Hedge fund billionaire Steven A. Cohen in sworn testimony earlier this year called the rules on insider trading very vague and said sometimes it's a judgment call as to whether a tidbit about a public company is inside information.

A deal to restructure Greek bonds could see banks rank on an equal footing with official euro zone lenders to the country under a plan being discussed, one of the lead negotiators said on Tuesday.

The Federal Reserve on Tuesday left monetary policy on hold but said financial market turbulence posed threats to economic growth, leaving the door open to further easing next year.

French bank Credit Agricole will unveil a restructuring on Wednesday, a trade-union representative told Reuters, and the number of jobs cuts could reach around 2,000, the Figaro later reported.

Stocks fell for a second straight day on Tuesday after the Federal Reserve gave no hints of new stimulus measures to offset the effects of the worsening European debt crisis.

Spending cuts proposed by a cash-strapped coalition government in London will likely also exacerbate the problem.

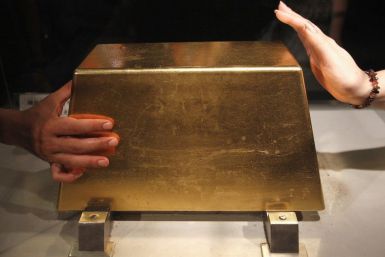

Gold prices slipped Tuesday, its seventh consecutive daily decline, to a two-month low as the dollar posted big gains in light trading.

The Federal Reserve on Tuesday pointed to turmoil Europe as a big risk to the economy, leaving the door open to a further easing of monetary policy even as it noted some improvement in the labor market.

Hedge fund billionaire Steven A. Cohen in sworn testimony earlier this year called the rules on insider trading very vague and said sometimes it's a judgment call as to whether a tidbit about a public company is inside information.

Three former executives of Washington Mutual Inc have agreed to a payment of about $75 million to settle a lawsuit brought by the Federal Deposit Insurance Corp over their role in the biggest bank failure in U.S. history, two sources familiar with the talks said on Tuesday.

Stocks rose on Tuesday as energy shares rallied on higher crude oil prices, but trading was volatile after German Chancellor Angela Merkel rejected any suggestion of raising the limit on Europe's bailout fund.

It's an understatement to say that the Great Recession took its toll on department store chains, but there are survivors, and Nordstrom (JWN) is one.

Former MF Global chief Jon Corzine said on Tuesday he felt a need to clarify his prior statements, definitively telling a new panel of lawmakers that he never gave instructions that could have been misinterpreted as permission to misuse customer funds.

Lawmakers investigating the collapse of futures brokerage MF Global showed frustration with the firm's leaders about what happened to hundreds of millions of dollars in missing customer funds.

DuPont expects to beat Wall Street's earnings expectation next year, with executives stressing that strong agricultural and chemical sales will offset weak shipments to electronic and housing customers.

Best Buy Co's quarterly profit missed Wall Street estimates as bigger discounts during the key holiday selling season ate into profits at the world's largest electronics chain.

U.S. lawmakers investigating the collapse of futures brokerage MF Global showed frustration with the firm's leaders about what happened to hundreds of millions of dollars in missing customer funds.

U.S.-Israeli start-up CloudShare, whose technology enables Web-based development and testing of software applications, expects to as much as triple sales in 2012 as its benefits from the rapidly growing cloud computing market.

ECR Minerals Plc said Tuesday it expects exploratory drilling on its El Abra gold prospect in Argentina to begin next month.

Students graduating from Canadian colleges and universities next year will face the same stagnant job market that has confronted 2011 graduates, a study released on Tuesday said.

Exchange operators NYSE Euronext and Deutsche Boerse AG offered more divestments in a bid to assuage European authorities' antitrust concerns over their proposed $9 billion merger.

Hecla Mining Co., the largest U.S. silver producer, acquired the remaining 30 percent interest in a prolific Colorado silver project that it did not already own, the Idaho-based company said Tuesday.

The amount of gold held in exchange-traded products is near record highs and although the gold price is suffering from investors' desire for the safety of cash, the risk of this $116 billion stash of bullion being jettisoned is distant.

Private bondholders told Greece that they were willing to consider the country's proposal on a debt swap scheme as long as new bonds they receive have the same credit status as official loans, a banker involved in the talks said.

Gold and gold receivables held by euro zone central banks fell by 1 million euros to 419.822 billion euros in the week ending Dec. 9, the European Central Bank said on Tuesday.

Canadian miner Endeavour Silver Corp said it has discovered two high-grade silver-gold zones at its Guanajuato mine in Mexico and expects a substantial increase in reserves and resources at the mine at the year-end.

The Federal Reserve is likely to hold off offering the economy fresh stimulus at a meeting on Tuesday as it weighs encouraging signs on the recovery against risks coming from Europe.

Retail sales rose less than expected in November as a drop in receipts for food and beverages weighed against stronger sales of motor vehicles, tempering some of the expectations of a strong holiday shopping season.

Papua New Guinea's governor-general decided on Tuesday that the two men claiming to be the resource-rich country's prime minister must negotiate a solution, leaving a tense political deadlock unresolved.

Freeport McMoRan Copper & Gold Inc and its Indonesian workers' union expect to sign a pay deal on Tuesday to end a three-month strike that has crippled production at the world's second-biggest copper mine, two sources told Reuters.