General Electric (GE) Goes Global: Revenues Over $1bn From 24 Countries

Industrial heavyweight General Electric Company (NYSE:GE) said on Friday that it drew revenues of more than $1 billion from each of 24 countries last year, with six new countries hitting that threshold in 2013.

Those six countries include developed European economies like Norway and Switzerland, alongside emerging markets like Thailand, Indonesia, Turkey and Algeria. The $268 billion market-cap conglomerate won a $2.7 billion contract for gas and steam turbines, and other energy equipment, from an Algerian state-owned group in September 2013, in one of the largest power agreements in GE history.

The company doesn't disclose revenues on a per-country basis, GE spokesman Seth Martin told IBTimes via email. He cited signs of "strong business" from those six countries, citing the Algeria power deal as an example.

Over the past decade, General Electric has moved from a company with heavy U.S. exposure to one with more than half its business coming from outside America, said GE CEO Jeff Immelt at a March 2013 economic summit.

Immelt revealed then that they’d sold 279 gas turbines to U.S. customers in 2000, but sold only 3 in 2012, but didn’t seem worried. He said that was due to a declining U.S. energy market, and a power bubble from 1999 to 2000, adding that GE retained its market share.

Here’s an infographic illustrating GE’s global reach. In 2012, it earned over $1 billion in 18 countries. Their research and development spending has been upped from 2 percent a decade ago, to five percent now, said the company.

GE also reported fourth quarter and full year earnings on Friday morning, showing strong growth in its industrial businesses. The company has worked to boost industrial sales recently, and to slim down its significant reliance on its financial services arm, GE Capital. They reported 13 percent more orders in growth markets, relative to 3 percent rise in European orders, and led by a significant 25 percent sales boost in China.

“We are increasingly constructive on GE’s fundamentals, particularly as its industrial earnings (aided by robust operating margin improvement) begin to solidly outgrow the earnings of GE Capital until 2016,” wrote William Blair & Co industrial analyst Nick Heymann in an update on Friday, following earnings.

In its 2012 annual report, GE said it invests more than $10 billion each year to launch new products and build global capacity.

Notably, the company is highly vulnerable to the global economic climate, where shifts in its industrial end-markets for its infrastructure and equipment can affect demand and pricing for its products. Its power and water business fared badly in 2012 on these grounds.

GE targeted countries rich in natural resources in 2012, the company noted in its annual report. Its ability to deliver mining, transportation and energy equipment and leverage its sheer size has been key.

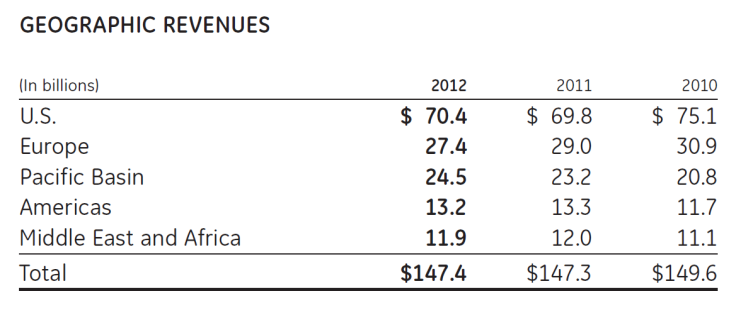

The company’s non-U.S. revenues were 57 percent of total revenue, excluding GE Capital, in 2012. They file over 5900 income tax returns in over 250 tax jurisdictions. The company also likes to make global acquisitions.

Here are more details from a May 2012 presentation at a UBS conference in London.

© Copyright IBTimes 2024. All rights reserved.