laying out buys the portion of Youku that it didn’t own already; Alibaba partnered with private equity firm Yunfeng to buy an 18.5 percent stake in the video website last year. Alibaba’s offer of $26.60 a share is 5 percent higher than Youku’s Friday morning opening stock price of $25.10. Under the proposal, Youku founder Koo would continue as chairman and CEO of the video service.

Youku Tudou, which offers a mix of licensed, premium and user-generated content, attracts more than 500 million unique visitors monthly, according to company filings. But despite its large audience, Youku, like Google-owned YouTube, has had trouble turning a profit. Revenues for the company in its second quarter came in at 1.61 billion yuan ($259.6 million), up 57 percent from the previous quarter last year. But its losses doubled to 342 million yuan ($55.2 million).

YouTube may not be profitable, but it has a much bigger business: $4 billion in sales in 2014, primarily from advertising, according to the Wall Street Journal.

That red ink did not deter Alibaba, which has been looking for a platform for the entertainment content it intends to begin producing to head off competition from big Chinese rivals like the search engine Baidu and the social media giant Tencent, as well as American entries like Netflix, which has been probing for an in to the mushrooming Chinese digital video market. There are 649 million Internet users in China, most of them mobile, and 71 percent of them watch full-length videos on their mobile phones. Alibaba launched its own streaming video platform, Tmall Box Office, in September.

The Youku acquisition follows a string of Alibaba investments on the entertainment front, including a $382 million stake in production company Beijing Enlight Media, the third-largest film distributor in China, and an $804 million majority stake in ChinaVision, now renamed Alibaba Pictures Group, according to the South China Morning Post. Last year, Alibaba also paid $1.04 billion for a 20 percent stake in Wasu Media, a company that has also had discussions with Netflix about licensing some of the American streaming giant’s content, including “House of Cards."

Establishing a command position in this market will be vital for Alibaba as China continues its march toward a consumption economy. Its most recent earnings report showed that quarterly revenues grew 28 percent year over year, to $3.4 billion, a number that seemed to dissatisfy Wall Street; Alibaba’s stock price has slid nearly 19 percent over the past year. Being able to produce and distribute content that consumers will want to watch, either a la carte or on a subscription basis, could provide a vital revenue stream for decades to come.

"Digital products, especially video, are just as important as physical goods in e-commerce,” Ma said.

© Copyright IBTimes 2025. All rights reserved.