Is Apple Admitting Its 3D Touch For iPhone Is A Bust?

This article originally appeared in the Motley Fool.

The signature feature of Apple 's (NASDAQ:AAPL) iPhone 6s and iPhone 6s Plus smartphones was a technology that Apple dubbed 3D Touch. In effect, 3D Touch allowed these devices -- as well as every flagship iPhone that launched afterward -- to detect the amount of pressure that the user applied to the screen and then use that to enhance the user experience.

The technology itself is quite interesting and the fact that Apple was able to bring it into mass production at a reasonable cost was impressive. However, the reality is that many users find the feature somewhat gimmicky, and I know many individuals with 3D Touch-capable iPhones that simply ignore the feature altogether.

Whether this is a failure of the app development community to take advantage of the hardware that Apple provided or if Apple simply didn't think this feature through all the way is hard to say.

However, according to a credible new report from KGI Securities analyst Ming-Chi Kuo, Apple is planning on leaving 3D Touch out of next year's 6.1-inch LCD iPhone -- a device that's expected to be the most popular of the new iPhones that Apple introduces next year due to its relatively low price.

If that report is accurate -- and I'd bet heavily that it is as Kuo's track record is exceptional in such matters -- then I think this tells us that, going forward, 3D Touch won't be an essential part of the iOS ecosystem. But will it matter?

3D Touch Is An Added Bonus, Not A Staple

Apple tends to be very careful about the technologies that it incorporates in its iPhones. Once a feature goes in, it usually stays in all future iPhones until a demonstrably superior replacement comes along.

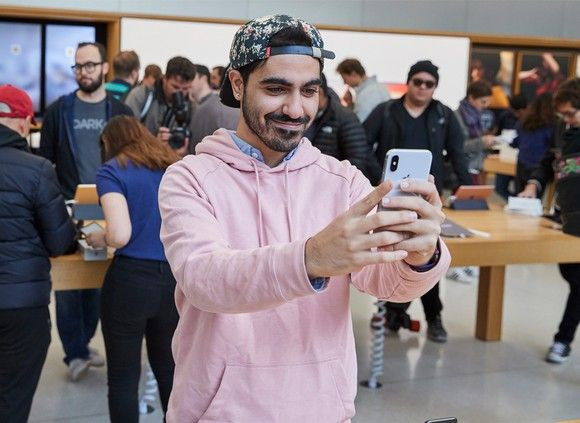

Perhaps the best example of this is Apple's Touch ID fingerprint recognition technology. Apple first introduced Touch ID in the iPhone 5s introduced in September 2013 and the feature has been present in every iPhone released since then until last year's iPhone X came along and did away with Touch ID in favor of a facial recognition technology, known as Face ID.

If Apple is planning to exclude 3D Touch from the upcoming 6.1-inch LCD iPhone -- a device that Kuo thinks Apple will sell for between $700 and $800 and will make up around half of Apple's new iPhone sales in the coming product cycle -- that indicates that Apple now views 3D Touch as a premium feature that'll only be included on premium iPhone models. Since premium iPhone models sell for more, Apple can justify the added costs of implementing 3D Touch in those devices.

If Apple continues to invest in making 3D Touch more useful over time (both by using it extensively in first-party applications as well as providing third-party developers with incentive to utilize it), then it can ultimately be a premium feature that helps Apple sell customers on more expensive iPhones.

However, if Apple stops investing so much in 3D Touch because it's no longer a feature that'll be expected to be present on all of its current iPhone models, then it could ultimately wind up as a feature that's present on high-end iPhones because removing it would simply make Apple look bad.

It'll be interesting to see how extensively 3D Touch is used in future iOS applications and how, if at all, Apple extends the capabilities of 3D Touch. For now, it seems clear that 3D Touch will no longer be an essential part of the Apple iPhone experience.

10 Stocks We Like Better Than Apple

When investing geniuses David and Tom Gardner have a stock tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

David and Tom just revealed what they believe are the ten best stocks for investors to buy right now… and Apple wasn't one of them! That's right -- they think these 10 stocks are even better buys.

Ashraf Eassa has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.