Netflix's Original Content Strategy Is Paying Off

Back in July, after its second-quarter report revealed lower-than-expected subscriber growth, everyone wanted to know what was wrong with Netflix (NASDAQ:NFLX). The company's stock sank 5% the next day as investors fretted about the company's strategy and future.

This article originally appeared in the Motley Fool.

Now, after the strong third-quarter report it delivered on Oct. 16, those concerns seem positively archaic: Netflix's growth is back on track. Netflix's stock soared after its Q3 report, and while a general slide in tech stocks has pushed the price down since, concerns about subscriber growth and content priorities have quieted.

Let's take a look at how things have been going.

Quantity versus quality

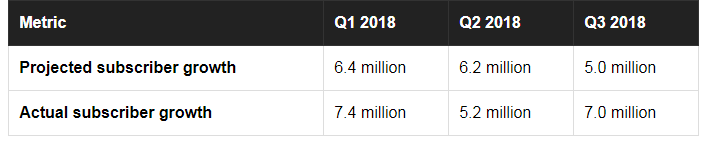

Netflix's Q2 troubles were primarily related to subscriber growth: Though the company added 5.15 million subscribers, it missed its own estimates.

Many observers -- including yours truly -- thought they had found the reason for that miss in Netflix's high-volume approach to original series.

Focusing on original content is a fundamentally good idea, because it will allow Netflix to save big on licensing costs over the long term, but its huge production budget seemed to be going at least as much toward mediocre shows and movies as it was toward widely popular prestige projects like The Crown. When subscribers go to their Netflix home screen, they're hit with a large number of previews for unknown shows and movies that have barely been marketed outside of the service. This flood of low-quality content, some observers concluded, was cutting into Netflix's competitive edge.

The idea that the flood of second-tier originals coming from Netflix could pose a problem for the company remains valid, but its latest earnings report indicates that pundits' attempts connect that with the subscriber growth miss were off base. The nature of its catalog remains the same, but the company once again hit its growth projections with 7 million streaming memberships added in the most recent quarter. Clearly, the relationship between growth and a greater focus on first-class shows and films is less direct than some imagined.

Strategy, profits, and growth

For Netflix, a key reason for developing its own original content is to lower its long-term costs.

Netflix doesn't want to drive away subscribers, of course, and it wouldn't mind if new prestige shows lured in even more of them, but the bottom line here is that it was growing rapidly even before it had original content, is growing now, and will keep growing. All of those owned shows and movies will allow it to pair higher subscriber income with lower costs, and become even more profitable.

The short-term budget for Netflix originals is eye-popping: According to a May article by Variety, 85% of its new spending will go to originals, which cost more up front than licensed content because they have to be created from scratch. With a content budget that could hit $8 billion this year, these are big investments.

But short-term spending on original content means long-term savings on content. The streamer's budget for licensed content doesn't have to grow -- and could even shrink -- if it can fill gaps with hit originals and pass on licensed content it feels is overpriced (as it did with Seinfeld, which went to Hulu for around $160 million).

Netflix can save even more when it uses its own studios to produce its content. The company says content comes at a 30% to 50% markup when outside studios are used.

It would be an oversimplification to say that Netflix doesn't care if you actually enjoy its original series and movies. If nobody watches this stuff, then it's not helping attract or retain subscribers. But it is nevertheless true that Netflix cares a lot more about how much money it can save on original content than it does about how much money it can make on it in terms of new subscribers.

How far and fast can subscribers grow?

If Netflix's strategy around original series isn't hurting its growth after all, as the latest quarterly report showed, the next question is this: How much more growth can we expect from Netflix?

The streamer blamed its Q2 subscriber growth underperformance on an error in its projections -- in other words, it said, the issue was less a lack of growth but an incorrectly high target. Not everyone believed that at the time, but a few more probably do now that it outpaced its Q3 growth targets to gain nearly 7 million new subscribers.

With this latest report, Netflix has renewed investors' confidence in its projections. And its new forecast is that it will add even more subscribers in Q4: 9.4 million, which is 13% more than the number added in 2017's Q4. The company's growth potential seems huge right now; some analysts expect its subscriber base to double by 2023.

A bright future for Netflix

Even a strong company can have one bad quarter -- just as weaker companies can deliver the occasional good one. But the healthy picture painted by the latest report comes at a great time for Netflix, and meshes well with the growth pattern that has been predominant for quite some time.

There are still things at Netflix that investors should keep an eye on, and its original series strategy may need some fine-tuning. But overall, that strategy has been a success, and there's every reason to expect the company's growth to continue.

Stephen Lovely owns shares of Netflix. The Motley Fool owns shares of and recommends Netflix. The Motley Fool has a disclosure policy.