How The Coronavirus Is Fueling Apple's Services Business

The backdrop is grim to be sure. The global coronavirus outbreak has shut down much of the world's commerce. Even the venerable Apple (NASDAQ:AAPL) has been affected, with supply chain disruptions as well as store closures that have prevented would-be customers from purchasing its devices.

The world's most profitable and (usually) biggest company is hardly in dire straits, however. In some regards, the worldwide lockdowns have even enhanced the relationships between Apple iPhones and their owners. We might become less glued to our handheld technologies once the pandemic is in the rearview mirror, but by that time, a wide swath of consumers could have trained themselves to love their iPhones and iPads even more than they already do.

More to the point, data suggests iPhone owners are increasingly comfortable with the idea of spending money on and within iOS apps, giving Apple's services business a big-time shot in the arm.

More services, less hardware

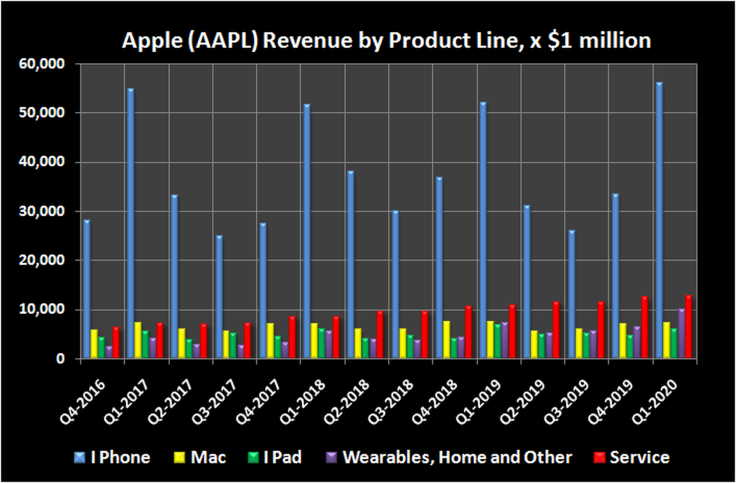

The shift was already under way. Up substantially from just a few years ago, Apple's service business -- apps, digital content, and commissions on app-based subscriptions -- reached a record $12.7 billion of revenue during the three-month stretch ended Dec. 28, 2019. That was up 17% from the prior-year period.

Services revenue is still dwarfed by iPhone sales, which generated $56.0 billion in the same period, up about 8% year over year. Its iPhone business will likely face a saturation headwind, however, at some point in the foreseeable future.

Now, that looming inflection point is not quite so dire, given the numbers from app market data provider Sensor Tower. It estimates the average U.S. iPhone owner spent $100 in 2019 on apps, in-app purchases, and subscription-based content accessed through an app. That number is well up from the $79 total Sensor Tower calculated for 2018, and leaps and bounds more than 2015's tally of $33 per iPhone owner when Apple's stand-alone service business was little more than an idea.

That's not the jaw-dropping metric to focus on, though. More noteworthy is the fact that there are now 1.5 billion Apple devices now in active use across the globe, with most of them being iPhones. The company has gotten very, very good at extracting revenue from a huge chunk of those owners.

Downloads galore

That task became significantly easier in the meantime thanks to the COVID-19 pandemic, of course. Exactly how much easier is still difficult to say. But we do know the App Store for Chinese iOS users experienced a 62% increase in mobile game downloads during February -- when China's lockdowns were in full swing -- according to reports from another app download data provider called App Annie. That figure topped the broader 39% increase in global game downloads, which was driven higher by Chinese smartphone owners.

North America's bout with the pandemic is just now approaching its peak, so it's somewhat premature to suggest we'll see a perfect repeat of the trend from China, but we're likely en route to a similar outcome. As reported by Mobile Marketer, an AdColony survey conducted last month indicated two-thirds of consumers were playing more mobile games near the end of March than they were at the beginning of the month. Nearly half of those polled said they have downloaded new mobile games for their smartphones in the middle of last month, and that was before most people started to take stay-at-home recommendations seriously.

App Annie confirms the idea, saying that between March 22 and March 28, game app downloads reached an all-time record of 1.2 billion.

It's a nuance that bodes particularly well for Apple. Of the $100 Sensor Tower says iPhone owners spent on and through apps in 2019, more than half of that was spent on mobile games.

Maybe not a new habit (but probably is)

Apple will want to do all it can to ensure this increase in app spending isn't just a temporary surge stemming from the outbreak. That's a tall order to be sure, but hardly out of reach -- the growth trend since 2015 makes that clear enough. Once a consumer spends their first dollar on an app, it's much easier to induce spending of the second, third, and so on.

More important to investors, though, it's a boost to a trend that was already starting to take pressure off Apple's iPhone as a growth driver and breadwinner for the company.

James Brumley has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Apple. This article originally appeared in the Motley Fool. The Motley Fool has a disclosure policy.