Groupon to Start Trading Friday: The Challenges Ahead for Business

Daily deals company Groupon, Inc. is expected to start trading on Nasdaq Nov.4 after it raised $700 million from its initial public offering, thereby becoming the largest IPO by an Internet company since Google Inc. (NASDAQ:GOOG) raised $1.7 billion in 2004.

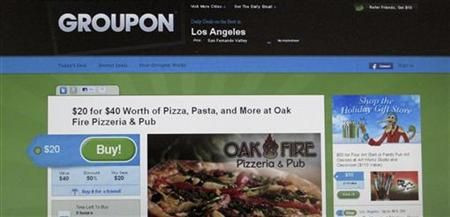

The company, which features daily deals for various restaurants, spas and other businesses in over 175 North American markets and 45 countries worldwide, is now valued at almost $13 billion after it increased the offering by 5 million shares to 35 million in total and pricing them at $20 each, above an initial range of $16 to $18.

Groupon IPO comes at a time when consumer interest in daily deals is taking off. Daily deals, group buying, group coupons, social commerce and flash sales has emerged as the Internet's new growth segment as it has modernized the way local consumer services are promoted.

Group buying revenue in the U.S. totaled $1.12 billion in 2010 and could grow 138 percent to $2.67 billion in 2011, according to Local Offer Network.

Groupon has generated rapid gross billings growth, up from $34 million in 2009 to $745 million in 2010 and reaching $2.75 billion in the first nine months of 2011. Groupon's take rate, defined as net revenue over gross billings, was 37 percent in the third quarter of 2011.

Its gross billings are on track to hit $4.1 billion in 2011. Groupon's take rate was 43 percent in 2009 to 42 percent in 2010 and 37 percent in the third quarter of 2011, according to Benchmark Capital.

However, stock analysis firm Trefis said while its past growth was impressive, growth would slow down as it penetrated major markets in North America and as competition intensifies. Groupon's business model has been challenged in some mature markets such as Boston and Chicago.

Competition in the social commerce space has surged and many users experience daily deal fatigue. As a result, revenue growth will slow down for the company as it penetrates most major markets and faces more competition, Trefis said in a note to clients.

The high costs of customer acquisition that Groupon is incurring will eventually force the firm to strike a balance between aggressive expansion and customer & merchant retention if it plans to move forward its profitability. Moreover, it will need to prove its ability to defend its business model by distinguishing itself as a leading provider of deals for the best merchants.

Trefis said apart from defending its core business model, the company could face some issues, including international expansion.

In addition, law regarding deal promotions may also hurt Groupon. Many critics allege that Groupon is ultimately selling gift certificates at the end of the day. In most U.S. states, gift certificates - which are essentially shopping vouchers - are not supposed to expire. In some extreme cases, the minimum expiration date stands at over 5 years.

However, many customers have complained that some of their Groupons expire before they have a chance to use them making them feel like they were hoodwinked, and this could lead to greater scrutiny by city and state authorities.

Groupon is also currently facing legal scrutiny in many U.S. states for alleged gift card violations, and any action taken by regulators could hold repercussions for other markets.

© Copyright IBTimes 2025. All rights reserved.