IBM To Cut ‘Several Thousand’ Jobs, Denies Mass Layoff Of More Than 100K Workers

IBM officials and workers’ representatives at Big Blue are denying a report the company plans to cut more than 100,000 jobs in the next several weeks in what would be the biggest mass layoff in U.S. corporate history. IBM, which has seen revenue dip in 11 straight quarters as customers move computing operations to the cloud, is, however, expected to reduce its head count by about 8,000 to 9,000 workers in coming weeks.

Tech columnist Mark Stephens, who writes under the name Robert X. Cringely, last week reported IBM would cut 26 percent of its worldwide staff, or about 112,000 individuals, under an initiative Stephens said is called Project Chrome. “The biggest reorganization in IBM history is going to be a nightmare for everyone,” Stephens wrote.

But analysts, union officials and IBM representatives were quick to dismiss the report from Stephens, who in 2012 wrote IBM would eliminate 78 percent of its U.S. head count by the end of 2015. An IBM spokesman called Cringely’s most recent report “ridiculous.”

“IBM does not comment on rumors, even ridiculous or baseless ones,” said the spokesman, in an email to International Business Times. IBM in the fourth quarter announced a charge against earnings of $600 million for “workforce rebalancing,” which is Big Blue speak for layoffs.

“This equates to several thousand people, a mere fraction of what’s been reported,” the spokesman said. Analysts estimate IBM’s redundancies cost the company about $70,000 to $75,000 per worker, which means the Q4 charge implies layoffs numbering 8,000 to 9,000.

Officials for an IBM workers group contacted by IBTimes also said they had no knowledge of pending job cuts on the scale reported by Stephens. “The Alliance has no information that this is true and is urging caution in reporting this number as fact,” said a spokesman for Alliance@IBM, an affiliate of Communications Workers of America, Local 1701. “But as you know, anything can happen at IBM anymore, and this is the time of year that IBM cuts jobs,” said the spokesman for the alliance, which is not recognized by IBM as a formal bargaining unit.

Toni Sacconaghi, an analyst at Bernstein Research, also questioned the numbers in Stephens’ report. “We struggle with the congruity of this on many fronts,” said Sacconaghi in a note, according to Barron’s. The analyst said the IBM units Stephens identified as ripe for culling -- storage, mainframes and security -- likely employ fewer than 50,000 individuals.

IBM’s worldwide head count stood at 431,212 in 2013, down from 434,246 in 2012. The company’s spokesman said while there were some layoffs last year, IBM also hired 45,000 new workers in 2014 and currently has 15,000 job openings in growth areas like the cloud, mobility, analytics and social media.

While IBM may not be planning what would be the largest mass layoff in the history of corporate America, surpassing its 1993 cull of 60,000 employees, the company does need to take steps to reverse what has been a series of dismal quarters.

IBM last week reported sharp declines in fourth-quarter revenue and profits as it was hit with the dual headwinds of a weak global economy and a strong U.S. dollar. Big Blue also continued to show signs it’s not growing sales in new markets like cloud and mobile computing fast enough to offset declines in traditional enterprise hardware and services, which still account for the bulk of its business.

Revenue for the period from continuing operations came in at $24.1 billion, roughly in line with estimates but down 12 percent from a year ago. Net income fell 11 percent, to $5.5 billion while earnings per share totaled $5.54, off 4 percent.

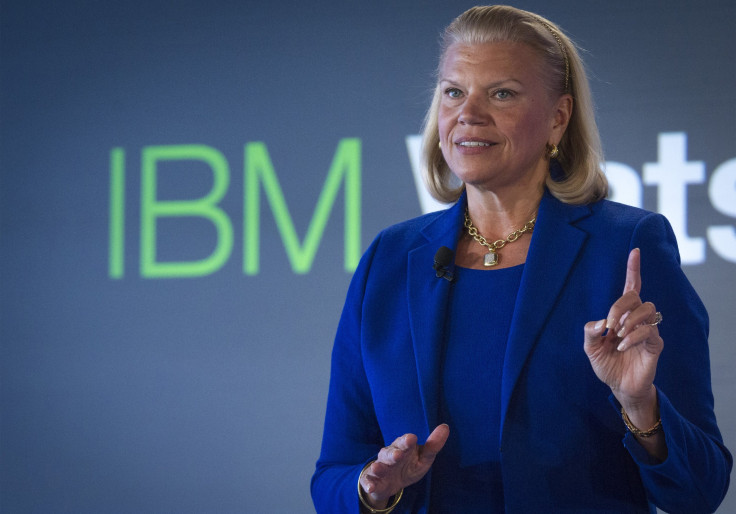

IBM is looking to build out its portfolio of products and services that facilitate cloud, mobile and social computing as well as security technologies. The company said sales in those areas increased 16 percent year-over-year, to $25 billion, or 27 percent of total revenue, in the fourth quarter. “We are making significant progress in our transformation, continuing to shift IBM’s business to higher value, and investing and positioning ourselves for the longer term,” CEO Ginni Rometty said in a statement.

Now in her fourth year atop IBM, Rometty needs to show she can position the company for a computing industry in which customers increasingly prefer to deploy applications on nimble, scalable cloud systems, such as those hosted by Amazon Web Services, as opposed to on-premises data centers that are expensive to manage and maintain. To give herself more leeway, she recently abandoned a pledge by her predecessor, Sam Palmisano, to deliver earnings per share of $20 by the end of 2015.

© Copyright IBTimes 2025. All rights reserved.