Infographic: Low-Cost Airlines Set To Reshape The Airline Industry

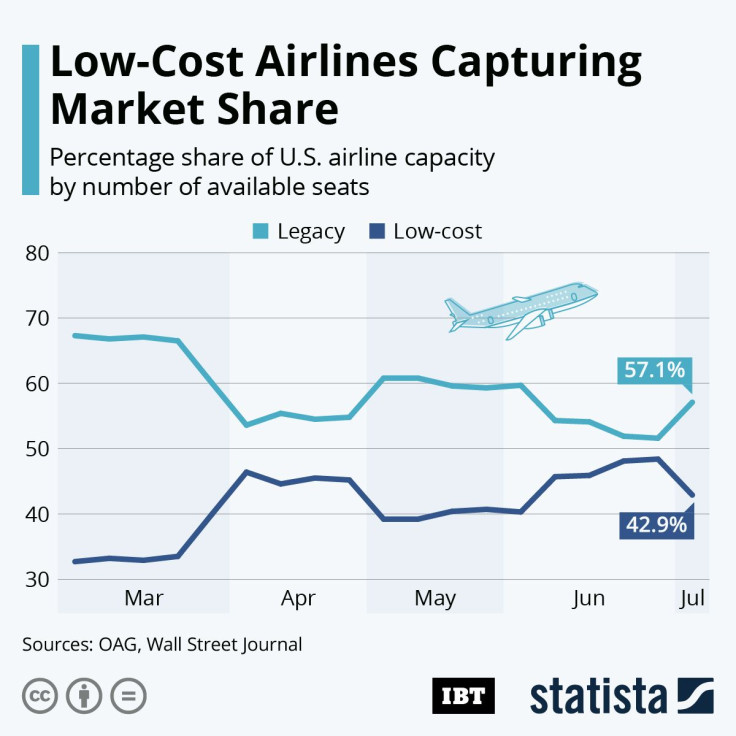

The airline industry is desperately trying to refill airplane seats that have sat mostly empty for the better part of three months. COVID-19 restrictions have caused mass layoffs and huge losses for nearly all airline companies, and with reopening measures in the U.S. and across the world moving forward, companies are aiming to rebound quickly. Recent data from the Wall Street Journal shows that low-cost airlines are capturing a larger proportion of seats from legacy airlines than they had before the pandemic, which may signal a potential reshaping of the airline industry.

After the first week of July, legacy airlines like American, United and Delta have shot back up to around 6.4 million available seats – up from a low of 3.1 million in May. Low-cost carriers, like Frontier, Southwest and others have bounced back to 4.8 million in July from a low of 2 million in May. While the increase in seats has been similar, low-cost airlines are seeing an opportunity to capture more of a market share than they had before the pandemic. Before restrictions took place, legacy airlines had 14.7 million seats available in mid-March compared to just 7.2 million from low-cost carriers. With just a 33% market share in mid-March, low-cost airlines now hold a 43% market share in terms of available seats, with room to grow.

Ultimately, legacy airlines may have more to lose if available seats fail to attract travelers in the coming months. That could prompt unprecedented price drops, especially if low-cost airlines are seeing more results.