Dollar Slips, Euro Above Parity Before U.S. Inflation Data

The euro edged higher on Wednesday, hovering just above parity with the U.S. dollar on Wednesday while traders focused on U.S. data due later in the session that is expected to show inflation at a 40-year high.

European stock markets were in the red and the dollar index was down 0.2% on the day at $107.93 at 1047 GMT.

The euro was up 0.2% on the day at $1.00595.

On Tuesday, the euro had dropped as low as $1.00005 on the most widely used Electronic Broking Services' (EBS) dealing platform and it touched $1 on Reuters dealing overnight.

Market-watchers were focused on U.S. CPI data due later in the session. Economists forecast headline U.S. inflation accelerated to 8.8% year-on-year in June, a four-decade high.

But "core" CPI, which strips away volatile food and energy prices, is expected to repeat May's 0.6% monthly increase and cool slightly to 5.7% year-on-year.

Higher-than-forecast inflation would reinforce expectations of Federal Reserve interest rate hikes and push the dollar higher - potentially causing euro-dollar to break parity, analysts said.

But traders will be looking for any signs of inflation having peaked as this could potentially convince the U.S. central bank not to become more aggressive in its future rate hikes.

The euro is down nearly 12% this year and fell to a 20-year low on Tuesday as the war in Ukraine has triggered an energy crisis that has hurt the continent's growth outlook.

Germany has moved to stage two of a three-tier emergency gas plan and warned of a recession if Russian gas flows are halted.

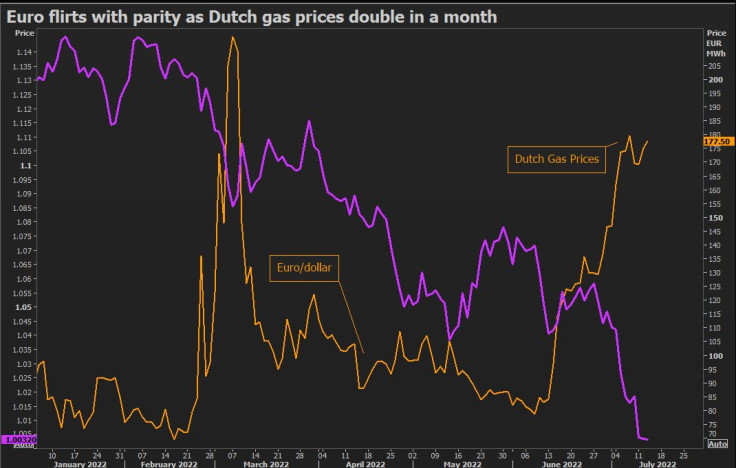

"I see relative recession risks as the primary driver of the drop towards parity - Dutch gas futures are up 100% over the last month, U.S. gas futures are down 35%. This is a clear negative for euro zone growth and is dragging the euro lower," said Colin Asher senior economist Mizuho.

Derek Halpenny, head of research at MUFG, said in a client note that risk-off market moves due to increased global recession risks have "further to run".

"We doubt that is the end of the move and see little reason for the U.S. dollar to turn weaker at this juncture," he said.

But Commerzbank analyst Antje Praefcke said in a note to clients that higher inflation data is no longer positive for the dollar in the long term because it could lead to the Fed "overshooting" in its rate hikes.

"Simply put, the faster rates rise now, the higher the likelihood of rapid rate cuts next year," Praefcke said.

The pound was up 0.3% versus the dollar at $1.1923.

Britain's economy expanded unexpectedly in May, driven by a rise in local doctor appointments and growth in other sectors although consumer-facing services fell slightly as inflation mounted, according to official figures.

Euro zone industrial production increased by more than expected in May, data showed.

The Japanese yen was a touch lower versus the U.S. dollar at 137.02, having taken a beating in recent months due to the Bank of Japan's ultra-easy monetary policy making it an outlier among major global central banks.

The Australian dollar - seen as a liquid proxy for risk appetite - was up 0.6% at $0.6795.

The New Zealand dollar was up 0.2% at $0.6148, having taken little support from a 50 bps interest rate hike by the central bank.

Graphic: euro parity-

© Copyright Thomson Reuters {{Year}}. All rights reserved.