Bank of america Stories

Newsmaker: Ex-UBS Star Shakes and Stirs at BofA Asia

When some bankers arrived late for work at Bank of America-Merrill Lynch's Asia headquarters in Hong Kong earlier this year, they found a Post-It note on their computer screens.

Buffett in Japan, Spotlight on Investment

Octogenarian billionaire investor Warren Buffett arrived on his first visit to Japan on Monday, fanning speculation about his possible investments in the country's battered stock market.

Wall Street Woes: Citigroup, UBS, BNP All Announce Job Cuts This Week

Citigroup, BNP Paribas and UBS all announced job reductions in this week.

Seven Banks Sued over Their Roles in the MF Global Collapse

Seven banks that helped MF Global Holdings Ltd. sell bonds were sued by pension funds who said the bonds' offering prospectuses concealed problems that led to the futures brokerage's collapse.

Wells Fargo Cutting Technology Jobs in Cost Drive

Wells Fargo & Co plans to cut technology and operations jobs by the end of this year as the bank tries to eliminate more than $1.5 billion of quarterly operating expenses.

Merrill Lynch Reportedly Agrees to Pay $315 Million in Mortgage-Backed Securities Settlement

Merrill Lynch has agreed to pay $315 million to settle a class action filed against it on behalf of investors in 18 mortgage-backed securities trusts, according to Reuters.

Vallejo Police Officer James Capoot Shot Dead While Chasing Bank Robbery Suspects

James Capoot, 43, a Vallejo police officer, was shot to death, when he was chasing two bank robbery suspects on Thursday afternoon.

Panic Selling Sends Jefferies Into Tailspin as Company Tries to Fend Off Rumors

Negative rumors have turned Jefferies Group Inc. into the latest financial whipping boy. A controversial report from ratings agency Egan-Jones, which the firm has stood by, has spooked the markets. Jefferies is insistent that it remains solid. Who will investors believe?

UBS Shares Rise on Pledge to Restart Dividends

Shares in Swiss bank UBS rose on Friday as investors welcomed its pledge to start paying dividends again, though its plans to trim its scandal-hit investment bank failed to go as far as some had hoped.

Anti-Wall Street Protesters Arrested at L.A. bank

Throngs of anti-Wall Street demonstrators snarled traffic by blocking a downtown Los Angeles street on Thursday, and later pitched tents outside a bank tower before police advanced to make arrests.

Occupy Wall Street: After Two Months, is the Movement Already Losing Steam? [PHOTOS]

Occupy Wall Street protesters marked the completion of two months of their movement Thursday with a national Day of Action. But the future of the nationwide movement already looks doubtful, with the number of demonstrators declining and their eviction from Zuccotti Park.

Spanish Borrowing Costs Soar to 14-Year High

The Madrid government 3.56 billion euros of new bonds, short of the maximum target of four billion euros.

Bank of America Touted Malcolm Gladwell Talks Without His Knowledge

Journalist Malcolm Gladwell told The Atlantic Wire on Wednesday that although Bank of America tapped him to speak at events focusing on small businesses over the past few weeks, he had no idea the corporation crowed about the arrangement in a press release.

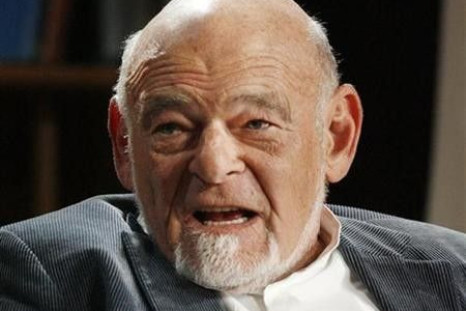

Sam Zell's Equity Residential Leads With $2.5 Billion Archstone Bid

Real estate mogul Sam Zell's Equity Residential is the lead bidder to buy 53 percent of rival company Archstone for over $2.5 billion, the Wall Street Journal reported.

Citigroup to Slash up to 3,000 Jobs

Citigroup plans to cut approximately 3,000 jobs, or around one percent of its workforce, continuing a pattern of job cuts on Wall Street.

Is It Time for a Better U.S. Banking System?

With a banking sector that seemingly cycles from reticence to lend, lending at prohibitive interest rates, and outright banker-to-banker mistrust (the latest round of which is being driven by renewed concern about Italy's debt), is today's U.S. banking sector where Framer/Founding Father Alexander Hamilton wanted it to be?

John Paulson Remains a Gold Bull - Analysis

Hedge fund manager and long-time gold bull John Paulson's move to slash ETF bullion holdings by a third in the third quarter does not appear to be a sign that he is abandoning his upbeat view of the metal, industry sources and analysts said.

BofA Learned a Lesson from Debit Card Fury - CEO

Bank of America Corp. learned a lesson from its abandoned debit card fee and will work to provide transparency and fair pricing to customers while producing a return for shareholders, Chief Executive Brian Moynihan said on Tuesday.

Asian Shares Drop as Eurozone Bond Yields Rise

Asian shares fell on Tuesday, as a rise in euro zone bond yields reflected lingering doubts about the ability of politicians in Italy and Greece to push through painful reforms to resolve their debt crises and win market confidence.

Bank of America Debit Card Backtrack Won't End More Fees

Even after Bank of America backed off its $5 monthly debit card fee, banks are still raising existing fees and tacking on new fees in order to garner additional revenue.

Wall Street Falls on Eurozone Recession Worries

Wall Street stocks declined on Monday as Eurozone data signaled the region could be facing a recession, adding to worries about Europe's debt crisis.

BofA to sell most of remaining CCB stake

Bank of America Corp plans to sell most of its remaining stake in China Construction Bank Corp for $6.6 billion in cash to boost the ailing U.S. bank's capital levels.

Bank of America to sell most of its remaining CCB stake

Bank of America Corp plans to sell most of its remaining stake in China Construction Bank Corp for $6.6 billion in cash to boost its capital levels.

Buffett Builds $10.7 Billion Stake in IBM

Warren Buffett said his Berkshire Hathaway Inc has accumulated a 5.5 percent stake in IBM, the billionaire investor's biggest bet in the technology field he has historically shunned.

Bank of America to Sell 10.4B Shares of China Construction Bank

Bank of America Corp. (NYSE:BAC) said it agreed to sell about 10.4 billion common shares of China Construction Bank Corp. (CCB) through private transactions with a group of investors, in a move that will result in an after-tax gain of about $1.8 billion.

HARP 2.0 Program Better Than Expected?

FBR Capital Markets said the broad changes to the Home Affordable Refinance Program (HARP) were outlined by U.S. President Barack Obama's administration on Oct. 24. However, the release of most of the technical details was delayed until Nov. 15.

UniCredit to cut 5,000 jobs in dire quarter

Profits at Italian bank UniCredit have all but evaporated and capital has shrunk to dangerous levels, results due on Monday will show as the bank prepares a $10 billion rights issue and 5,000 job cuts to get back on track.

Wall Street Gains for the Week as Italy-Related Fears Ebb

Stocks jumped on Friday, ending higher for the week after the Italian Senate's approval of economic reforms gave investors some relief from worries about the Eurozone's debt crisis.

MF Global's Mass Layoff Only First Rumbling of Upcoming Storm

The decision to lay off 1,066 people who worked for MF Global -- effective immediately and without severance -- will give people pause. But it is only the beginning of the nastiness in the MF Global saga

Wall Street Soars 2 Percent on Italy Vote

Stocks rose about 2 percent on Friday, with major indexes on track to end the week higher as Italy's Senate approved economic reforms, easing investor concerns about the euro zone's debt crisis.