Fitbit Has Made Little Progress In Its Services Business

Fitbit (NYSE:FIT) reported surprisingly strong third-quarter earnings last week, notably marking a return to profitability (on a non-GAAP basis) as its mainstream Versa smartwatch enjoys robust demand. However, the company is keenly aware of how brutal the consumer hardware space is, and has been trying for years to grow its premium subscription business while also hoping to expand into the corporate wellness sector. Fitbit Coach (a rebranded version of FitStar, which Fitbit acquired in 2015) was launched last year, with a subscription price of $40 per year.

This article originally appeared in the Motley Fool.

Unfortunately, the company is making little progress on either front.

Fitbit Coach subscriber base is tiny

One or both of these lines have been fixtures in Fitbit's SEC filings for years, and were again included verbatim in the most recent 10-Q:

- "Revenue from subscription-based services was less than 1% of revenue for all periods presented."

- "Revenue for corporate wellness software and services was less than 1% of revenue for all periods presented."

Fitbit has never really disclosed how many users have signed up for any of the services, but investors can derive some loose estimates. Total revenue in the third quarter was $393.6 million, so we know the subscription-based services business generated no more than $3.93 million during the quarter. At $40 per year (billed up front and recorded as deferred revenue), Fitbit only recognizes $10 per quarter. That means that Fitbit has at most 393,000 Fitbit Coach subscribers -- a tiny portion of its 25 million active users.

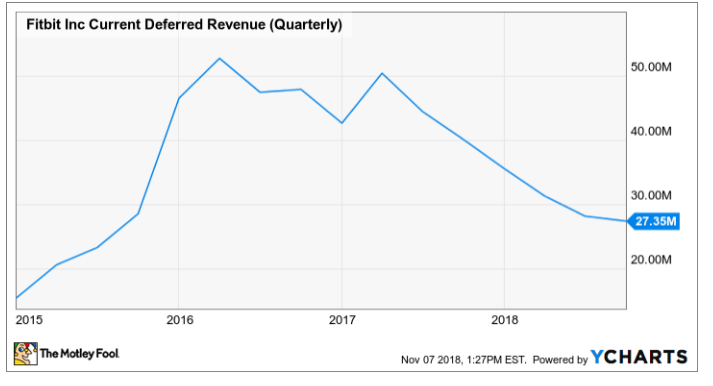

Furthermore, Fitbit's deferred revenue balance has been trending lower, suggesting that its pipeline of users signing up for services is deteriorating as well. (Deferred revenue also includes hardware shipments in transit, as well as deferred subscription revenue.)

More transparency next year

CEO James Park noted on the call that Fitbit Health Solutions, its corporate wellness segment that includes the Fitbit Care enterprise health platform, grew 26% during the quarter, but that's growth off a small base. The good news is that Fitbit will start disclosing more information around its progress in healthcare next year, according to Park (emphasis added):

So the growth reflects the fact that we added to our [corporate wellness] customer base of 1,600 health plans for enterprises and looking forward, we're trying to shift our model away from being purely device-centric to being a more solutions-oriented business that combines both devices and software services and Fitbit Care is really the key part of our strategy to do that and Humana's selection of Fitbit Care is a really powerful endorsement of our strategy. And in terms of numbers that we can share, what we can say is we're committed in 2019 to provide more transparency into our healthcare business, as it continues to grow.

Rebounding device sales and the return to profitability are at least alleviating some of the financial pressure Fitbit was feeling last year, which should give it some breathing room to focus on growing its services businesses, even if the company has only made modest progress so far.

Evan Niu, CFA has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Fitbit. The Motley Fool has a disclosure policy.