Cryptocurrency Miners In Norway Lose Electricity Subsidies, May Face Closure

The crash in the price of bitcoin and other cryptocurrencies is far from the only trouble facing miners of virtual currencies. The Norwegian government said it would do away with the electricity subsidy granted to cryptocurrency miners. According to a news report from the country's largest circulation newspaper Aftenposten, the government said Wednesday cryptocurrency miners in the country would have to pay regular electricity tax from 2019.

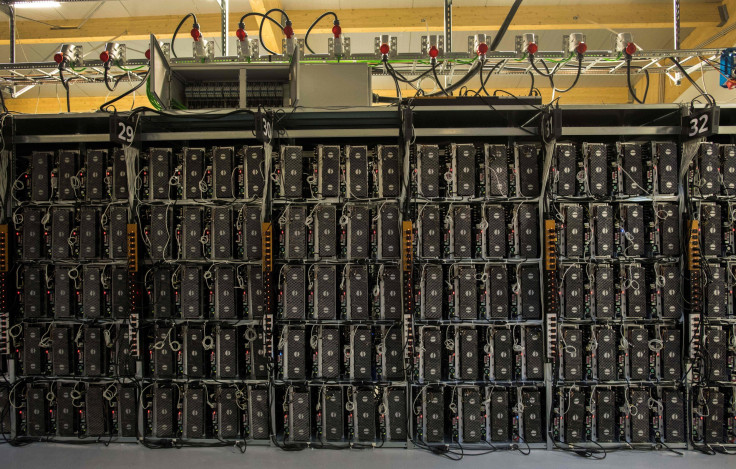

In Norway, mining firms currently receive the same electricity tax discount as other power-intensive industries. Those with a capacity of more than 0.5 megawatts are charged 0.48 Norwegian kroner ($0.056) per kilowatt hour, instead of the standard rate of 16.58 Norwegian kroner. That means miners have been paying less than 2.8 percent of the standard rate to power their rigs.

“Norway cannot continue to provide huge tax incentives for the dirtiest form of cryptographic output like bitcoin. It requires a lot of energy and generates large greenhouse gas emissions globally,” Aftenposten reported, citing Norwegian parliamentary representative Lars Haltbrekken.

With an end to the subsidy, cryptocurrency miners would see a large increase in their expenses, which in turn, is likely to subdue their net profits. With the already depreciating cryptocurrency prices, it would add to the pressure on the industry.

The proposal to dismiss Norway’s subsidy was proposed by the Norwegian Tax Administration, the agency responsible for resident registration and tax collection in Norway. The proposal was approved in the state budget and would be effective from January 2019, Aftenposten reported.

Roger Schjerva, the chief economist of the technology industry group ICT Norway told Aftenposten the government move was shocking and the budget was not discussed with the industry before framing. He also pointed out that this move would harm the crypto industry in Sweden and Denmark. "We can only hope that politicians understand that energy-intensive computing is one of the things we will be living in future," Schjerva added,

"If this is correct, it will be a complete disaster for the cryptocurrency industry in Norway. This gives a terrible signal to foreigners that are thinking of investing in Norway," business news portal E24 reported, citing Gjermund Hagasæter, a spokesperson from Kryptovault — a Norwegian company that specializes in large-scale cryptocurrency mining and data center operations.

In April, Reuters reported that cryptocurrency miners are moving to Norway and Sweden to take advantage of cheap hydroelectric energy and low temperatures to power and cool their servers. At the time, China accounted for around 70 percent of the cryptocurrency mining industry, but Beijing curbed it due to concerns about pollution from the coal-fired power which forced miners to move to Norway.

Concerns over cryptocurrency mining affecting the climate have been surfacing, which is creating tension among policy-makers of various countries. A recent report by United Nations said we have about 12 years to contain the climate change catastrophe, and it pointed out that emerging not-so-eco-friendly technologies, like cryptocurrencies, were large contributors to the crisis.

A research paper published Oct. 29 by the University of Hawaii said the use of bitcoin (purchasing, creating, and safeguarding it) in 2017 emitted 69 million metric tons of CO2 and it also projected that "if bitcoin is incorporated [at large], its cumulative emissions will be enough to warm the planet above 2 degrees Celsius in just 22 years. If incorporated at the average rate of other technologies, it is closer to 16 years."

In Sweden, two mining companies — Miami-based NGDC and Sweden's Chasqui Tech — abandoned their mining facilities recently. NGDC disappeared from the area, leaving $1.5 million worth of electricity bills unpaid. The reason behind the companies' move was linked to the fall in cryptocurrency prices.

© Copyright IBTimes 2025. All rights reserved.