Apple Can't Keep Raising Prices Forever

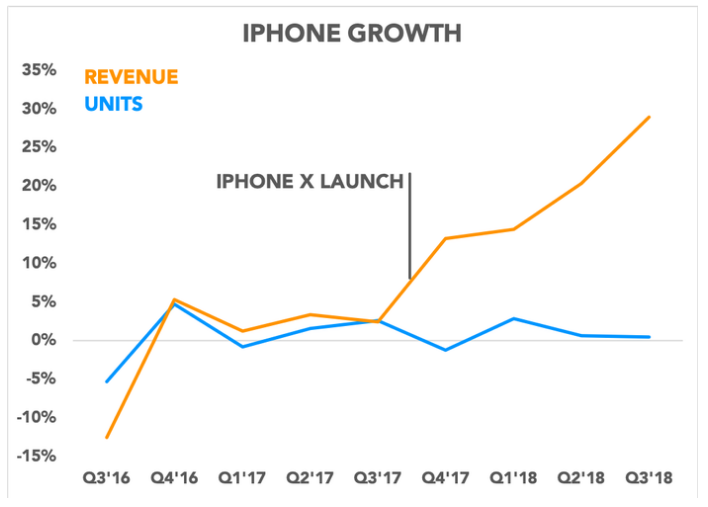

Since the iPhone X was launched in late 2017, iPhone pricing has been by far the most important aspect of Apple's (NASDAQ:AAPL) growth strategy for its most significant business. That's how the Mac maker has been able to grow iPhone revenue despite unit volumes being mostly flat. The ironic effect is that expensive smartphones only elongate upgrade cycles, as consumers hold on to those $1,000 iPhones for longer, which inevitably impacts iPhone unit sales.

With Apple's recent admission that it will miss its revenue guidance in the December quarter, it's become clear that the company can't keep jacking up prices forever.

HSBC slashes Apple price target

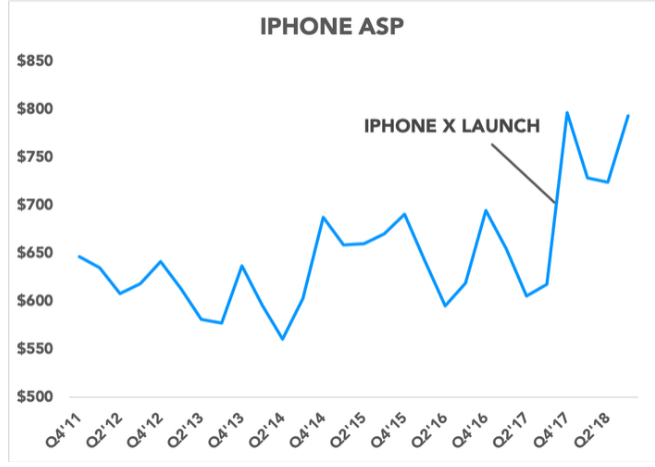

That's one of the main reasons why HSBC has just cut its price target on Apple shares, from $200 to $160 -- just 5% upside from current levels. iPhone average selling prices (ASPs) have marched higher in recent quarters, driven by the price increases, but HSBC does not think Apple can meaningfully increase ASPs going forward.

For years, iPhone ASPs would fluctuate between $600 and $700, but have recently been able to approach $800. For context, here is iPhone ASP going back to 2011:

Apple had also primarily blamed the slowing Chinese economy for its lackluster performance in the Middle Kingdom. "Although we had expected challenges for Apple in China and other economies, the intensity has surprised us to the downside," HSBC said in its research report. That largely echoes CEO Tim Cook's sentiments, who wrote in a shareholder letter, "While we anticipated some challenges in key emerging markets, we did not foresee the magnitude of the economic deceleration, particularly in Greater China."

HSBC also points out that President Trump's trade war with China is adversely impacting "consumers' attitude toward Apple products." Many countries around the world have been seeing a growing sense of nationalism in recent years, which can at times include calls to boycott foreign brands in a country. More recently, the arrest of Huawei CFO Sabrina Meng Wanzhou has renewed such calls. Combined with local Chinese vendors stepping up their competitive game with compelling handsets at affordable prices, Apple is facing an uphill battle in China.

China represents an estimated 20% of Apple's overall business, including both hardware and services, according to HSBC. That's a massive portion of revenue that's facing significant challenges, particularly compared to neighboring emerging markets like India, which represents just 0.7% of 2018 revenue. Last summer, Cook noted that the U.S. economy and China's economy are intricately linked, a point that is now being underscored by Apple's recent woes.

"There's an inescapable mutuality between the U.S. and China that sort of serves as a magnet to bring both countries together," Cook said. "Each country can only prosper if the other does."

This article originally appeared in the Motley Fool.

Evan Niu, CFA owns shares of Apple. The Motley Fool owns shares of and recommends Apple. The Motley Fool has the following options: long January 2020 $150 calls on Apple and short January 2020 $155 calls on Apple. The Motley Fool has a disclosure policy.