Ant Group Investors In Indefinite Limbo After Chinese Government Turns On Company

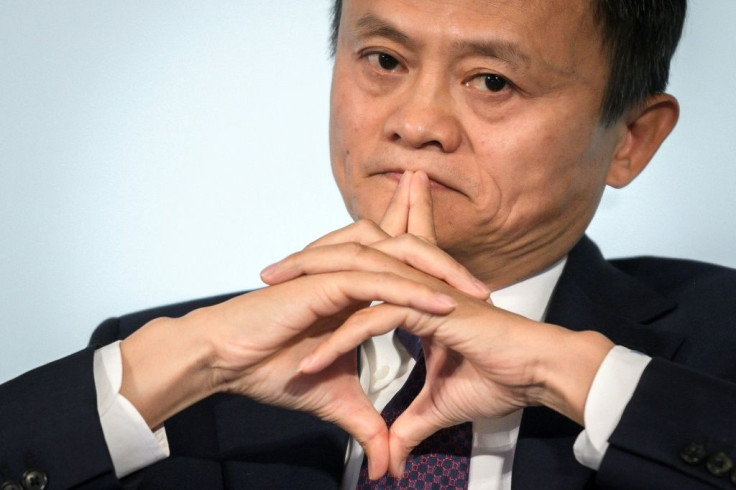

The Ant Group was supposed to be a safe bet for investors, but after Jack Ma angered the Chinese government they find themselves locked into an investment that won’t pay off any time soon. Without any legal way to pull out of the 2018 contract, they’re forced to sit on the investment and hope it pans out, the Wall Street Journal reported Tuesday.

The Ant Group specialized in financial tech, and with control of the popular Alipay went into 2018 fundraising negotiations as one of the hottest commodities on the market. That status raised $14 billion in investments under terms that heavily favored the company.

Those terms weren’t a problem until Ma, the controlling shareholder, made a speech that personally angered Chinese President Xi Jinping.

“All the way until [Jack Ma’s] speech, the strong consensus was this company had a strong relationship with the government in a way that protected it from disruptive regulation,” Martin Chorzempa, a research fellow with the Peterson Institute for International Economics, told the Journal.

The ensuing government crackdown turned the Ant Group’s prospects from a sure 80% return on investment to dead in the water. An IPO was canceled, something the investment contract theoretically allowed to trigger a buyback with 15% returns to investors.

The contract, however, lacked a specific timeframe, and with a public offering still on the table at some point in the future investors have no legal recourse to do anything but wait for the company to overhaul its structure in a bid to placate regulators.

“Practically it means every investor has to patiently wait,” Rocky Lee, an international partner at law firm King & Wood Mallesons, told the Journal. “They have no right to demand an exit, they don’t even have board seats and there’s not much influence they can exert on the company as a minority shareholder. There’s really nothing they can do.”

But it’s not all bad news for investors. The Ant Group recently reached a deal with the Chinese government that could put it back on track for a public offering, Reuters noted.

It's still likely to be valued less and under greater scrutiny, giving a smaller payout on a longer timeframe than investors originally hoped.

© Copyright IBTimes 2024. All rights reserved.