Here's How Ford Will Improve On A Dismal 2018 In China

The full-year numbers are in, and it was a tough, tough year for Ford Motor Company (NYSE:F)in China. The Blue Oval's sales in China fell 36.9% in 2018, with mainstream Ford passenger models accounting for much of the decline.

This isn't just about a slumping market for new cars in China, though that has been a growing factor in recent months. It has become clear that Ford needs to completely retool its approach in China if it's going to have a substantial presence in the world's largest vehicle market.

Ford's stock price took a big hit last month, in part because of worries about China. Fortunately, the retooling is already starting to happen. But before we get to that, let's take a closer look at what happened to Ford's sales in China in 2018.

A deeper dive into Ford's China results

Most of the vehicles Ford sells in China are built by two joint ventures between Ford and Chinese automakers. Changan Ford (CAF) builds and sells Ford-brand passenger cars and SUVs, most of which (but not all) would be familiar to Americans, though some wear different nameplates in China.

JMC, a joint venture between Ford and truck maker Jiangling Motors, makes -- you guessed it -- trucks, including commercial vans and a truck-based Ford SUV called the Everest.

In addition to the vehicles sold by CAF and JMC, Ford imports vehicles to sell in China under the Ford and Lincoln brand names. At least as of right now, those 4 categories (CAF, JMC, imported Fords, and Lincolns) account for just about all of the vehicles that Ford sells in China.

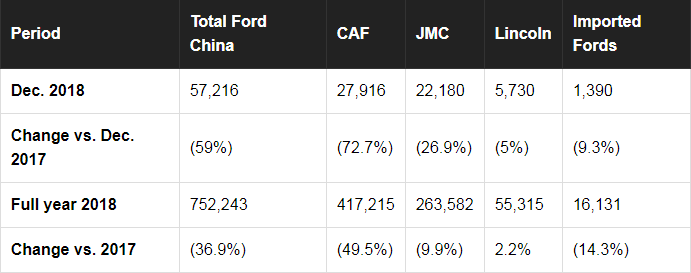

Here's a look at how each of those categories performed in December and for all of 2018.

As you can see, while Lincoln did pretty well for the full year, and JMC's commercial vehicles held their own, Changan Ford got absolutely clobbered in 2018. Ford stopped reporting monthly sales of individual models in China after September -- but through September, every mainstream Ford model sold by CAF was down over 25% from the same period in 2017. It's not unreasonable to assume that trend continued through the last three months of 2018.

Long story short: Commercial vehicles and Lincolns are still doing OK for Ford in China, but regular Ford model vehicles aren't. How can Ford turn this around?

How Ford is working to fix this mess

A little over a year ago, Ford announced a turnaround plan for China. The key points:

- A lot of new products: over 50 by 2025, including eight all-new SUVs.

- Ford will build more vehicles locally. Right now, in addition to the Ford-brand imports, all Lincolns sold in China are imported. That will change.

- More consumer-friendly technology, including internet connectivity in all vehicles by the end of this year.

- Cost reductions.

- Major changes to Ford's distribution and dealer network.

The results aren't visible in Ford's China sales numbers yet (to say the least), but some important progress has already been made. Ford has reworked its distribution network to simplify its wholesale operations, and has worked with dealers to help reduce excess inventories of aging products. The inventory reduction hurt Ford's results for a while, because it was shipping fewer vehicles-but it helped Ford's struggling Chinese dealers return to profitability.

Ford has also hired a strong new leader for its China operation. Anning Chen, the former CEO of Chinese automaker Chery, because president and CEO of Ford China on November 1. He has moved quickly to boost Ford's marketing, sales, and service team, which directly supports its dealer network, and to bring in more executives with deep local experience.

Right now, Ford is in the process of launching three new products. An all-new Focus is in the works, as is an all-new version of its lower-cost China-only compact sedan, called the Escort. Also, Ford's launching a new low-cost crossover developed specifically for China, the Ford Territory. More new products are on the way, including the all-new Lincoln Aviator and an all-new version of the compact Kuga SUV, a near-twin of the U.S.-market Escape.

That will all help. But unlike rival General Motors (NYSE:GM), which is also planning to launch a slew of new products in China this year, Ford has a lot of rebuilding to do with its customers and stakeholders. Given the slump in China's new-vehicle market, it may be several months or more before we know whether Chen has Ford China on the right path.

This article originally appeared in The Motley Fool.

John Rosevear owns shares of Ford and General Motors. The Motley Fool recommends Ford. The Motley Fool has a disclosure policy.