Bitcoin Falls Again: Why China May Not Matter In The End

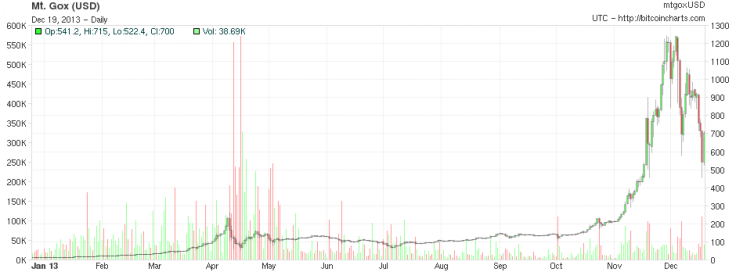

Bitcoin values have taken yet another dive Wednesday as BTC China, China’s number one Bitcoin trading site, announced it can no longer accept deposits in Chinese Yuan. This comes after Chinese payment processor YeePay stated they will no longer provide services in the currency. Prices dropped to the lowest they have been in a month, bottoming out at $520 before rising back to $685 where they remain at time of writing. Not to despair though, values are still up for the cryptocurrency over a two month period.

This is just the most recent massive valuation swing for the currency, giving weight to opponents of the currency who constantly cite the volatility as a deterrent. Earlier this month, in another Chinese-related drop, Bitcoin fell when the People’s Bank of China denounced the validity of Bitcoins. Stating that financial institutions could not use the currency as legal tender, the Chinese bank sought to end an arbitrage play that some traders were taking advantage of. Prices fell about $300 after a two day swing, stabilizing at around $900.

With all of the acrobatic-like tumbling Bitcoin is doing, one begs the question, what’s next for Bitcoin? Is the decentralized currency in its decline, burdened with a future of over-regulation and centralized banks banning the currency just like China has? Is this the beginning of the bubble bursting? Or is this just a period of flux? Will we see a future that Cameron Winklevoss recently suggested in an AmA on Reddit, a $40,000BTC valuation?

“When this will happen, if it happens, I don’t know, but if it happens, it will probably happen much faster than anyone imagines.” Winklevoss said.

While this year has seen record gains and devastating losses, overall Bitcoin values are still up, and by quite a large margin. Barring any further drops or rapid increases, Bitcoin will end the year at around $1000 based on how the market has reacted in the past to a sudden decline. This means that in the 2013 calendar year Bitcoin will have seen a staggering 7700 percent increase from an opening value of just $13.

The overall increase in value came in many stages this year, with a majority ascent in the last two months. The prices initially climbed to (what seemed at the time) a whopping high of $260 at the beginning of April. Then promptly crashed; the first of several to come. Although the crash dropped prices by about half after stabilization, media outlets started to take notice. The increase of coverage brought more investors and prices ebbed and flowed, seeing lows, as late as July, of $70. Prices climbed back up, and in October they really took legs.

The rapid increase in valuation seen late this year may be attributed to one man, Kristoffer Koch, the man who forgot his fortune. In early October, Koch’s memory was jolted to life by media coverage of the currency; the Silk Road, a black market liked to Bitcoin, had been recently shut down. Nearly four years earlier in 2009, Koch had invested into the then new currency, spending 150 Kroner on 5000 BTCs, about $27. Now Koch owns his own place, an apartment in the wealthy neighborhood Toyen in Oslo, Norway, which he bought with one fifth of his Bitcoin savings. At today’s rate, Koch stands to be a multimillionaire.

While it is good for investors to see year-to-date growth, new investors should be wary of the mountainous spike in value. China is not the only nation to be focused on the currency. Mid November, the Senate Homeland Security and Governmental Affairs Committee met to discuss Bitcoin and its validity. Chairman Tom Carper (D-Del.) who led the hearing said today in an interview on Bloomberg, “Virtual currencies are not going away, and if they are going to be a reality we need to figure out how to let them exist to do good, a lot more good than bad, and figure out how to deal with the bad.” He indicated that while he was relatively new to the subject, the witnesses that spoke, such as the FBI, had been focused on it for some time, alluding to the Silk Road shut down. He said the FBI had some suggestions for the HSGAC, “Their advice was ‘let’s be mindful of the bad,’” but to remember the good.

What’s next for the currency is still unknown, but Rep. Carper gave an apt metaphor.

“Remember the internet; when the internet was young a lot of people would tell of the horrible - the bad things that could happen if we have the internet. Well as it turned out, those bad things do happen, part facilitated by the internet, but there is so much more good that the internet makes possible. While we work to tamp down the bad on the internet, we work hard to make sure that the good is able to flourish.”

© Copyright IBTimes 2025. All rights reserved.