Gold ETF Holdings Massive But Stable

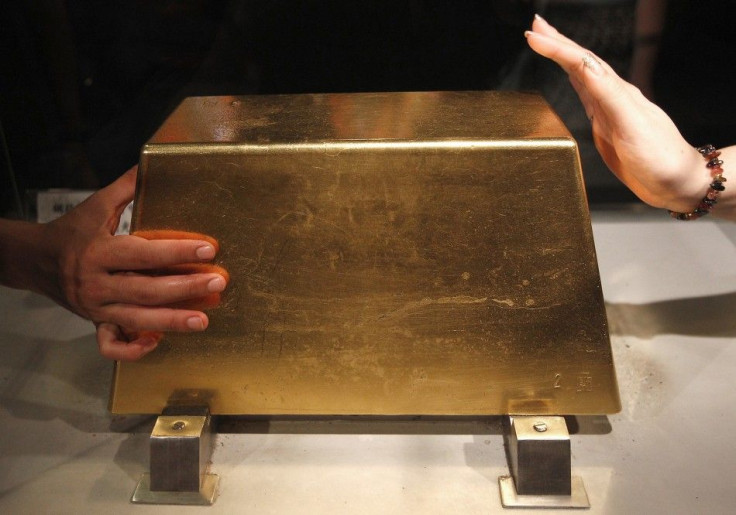

(REUTERS) -- The amount of gold held in exchange-traded products is near record highs and although the gold price is suffering from investors' desire for the safety of cash, the risk of this $116 billion stash of bullion being jettisoned is distant.

Exchange-traded products assume a number of formats and essentially issue investors with either shares or notes in a fund whose assets are entirely made up of a physical product. The eight largest ETPs tracked by Reuters now hold over 70.0 million ounces, or 2,200 tonnes of gold.

This hoard of metal is almost equivalent to the holdings of the French central bank, the world's fifth largest official holder of gold, or to a year of mine supply, and is worth about $116 billion based on the current spot gold price, which is up nearly 20 percent so far this year at $1,670 an ounce.

Gold ETPs are by far the largest in the entire exchange-traded commodity universe, accounting for 80 percent of the $187 billion invested in raw materials ETPs in November, according to asset manager BlackRock

Gold is the trade of uncertainty, Robin Bhar, analyst at Credit Agricole said. I don't think it's been really acknowledged that if you want to own gold, (ETFs) are a great vehicle.

You've got physical gold, you've got futures, you've got equities and ETFs, which are relatively cheap to own, so they've got a pretty solid place now in the mix of how you can get exposure to gold, he said.

ETPs are established products that mainly attract large institutional players with deep pockets and generally speaking, a long-term investment strategy, such as pension funds.

I suspect they are more for the medium to longer term investor, said Bhar.

However, the investment vehicles are not immune to changes in taste. Palladium exchange-traded funds, for example, were major sources of demand for the metal in 2010, but the uncertainty that pervaded the markets last year turned ETFs into a source of oversupply for 2011.

Inflows into gold ETPs have been moderate in 2011 compared with last year. So far in this year, the major funds have drawn in around 5.05 million ounces of metal, based on the funds monitored by Reuters, compared with 10.8 million ounces of investment in 2010, according to figures from consultancy GFMS.

HIGH-PRESSURE STAKES

ETF investors are not investment banks, which may take short-term bets on the price, nor are they central banks, which must manage reserves on behalf of an entire nation, so how does this group behave under pressure?

In January, when the gold price fell by 6.2 percent, which at that point was its largest monthly fall in over a year, ETFs registered an outflow of over 2.2 million ounces, or 3.4 percent of total holdings.

As the year has worn on and the perils of being exposed to once-super safe government debt have become apparent with the bailouts of Ireland and Portugal and the leap in yields of debt issued by Spain and Italy, ETF investors with their longer investing timeframe have been more sanguine in the face of market volatility.

In September, when the gold price tumbled by as much as 20 percent from a record $1,920.30 an ounce, the world's largest ETFs lost a collective 444,000 ounces, or 0.7 percent of total holdings, compared with a fall of nearly 5 million ounces, or 28 percent, in holdings of gold futures by speculative investors.

There was redemption of 1 pct, about 25T, during that rapid fall, which was shockingly small, when we are told most investors are retail, Ross Norman, director of bullion broker Sharps Pixley said.

The futures boys will turn on a sixpence if the market looks weak.What I find surprising is gold ETF holders tend not to be spooked by those bigger moves and I think it tends to reflect that long-term horizon, Norman said.

The ETF industry is mainly institutional, both in Europe, where ETP provider Source estimates retail investors account for only 10 percent of the market, and in the United States, where the market is split roughly 50-50 between institutional and retail buyers.

The World Gold Council, an industry group, estimates that in the third quarter of this year, ETF demand rose to 77.6 tonnes, while global demand for gold bars and coins reached a whopping 468.1 tonnes, highlighting the rush for gold among the retail sector which could prove to be more fickle.

Daniel Smith, a commodities strategist at Standard Chartered, said the amount of metal held by ETPs was not necessarily a harbinger of sell-offs to come.

I think that is more of a worry for the next few years, I don't think that's a worry for the next few months and obviously the other thing is, you've got to see a constant flow, it's not just about the level of stocks, he said.

© Copyright Thomson Reuters {{Year}}. All rights reserved.