Mylan Could Lose Perrigo As Deadline Nears In $26B Takeover Deal: Reports

Generic drug maker Mylan NV may lose its protracted hostile takeover bid for peer Perrigo Company Plc. as only a minority of Perrigo’s shareholders reportedly tendered their stock into Mylan’s $26 billion takeover proposal by late Thursday night.

Around 40 percent of Perrigo's ordinary shares had been tendered with 10 hours left -- significantly short of Mylan’s acceptance threshold of 50 percent, reports said, quoting sources close to the matter.

While shares could still be tendered, many large investors would have done so by now if they wanted to accept the offer, the sources added.

If the deal does not secure the support, it would represent a major win for Perrigo chief executive Joseph Papa, who has long maintained that Mylan has resorted to “inappropriate tactics to push its inadequate offer ” and on Tuesday urged investors against taking up the offer.

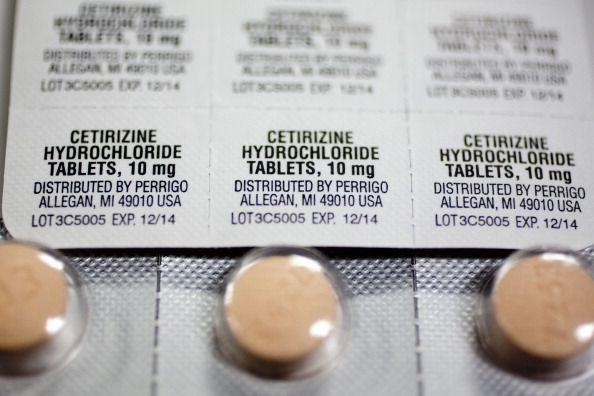

Perrigo, which makes over-the-counter medicines, reported better-than-expected third-quarter profit last month and announced a $2 billion share buyback and job cuts meant to appease investors ahead of the Mylan vote.

Mylan, which initially made a bid for Perrigo in April, went hostile in September, with both companies trading barbs about the perceived value of the deal and shareholder interests. Mylan contends that the Perrigo board's inaction over the deal was a “reckless gamble” while Perrigo has criticized Mylan’s corporate governance, which it said lacks transparency. Mylan has also drawn accusations of insider dealing earlier in the year.

Mergers and consolidation deals worth $532 billion have been announced in the healthcare industry so far this year -- a jump of 60 percent from 2014, the Wall Street Journal said, citing a report from data provider Dealogic.

© Copyright IBTimes 2025. All rights reserved.