Homeownership Drops To Lowest Level In Over 20 Years As Rental Costs Climb

More Americans are renting their homes than at any time in more than two decades, as homeownership continues to plunge to record levels.

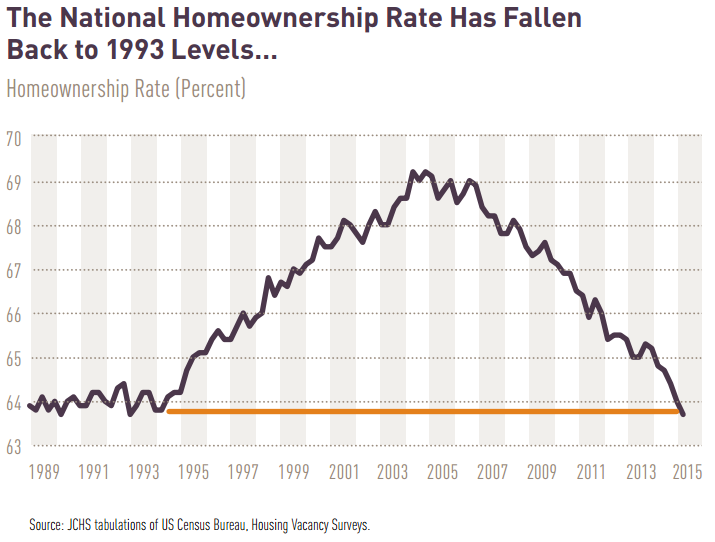

Those are the findings from new research out of Harvard’s Joint Center for Housing Study. Continuing a decadelong decline, homeownership rates stood at just under 64 percent at the start of 2015 -- about the same level that prevailed in the early 1990s.

The unrelenting drop in homeownership “erases nearly all of the increase from the previous two decades,” said Chris Herbert, managing director of the housing center, in a statement. “The trend does not appear to be abating.”

Much of the decline in homeownership came from members of Generation X, now in their late 30s to early 50s. Having hit their peak home-buying years in the throes of the financial crisis, Gen Xers lag significantly behind their elders in owning homes. Those aged 65 and over represent the only age group that has kept its homeownership rate relatively steady over the past decade.

As a result of muted homeownership, millions of adults are streaming into rental markets, sending vacancy rates to a 20-year low and driving up rents. Nationwide, rental costs increased 3.2 percent in 2014, double the rate of inflation.

All across the income spectrum, rent has grown into a significant burden: Overall, roughly half of American renters pay more than 30 percent of their income to landlords.

The chief forces behind the dual trends, according to the study: slow wage growth and lack of financing. At the same time that employers have been sluggish in bringing wages back to prerecession levels, lenders have been reticent to extend mortgages for fear of repeating the steps that plunged the U.S. into the subprime mortgage crisis.

And even as housing construction shows signs of picking up, vast swaths of the country are stuck with underwater mortgages, depressed home prices and moribund home sales. These problems are acute in low-income and minority communities, where housing prices have declined more precipitously than in white neighborhoods.

Still, there’s good news in recent data. New-home sales rose to a seven-year high in May, bolstered by a booming Northeast. The report's authors project that as millennials enter their prime, homeownership should pick up. But the historic highs of the mid-2000s are still a long way off.

© Copyright IBTimes 2025. All rights reserved.