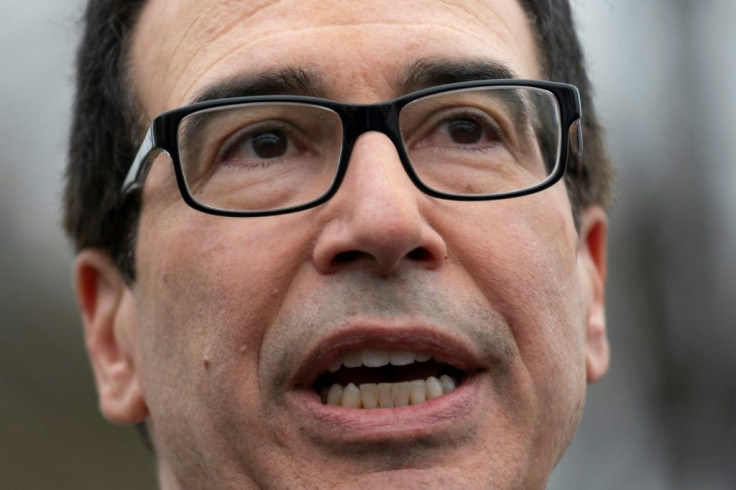

Close The Markets? It Won't Happen, Mnuchin Says

The Great Depression closed Wall Street and so did 9/11, but as the coronavirus hammers the global economy and likely sends the United States into recession, Treasury Secretary Steven Mnuchin on Tuesday ruled out a temporary closure of the stock markets.

"We absolutely believe in keeping the markets open," Mnuchin said at the White House. "Americans need to know they have access to their money."

As businesses have slowed or shuttered operations globally, the benchmark Dow Jones Industrial Average has lost more than 25 percent of its value since mid-February, while the "circuit breakers" that temporarily halt trading when the S&P 500 falls by more than seven percent have activated three times in the last six sessions.

That has raised the question whether it may be necessary to treat the coronavirus pandemic as a true calamity and halt trading for several days, but many analysts believe that would be a bad idea and could worsen the panic.

A shutdown "would exacerbate the fear and unknown," Sam Stovall, chief investment strategist at CFRA told AFP. "Investors need to be able to keep a finger on the pulse of investors' assessment of the global crisis through the monitoring of stock market prices."

The viral pandemic has transformed the outlook for the US economy, and President Donald Trump, who has acknowledged a recession is possible, is moving to get an emergency spending package through Congress.

Meanwhile, the Federal Reserve has dramatically stepped up cash injections into markets as the outbreak threatens to paralyze consumer demand and supply chains.

While Mnuchin said US markets may eventually have to shorten trading hours, there appears to be no appetite for tightening down further.

After plunging into bear market with dramatic declines in recent days, Wall Street recovered on Tuesday, with the Dow ending up 5.2 percent after Mnuchin announced that the stimulus plan would include immediate, direct payments to Americans.

"The market is a reflection of the larger uncertainties that everyone is experiencing during these challenging days," New York Stock Exchange President Stacey Cunningham tweeted on Monday.

"Closing the markets would not change the underlying causes of the market decline, would remove transparency into investor sentiment, and reduce investors' access to their money."

Wall Street was shuttered for days in 1933 during the Great Depression and when the 9/11 attacks occurred just blocks away from the trading floors in 2001.

With the coronavirus, daily life has been upended partially because of its ease of spread, leading people in badly affected areas to work from home to stem the contagion.

Securities and Exchange Commission Chairman Jay Clayton also called for Wall Street to continue to function.

He told CNBC his agency has been "working with the critical market infrastructure entities to make sure that their business continuity plans match up with the health and safety plans."

Richard Scylla, a specialist in market history at New York University, said shutting down trading could actually make the economy worse.

"The purpose of these markets is to give securities -- stocks and bonds -- liquidity and tradability. If the markets shut down, that is lost," he said, adding a shutdown could spook people and fuel panic.

"The effect in the longer run would be to discourage folks from investing in stocks and bonds, thus making it harder for businesses and the government itself to raise funding."

Quincy Krosby, chief market strategist for Prudential Financial, agreed, saying it would be irresponsible to "shut it down anytime you don't like what the market is doing."

Amid the turbulence, some have called for limits on short-selling, which allows investors to bet on falling prices -- a practice several European countries temporarily banned on specific stocks in recent days.

Krosby called for a reconsideration of high-frequency, fully automated trading, which she said "dominate daily market volume."

"The velocity of the markets moves are so dramatic on the upside and the downside, that there have been complaints all along," she said.

© Copyright AFP {{Year}}. All rights reserved.