Friday's Stock Market Close: US Equities Fall On Disappointing December Jobs Data

KEY POINTS

- The U.S. economy added 145,000 jobs in December

- The U.S. government slapped more sanctions on Iran in retaliation for their missile strike

- Chinese trade officials meet in Washington next week to sign trade deal

U.S. stocks finished lower on Friday on a disappointing December jobs report and the imposition of new sanctions on Iran. The Dow Jones Industrial Average, however, crossed the 29,000 mark for the first time before falling back.

The Dow Jones Industrial Average dropped 133.47 points to 28,823.43 while the S&P 500 slipped 9.37 points to 3,265.33 and the Nasdaq Composite Index dropped 24.57 points to 9,178.86.

For the week the Dow inched up 0.66%.

Friday’s volume on the New York Stock Exchange totaled 2.57 billion shares with 1,342 issues advancing, 255 setting new highs, and 1,605 declining, with 19 setting new lows.

Active movers were led by General Electric (GE), Sorrento Therapeutics Inc. (SRNE) and Advanced Micro Devices (AMD)

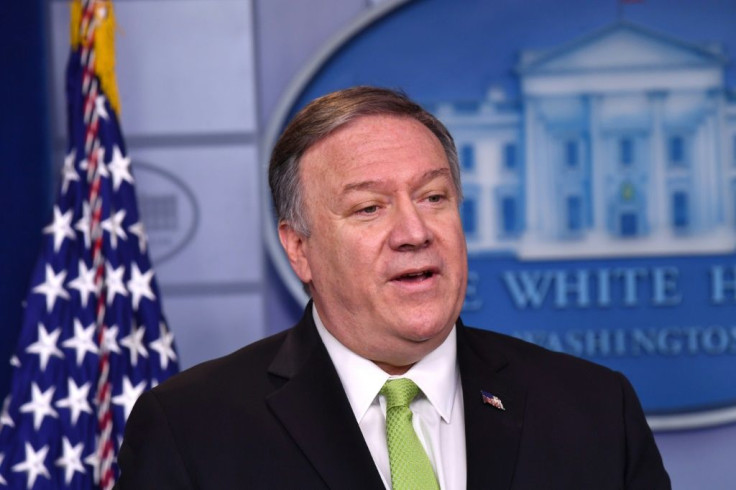

Secretary of State Mike Pompeo and Treasury Secretary Steven Mnuchin unveiled new sanctions on Iran’s metal exports and on eight senior Iranian officials in retaliation for Iran firing missiles at U.S. targets in Iraq.

Nonfarm payrolls rose by 145,000 in December, following a downwardly revised 256,000 advance the prior month, while the unemployment rate remained at 3.5%, the Labor Department said on Friday. Economists had expected 160,000 new jobs created.

Average hourly earnings climbed by 2.9%, below projections for a 3.1% increase.

For the year payrolls increased by 2.1 million, or an average of 176,000 per month, the slowest pace since 2011. In 2018, 2.7 million new jobs were added.

“It’s a real question why wages haven’t accelerated more,” said Jay Bryson, acting chief economist at Wells Fargo. “Part of it may be just due to the underlying fact that inflation expectations among folks just remain very, very low.”

“The December jobs report was a little softer than expected but not so much so as to stoke big worries about the U.S. consumer and the health of the overall economy,” said Alec Young, director of global markets research at FTSE Russell. “Although both readings were slightly below expectations and the recent trend, neither is overly alarming by itself.”

Chinese officials are expected sign the first phase of a trade agreement with the U.S. at the White House next week. President Donald Trump said that he might wait until after the 2020 presidential election to achieve phase two of the trade deal.

In other economic data, wholesale inventories in the U.S. fell by a seasonally adjusted 0.1% in November from October. Economists surveyed had expected no change over the month. Inventories had increased in October by 0.1%, unchanged from the prior estimate.

Overnight in Asia, markets were mixed. China’s Shanghai Composite slipped 0.08%, while Hong Kong’s Hang Seng gained 0.27%, and Japan’s Nikkei-225 rose 0.47%.

In Europe markets closed lower, as Britain’s FTSE-100 slipped 0.14% while France’s CAC-40 and Germany’s DAX each fell 0.09%.

Crude oil futures slipped 0.76% at $59.11 per barrel and Brent crude edged up 0.09% at $65.04. Gold futures rose 0.42%.

The euro rose 0.16% to $1.1123 while the pound sterling fell 0.08% to $1.3055.

The yield on the 10-year Treasury fell 1.78% to 1.825% while yield on the 30-year Treasury tumbled 1.97% to 2.284%.

© Copyright IBTimes 2025. All rights reserved.