Boeing's Sales Weakness Weighs On US Durable Goods Orders

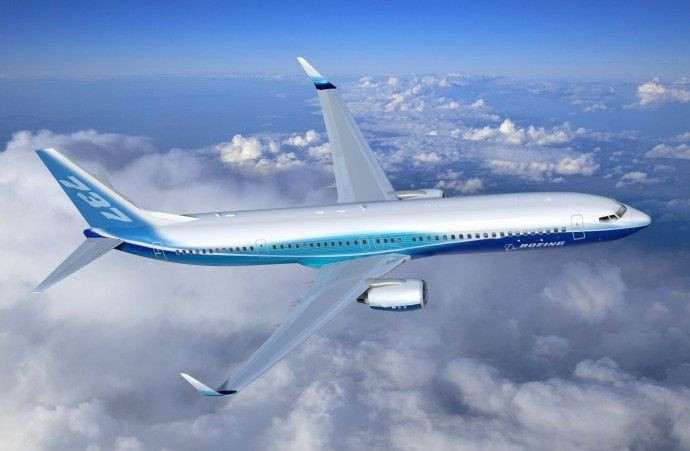

Durable goods orders in the U.S. have fallen by 1 percent month over month after commercial aircraft orders dropped by 20.2 percent m/m in January and motor vehicle orders declined by 2.2 percent m/m over the same period. With only 38 orders in January, hugely down from 318 in December, the Boeing Company (NYSE:BA) demonstrated a poor month in the famously volatile aircraft industry.

The decline in motor vehicles sales slowed from a 6.6 percent drop in December to a 2.2 percent slip in January, but this was no surprise given that many of the production plants were closed on and off during the harsh winter.

While overall transportation sales have brought the durable goods figure down, core orders have seen an increase of 1.1 percent m/m. This was primarily due to a 7.3 percent increase in fabricated metals orders, which bounced back from a 6.5 percent drop in December. In addition, a rebound in defense orders, which turned around from a 29.5 percent slump to a 26.3 percent increase, also helped the figure.

Excluding aircraft sales, non-defense capital goods increased by 1.7 percent m/m and the three-month-on-month annualized growth rate improved to 6.6 percent, indicating that equipment investment is expanding sufficiently.

Paul Ashworth, the chief U.S. economist at Capital Economics, concedes that little can be drawn from the data until the February employment number are released and the weather improves.

© Copyright IBTimes 2025. All rights reserved.