Hong Kong stocks may receive respite from good corporate results on Friday, but will remain under pressure and will likely trade in a narrow range, weighed down by concerns about volatile oil prices and ongoing turmoil in the Middle East.

China's securities regulator plans to review refinancing rules for companies listed on the Nasdaq-style ChiNext board, the official Securities Times reported on Friday.

U.S. stock markets ended mixed in a volatile session on Thursday as oil prices eased and encouraging job data helped the market to stabilize in the final hours.

The US dollar has traditionally been a safe-haven asset, meaning whenever people are afraid, they sell ‘risky’ assets and flee to the safety of the US dollar. However, starting the week of February 21, 2011, this pattern has been broken.

Shares of General Motors (NYSE: GM), despite having delivered its first profitable year of operations since 2004.

Long-term South African government bonds continued to fall on Thursday in anticipation of supply to fund the budget deficit, while the rand climbed and stocks closed moderately lower.

The Bank of Shanghai has submitted its listing application to the banking regulator and is targetting an initial public offering (IPO) this year, the Shanghai Securities News reported on Thursday, citing a government official.

The Gold Price rose further in London trade Thursday morning, hitting new 2011 highs for Dollar investors as Brent crude oil jumped to $119 per barrel and a raft of economic analysis warned of stagflation ahead for the global economy.

Orders for durable-goods items rose 2.7 percent in January, the first such increase since September, reported the Commerce Department said. However, the higher demand was largely due to the aircraft sector.

Soaring oil prices will have little impact on Chinese consumer inflation, but will place considerable cost pressure on the country's manufacturers, a government adviser and ministry official said on Thursday.

He Shuaixing shakes his head listening to the pitch from a job recruiter on a cold wet day in a factory district outside Shenzhen , epicentre of China's export machine.

Jeffrey Gundlach of DoubleLine Capital, dubbed 'King of Bonds' by Barron's, sees a major collapse in the municipal-bond market. After the carnage happens, he plans to scoop up the bargains left behind.

Biogen Idec stock price can appreciate to the mid $70s based on five areas of potential upside, according to RBC Capital Markets. The brokerage upgraded its rating on shares of the biotechnology company to outperform from sector perform and increased its price target to $75 from $60.

The MacBook Pro refresh today reveals that Nvidia's graphic chips has been replaced by Advanced Micro Devices (AMD) on high end MacBook Pros.

New home sales dropped more than expected in January, almost erasing the gains witnessed in December. The Commerce Department said new-home sales fell to a seasonally-adjusted annual rate of 284,000 (well below expectations of 300,000) and down 12.6 percent from the revised figure of 325,000 recorded in December.

Initial jobless claims applications dropped to 391,000 for the week ended February 19, down from 413,000 in the previous week, according to the Labor Department, a sign that the labor market is finally showing some signs of strength,

Credit Suisse said the 6.3 magnitude earthquake that hit Christchurch, New Zealand on Monday appears to have caused more physical damage than the larger (7.1 magnitude) quake that hit the South Island city on September 4.

Apple Inc. celebrated the 56th birthday of its Chief Executive Steve Jobs with an update to its MacBook Pro computers

The companies whose shares are moving in pre-market trade on Thursday are: Priceline.Com, Integrys Energy, ConocoPhillips, Chesapeake Energy, Chevron Corp, E TRADE Financial, Red Hat, Suntrust Banks, Monster Worldwide and eBay.

Gold steadied near seven-week highs on Thursday, as investor fears over inflation stemming from the spike in crude oil were partially offset by pockets of profit-taking after the market's 6 percent rise this month.

The top pre-market NASDAQ stock market gainers are: Crescent Financial, Netease.com, priceline.com, Hanwha SolarOne, and Clean Energy Fuels. The top pre-market NASDAQ stock market losers are: Salix Pharmaceuticals, AXT, InterDigital, Calumet Specialty Products Partners, and E*TRADE Financial.

Apple Inc., which revolutionized the tablet market with its launch of iPad in April 2010, will be reportedly launching its new iPad 2 at an event in San Francisco, California on March 2 with a launch date on early April.

Futures on major U.S. indices point to a lower opening on Thursday as oil prices continued surge due to continued turmoil and violence in Libya.

Researchers have developed an advanced lithium-ion battery, having high energy content and rate capacity, to make electric vehicles a more realistic alternative to gas-powered automobiles.

The U.S. Food and Drug Administration (FDA) has cleared the first test for the preliminary identification of norovirus that cause the “stomach flu,” or gastroenteritis.

Western investment banks are keen to underwrite more IPOs on China's Shenzhen exchange this year as a surging economy turns the once insignificant market into a fundraising hotbed.

The top after-market NYSE gainers on Wednesday are: Polypore International, Jarden, iStar Financial, Calgon Carbon and K-V Pharmaceutical. The top after-market NYSE losers are: American Equity Investment, St. Joe, Magna International, Tenet Healthcare and Whiting Petroleum.

The top after-market NASDAQ stock market gainers are: Netease.com, ArQule, Biogen Idec, priceline.com, and Leap Wireless International. The top after-market NASDAQ stock market losers are: AXT, InterDigital, POZEN, Calumet Specialty Products Partners, and United Online.

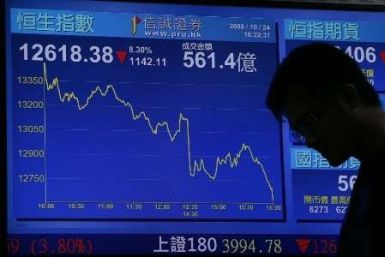

Hong Kong stocks are expected to open lower on Thursday, pressured by a surge in oil prices on fears turmoil in Libya could spread to other oil exporters in the region, and declines in global markets.

Stocks sank for a second consecutive day in tandem with oil prices surging to 28-month highs as continued turmoil and violence in Libya shatters traders nerves.