Dell Buyout: Delaware Court Refuses To Expedite Icahn’s Lawsuit Against Dell

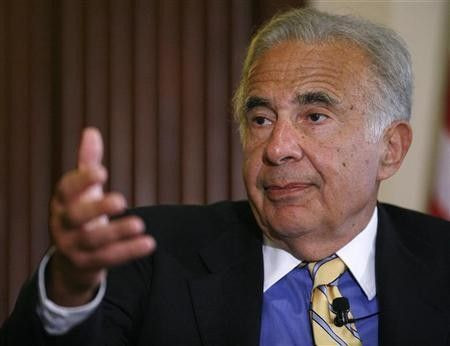

Billionaire investor Carl C. Icahn’s bid to deter Michael Dell’s proposal to take Dell Inc. (NASDAQ:DELL) private for almost $25 billion suffered a setback on Friday, when a Delaware state court refused to expedite Icahn’s lawsuit, clearing the way for shareholders to vote on the buyout on Sept. 12.

Icahn had argued that the buyout bid by Dell’s founder, chairman and CEO, Michael S. Dell, undervalues the personal-computer maker, and that Dell’s board wronged the company’s shareholders by accepting an undervalued offer.

In a legal challenge filed on Aug. 1, Icahn asked the court to force Dell to hold simultaneous votes both on Michael Dell’s offer and on Icahn’s rival proposal to buy back 1.1 billion shares at $14 apiece, in addition to one warrant for every four shares, allowing a warrantholder to buy one Dell share for $20 over the next seven years.

Icahn, who holds about 9 percent of Dell shares, is the company’s second-largest shareholder behind Michael Dell, who owns about 16 percent, according to Reuters.

Icahn had sought to fast-track hearings on the lawsuit to derail the shareholder vote on Sept. 12, even as Icahn’s competing offer is set to expire Sept. 30 and Dell’s board is scheduled to vote on Oct. 17.

Delaware Court of Chancery Judge Leo Strine dismissed Icahn’s argument that Dell’s special committee, formed to review the company founder’s buyout offer, was acting against the interest of shareholders by accepting Michael Dell’s offer. Friday’s proceedings opened with Strine reading a prepared statement, and he did not allow lawyers from either side to speak, Reuters reported.

On Aug. 2, Michael Dell and Silver Lake Management LLC revised their buyout proposal, offering $13.75 per share, a special dividend of 13 cents per share and a regular dividend of 8 cents per share.

Dell’s share price closed 12 cents, or 0.84 percent, higher at $13.82 on Friday.

© Copyright IBTimes 2025. All rights reserved.