Australia On Brink Of First Recession In Nearly Three Decades

KEY POINTS

- Australia’s economy shrank by 0.3% in the first quarter of 2020

- An economist predicted that gross domestic product may shrink 8.4% in the second quarter

- Australia’s economy had grown steadily since 1991

Australia’s economy shrank by 0.3% in the first quarter of 2020 due to the negative impact of widespread bushfires and the early stages of the covid-19 pandemic. However, the economic output is expected to show an even bigger decline in the second quarter – meaning Australia will see its first recession in in 29 years, partly due to weak household consumption.

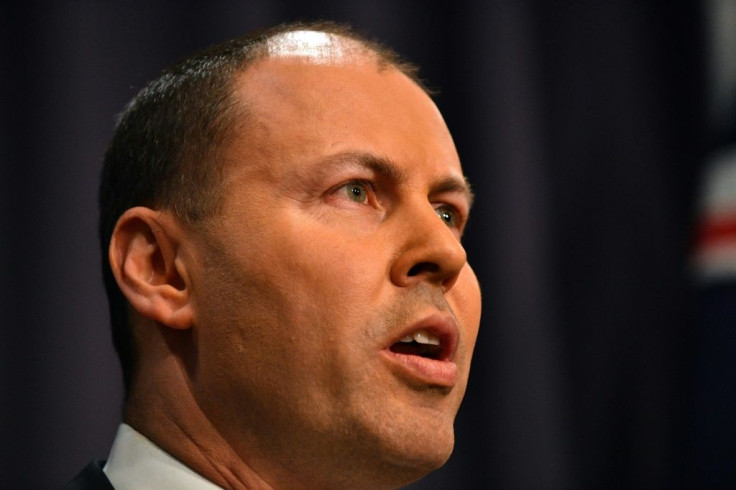

Treasurer of Australia Josh Frydenberg confirmed on Wednesday the Australian economy will have contracted in the second quarter.

“The June quarter, the economic impact, will be severe. Far more severe than what we have seen today,” Frydenberg said.

Kaixin Owyong, an economist at National Australia Bank, predicted that gross domestic product may shrink 8.4% in the second quarter.

(A recession is generally defined as two straight quarters of economic contraction).

Major global economies ike Japan and Germany have already slipped into recession.

Australia’s economy had grown steadily since 1991, marking the longest such growth streak in the developed world.

"This [first quarter 2020 performance] was the slowest through-the-year growth since September 2009, when Australia was in the midst of the global financial crisis, and captures just the beginning of the expected economic effects of Covid-19," said Bureau of Statistics chief economist Bruce Hockman.

Greg Jericho wrote in The Guardian: “Households make up roughly 56% of our entire economy, so when we stop spending, our economy is in big trouble. And in the March quarter we really stopped spending.”

Since the emergence of the pandemic, the Reserve Bank of Australia has slashed cut its main interest rate to a record low of 0.25% and also introduced an unlimited bond buying program.

The Australian government has pumped in $180 billion to help support businesses and residents and has pledged more stimulus measures.

Nonetheless, central bank Governor Philip Lowe issued a grim assessment tinged with faint hope. "The Australian economy is going through a very difficult period and is experiencing the biggest economic contraction since the 1930s," he said. "[But] it is possible that the depth of the downturn will be less than earlier expected. The rate of new [virus] infections has declined significantly and some restrictions have been eased earlier than was previously thought likely.”

Other analysts ae rather optimistic about Australia’s near-term future.

“The relatively good handling of the virus and supportive economic policies will mean that Australia comes out of the crisis in better shape compared to many of our global counterparts,” said Shane Oliver, chief economist at AMP Capital Investors Ltd. in Sydney. “We think there will be a strong bounce-back in GDP growth in the second half.”

Frydenberg himself gushed that: “We were on the edge of the cliff. What we were facing was an economist’s version of Armageddon. We have avoided the economic fate, and the health fate, of other nations because of the measures that we have taken as a nation.”

Indeed, consumer confidence has climbed for nine consecutive weeks, while the household savings ratio rose to 5.5%, the highest level since 2016.

“The outlook, including the nature and speed of the expected recovery, remains highly uncertain,” Lowe said Tuesday. “In the period immediately ahead, much will depend on the confidence that people and businesses have about the health situation and their own finances.”

Australia’s key mining industry has been buoyed by rising commodity prices

“Mining investment has climbed to a 7-year high, Australia’s terms of trade have risen and exploration intentions are elevated. This bodes well for the recovery,” said James McIntyre, economist at Bloomberg.

Owyong of National Australia Bank concluded that a full recovery of the country’s economy “will also require confidence in health and economic outcomes to be restored, where households may remain cautious for some time given record job losses and with the labor market historically lagging recovery in activity.”

© Copyright IBTimes 2025. All rights reserved.