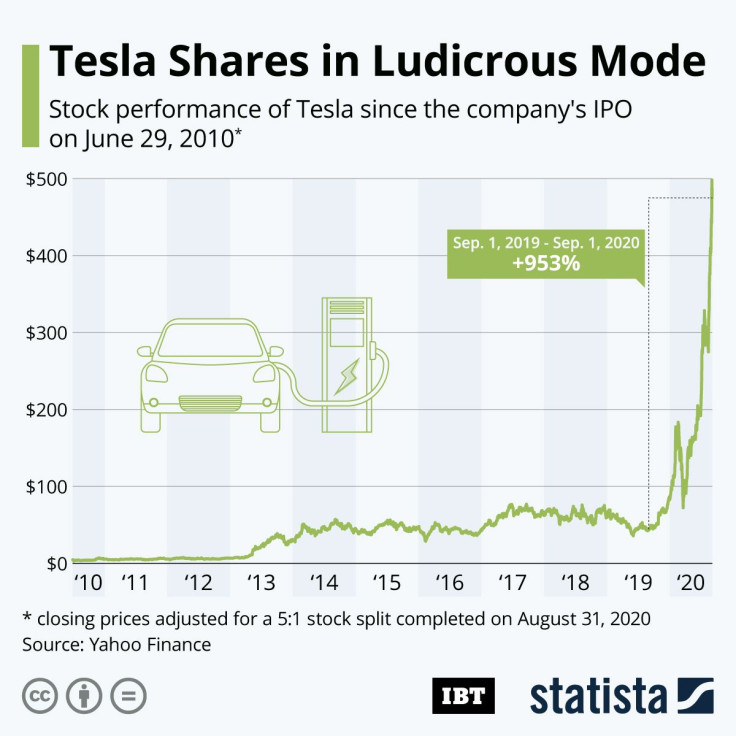

Infographic: Tesla Shares In Ludicrous Mode

After seeing its share price rally for large parts of the past year, Tesla announced a five-for-one stock split on August 11 to "make stock ownership more accessible to employees and investors." Unsurprisingly, the announcement added fuel to the company’s rally, boosting its share price by more than 70 percent over the past three weeks alone. The electric car maker has now seen its share price skyrocket by almost 1,000 percent over the past 12 months, bringing its market capitalization to $442 billion by September 1.

Seeking to take advantage of its unprecedented stock market run, Tesla revealed plans to sell up to $5 billion worth of new stock in a filing with the U.S. Securities and Exchange Commission on Tuesday. The once notoriously cash-strapped company will use the proceeds of the offering to “further strengthen” its balance sheet, as well as for “general corporate purposes,” according to the filing. Following the completion of its 5-to-1 split on Monday, the company’s shares fell by 4.7 percent on Tuesday.