Silo Protocol, Winner Of ETHGlobal’s 2021 Hackathon Launches Its Gnosis Token Auction

Silo protocol, winner of ETHGlobal’s 2021 Hackathon that aims to create a secure and efficient money market, successfully launches its Genesis Token Auction on December 6, 2021. Prior to the launch, the Silo protocol had put to writing a codebase for a secure and efficient lending protocol. Silo aims to contribute to the lending protocol as Uniswap did to liquidity by allowing any token as collateral.

In an interview, the protocol announced its aim to integrate its token holders in its governance, to help decide on tokenomics.

Gnosis Auction: Benefit as Opposed to Balancer LBP and other IDO platforms

Silo protocol offers DeFi lending protocols major benefits and features which is proven the best compared to existing platforms like Balancer LBPs. Silo protocol runs on decentralized infrastructure, and it is offering the community of users a chance to be a major part of its project through Gnosis Auction.

Although new compared to other lending protocols, Silo seeks to create an inclusive money market that will enhance growth in the protocol by providing liquidity in Silo DAO. Apart from offering fair pricing and preventing rug-pulling, Gnosis Auction offers benefits that include; a user-friendly bidding process, no frontrunning, and a fair distribution of tokens.

There is a single clearing price for all tokens when the auction ends. After the end of the auction, each winning bidder is given the same clearing price regardless of the amount. This way, the community seeks to create a single value for the Gnosis token before circulation. Speaking of circulation, 100% of Silo’s supply circulation will be derived from the Genesis event at least for the first six months.

Bidding processes aren’t complicated, the auction offers user-friendly bidding. All bidders are allowed to decide the token price when the auction is ongoing. Bidders don’t have to worry about frontrunning, tokens can’t be purchased only to be sold at a higher price during the auction. Gnosis token auction offers a fair distribution and pricing of tokens. Participation in the auction is open, so bidders don’t have to rush when participating.

Silo has refused to launch with traditional mining programs, instead, it seeks to create its protocol owned liquidity (POL ). Silo aims to achieve a money market that attracts users and contributes to the growth of the protocol through protocol-owned liquidity. POL will allow Silo to achieve quick growth, flexibility, reduce market volatility, and autonomy.

Unique Features of Silo Protocol

Silo protocol has potential and value to the lending DeFi protocol. Some of its features are;

Secure

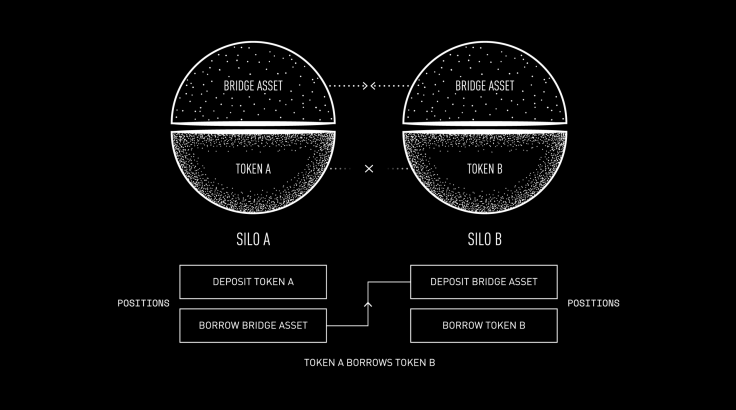

Silo protocol offers solutions to the vulnerable and restrictive existing lending protocols. To avoid exploitation, Silo aims to reduce risk through security by design. Silo implements an isolated money market where Silo consists of two assets; the bridge asset and a unique token. The protocol seeks to manage and prevent higher risk by isolating a risk asset into a silo.

Efficient

Apart from providing security to its community, Silo provides efficiency. It seeks to create an inclusive money market that creates value. Liquidity will be concentrated in single pools and it allows any token to be used as collateral to borrow another token. This feature is not available in existing lending protocols.

Inclusive Money Market

Silo protocol is a permissionless and risk-isolating lending protocol. It integrates all crypto assets, and it is not limited to 10 or 30 major token assets but all crypto assets. Users will also be allowed to create a market for tokens.

Isolated Money Market

Silo protocol offers a different isolated money market compared to other protocols. Major protocols like Kashi and Rari create an isolated money market that offers any tokens, but they don’t offer users efficiency. Kashi has achieved high security with its design, but liquidity isn’t strong and the markets aren’t effective. On the other hand, Rari’s Fuse creates isolated pools which have Aave functionality, but the pools are risky because of the many tokens in a pool. So, users tend to share the risk of other tokens.

However, Silo mitigates risk, enhances security, efficiency and implements a risk-isolating money market, unlike other lending protocols. Each token asset is stored in one pool (Silo). It also creates its protocol-owned liquidity to ensure liquidity is provided between markets.