Robinhood has just unveiled its Q1 2024 earnings, highlighting how its embattled cryptocurrency unit played a major role in the fintech giant's overall profits during the first quarter.

The crypto space is outraged over the SEC's seeming "abuse" of the Wells process as the regulator issued a Wells Notice to Robinhood's crypto arm just weeks after Uniswap received a notice.

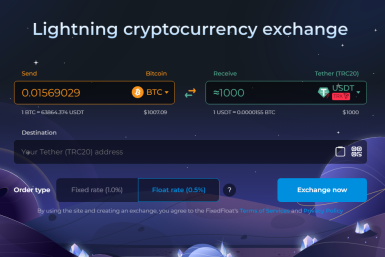

The FixedFloat exchange has started operating again after it was hacked for the second time by the same exploiters who first stole $26 million from the exchange.

Coinbase is once again in the spotlight for all the wrong reasons as a new class action lawsuit from investors alleged that the crypto exchange "knowingly" operated an unregistered business.

Jack Dorsey's Block is once again under fire, and this time, for alleged non-compliance at the fintech company's top units: Square and Cash App.

Sen. Lummis, who has called for regulations that do not stunt innovations in the crypto space, on Wednesday called out the Biden administration for criminalizing the "core tenants of the Bitcoin network."

Samourai wallet's co-founder, who was arrested last week by U.S. authorities, has pled not guilty and was released on a $1 million bond. He is due for his next hearing on May 14 over charges linked to the development and marketing of the crypto mixing service.

Venezuela's PDVSA is reportedly planning to speed up crypto adoption in oil transactions after the U.S. Treasury announced it will reimpose sanctions on the country's vast oil sector.

Binance's Nadeem Anjarwalla has reportedly been arrested in Kenya and will reportedly be extradited to Nigeria sometime this week following his "escape" from Nigerian custody.

Deaton has entered the picture in the SEC's case against Coinbase, as he filed an amicus curiae on behalf of thousands of Coinbase users.

Tether has announced four new business units that should help the stablecoin giant expand beyond its stablecoin business and pursue other subsectors in the vast crypto industry.

Norway has passed a new law that should help efforts in curbing the environment-related consequences of cryptocurrency mining.

Metaco, which saw its CEO depart the company earlier this year, has lost most of its executives and marketing department members, a new report revealed.

Russia's first crypto regulations may focus on the mining sector, as the Russian parliament's chief crypto expert said that mining activities should be the first in line when crafting the country's regulatory framework for the sector.

Goldman Sachs has been added into the list of "authorized partners" for BlackRock's spot Bitcoin ETF, marking a significant shift in the banking giant's view of Bitcoin and the crypto market as a whole.

Waterfall Network has just launched a new app for Windows and macOS that gives almost anyone the power to participate in the blockchain, even those who aren't tech-savvy.

Diamond Standard Co.'s CARATS, the natural diamond commodities that can be sent conveniently via SMS messaging, just could be what Asia needs to see a revolution in its remittance sector.

Insider malfeasance had a major impact on the web3 ecosystem last month, leading in losses of over $65 million, a blockchain security firm said in its monthly security report.

CertiK said in its March 2024 report that the confirmed crypto-related exploits during the month resulted in over $52 million in losses, further highlighting the evolving ways through which threat actors leverage vulnerabilities in the cryptocurrency sector.

Roman Storm, the co-founder of embattled Tornado Cash, has filed to dismiss an indictment against him that alleged the open-source crypto tool was used to launder over $1 billion in "criminal proceeds" for North Korean hacking group Lazarus.

The Philippines Securities and Exchange Commission (SEC) has announced the prohibition of local access to Binance, the world's largest cryptocurrency exchange.

The SEC's motion for judgment and remedies, filed Friday, remains confidential to outside parties. But Ripple's chief legal officer Stuart Alderoty said the redacted versions of the documents will be made public by March 26.

ZachXBT has once again flagged cryptocurrency market maker Gotbit, this time noting there were two partner projects of Gotbit that rug pulled in the past week alone.

Nigeria's securities regulator now wants companies that want to operate as a digital platform in the country to pay up over $95,000 to register the business – and that's on top of other fees in the registration process lineup that crypto firms need to pay so they can do business in the country.

LedgerPrime, which was forced to wind down when FTX crumbled late in 2022, has returned under a new name and is looking to duplicate or surpass its achievements during its peak.

The Treasury's OFAC has blacklisted 10 Bitcoin and Ether addresses that it said were linked to two LockBit-associated individuals.

Fed Governor Christopher Waller has given a different take the DeFi marketplace amid ongoing fears that it could erode the U.S. dollar's dominance.

The sentencing of Binance founder and ex-CEO Changpeng Zhao has been pushed to late April following his piling legal losses, including the denial of his request to travel overseas.

MicroStrategy's rebranding move into a "Bitcoin development company" is "natural" for a firm that now has an enterprise value largely related to its Bitcoin strategy, Michael Saylor said.

BlackRock's Rick Rieder hinted that the world's largest asset manager may amass more Bitcoin in the future, depending on the public's attitudes toward the cryptocurrency.