Cryptoverse: New Breed Of Bitcoin NFTs Sell For Millions

Imagine digitally inscribing 3D images of objects such as multi-colored spheres onto a tiny fragment of bitcoin. Then imagine selling them for $16.5 million.

Just when you thought crypto couldn't get any stranger, bitcoin accidentally births a new breed of NFTs.

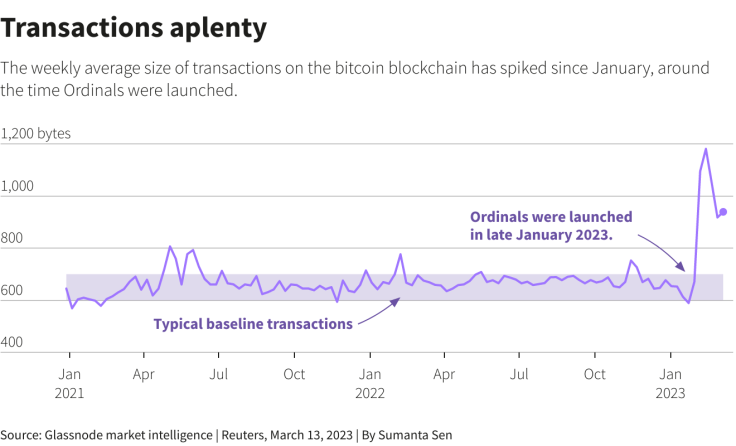

The new entrants have materialized in 2023 following bitcoin network upgrades that enabled each satoshi - the smallest denomination of bitcoin, or one hundred millionth - to store a few megabytes of data, from text and images to audio and video.

The data storage was an unintended consequence of the upgrades. Now crypto enthusiasts have embedded a total of 385,000 "inscriptions" known as Ordinals on bitcoin since January, including more than 200,000 image files and over 150,000 text ones, according to Glassnode Market Intelligence.

"I think this is really the start of a fundamental shift in what you can do with bitcoin," said Alex Miller, CEO at bitcoin developer network Hiro.

The colored balls form part of TwelveFold, a collection of 300 images of 3D objects rendered in a square grid, from NFT developers Yuga Labs, best known for its Bored Ape Yacht Club. It calls the set "a visual allegory" for data on blockchain.

They became a lucrative allegory this month when the company auctioned 288 of them off for $16.5 million, according to data from research firm Delphi Digital.

Other top-selling Ordinals - named after the software protocol that facilitates inscription - include JPEGs of rocks and shadowy crowned figures which have sold for $213,845 and $273,010 respectively, according to Galaxy Digital Research.

Although the market for bitcoin NFTs has only been going since January, Galaxy estimates it could be worth $4.5 billion by 2025, basing its bullish forecast on factors such as the growth of the more established Ethereum NFT market and the fact that bitcoin is by far the most popular cryptocurrency.

Caveat emptor, though: Little can be accurately foreseen in the highly unpredictable market for non-fungible tokens, it would appear.

Overall sales of NFTs - excluding Ordinals - stood at about $1 billion last month, according to CryptoSlam data, a recovery from the $324 million in November but still a fraction of the roughly $5 billion seen last January and $2.7 billion in May.

Nonetheless, bitcoin NFTs have built up a head of steam in a short space of time. Satoshis inscribed with NFTs are involved in about 7% of the total number of bitcoin blockchain transactions, according to Glassnode data.

GRAPHIC: Transactions aplenty-

'KIND OF FRIVOLOUS'

One of the biggest challenges for this new class of NFTs is the dearth of a user-friendly marketplaces, with early transactions taking place over-the-counter on shared online spreadsheets, according to market players.

This lack of infrastructure is a definite barrier to entry, Delphi Digital said.

Not everyone is happy about this surge of activity, especially some bitcoin purists who believe the cryptocurrency should solely be used for payments.

The average fee to make a bitcoin transaction, measured over a 7-day period, has spiked to $1.981, its highest since November, as Ordinals trading surged compared with under $1 at the start of February, according to data from Blockchain.com.

"We want transactions to remain as inexpensive as possible so people around the world can run businesses and send money," said Cory Klippsten, CEO of bitcoin-focused financial services firm Swan Bitcoin, who sees problems in "having it priced out through this non-monetary use case that's kind of frivolous".

Some critics say Ordinals are also clogging up the network; the 7-day average of time to confirm bitcoin transactions spiked to over 186 minutes in late February, its highest since November's bitcoin selloff, according to Blockchain.com.

That's since dropped to over 124 minutes, though that's still significantly longer than the range of 12.8 to 35 minutes transaction time in January and February.

"Ordinals have brought some more eyes to the network," said Brendon Sedo, a developer at the Core DAO blockchain. "But NFTs on bitcoin are a distraction from the network's core purpose, which is to serve as a permissionless network that is globally available, 24/7, and uncensorable."

© Copyright Thomson Reuters {{Year}}. All rights reserved.