NY Fed Says Supply Chain Pressures Normalized In February

Global supply chains have "returned to normal," the Federal Reserve Bank of New York said on Monday, with pressures dropping to the lowest since before the COVID-19 pandemic threw a wrench into procurement networks worldwide and created shortages for everything from microchips to motor vehicles.

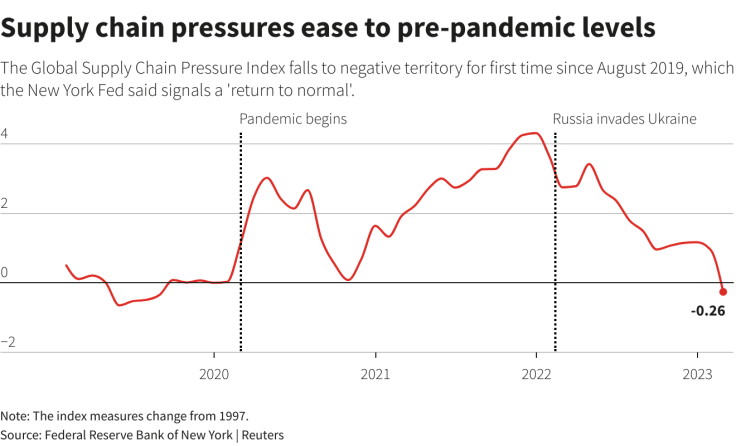

In a development that could also point to softening inflation, the New York Fed said its monthly Global Supply Chain Index fell to a reading of negative 0.26 in February, down from a revised 0.94 seen in January. The negative turn for February - which indicates pressures are below the index's historic norm dating from 1998 - was the first since August 2019.

The index's recent downshifts from a record high in December 2021 "suggest that global supply chain conditions have returned to normal after experiencing temporary setbacks around the turn of the year," the bank said.

Graphic: Supply chain pressures ease to pre-pandemic levels;

The New York Fed observation dovetails with other recent business surveys showing the bottlenecks that have dogged the global economy for roughly three years have finally been unplugged, with the latest improvements occurring after China ended its COVID restrictions at the end of last year. A measure of supplier delivery times from S&P Global was the most improved in February since 2009.

Supply chain pressures have been a notable contributor to the high inflation seen around the world over the last few years. The latest data suggests that an easier time of moving goods around the world could help reduce price pressures.

The world's major central banks have been aggressively boosting the cost of borrowing in a bid to cool their economies and bring inflation down. The persistence of inflation in recent data has made it likely that institutions like the Federal Reserve will raise rates higher than expected and hold them there for longer to bring inflation back to target.

The New York Fed report arrives amid a major shift in supply chain dynamics as China reopens its economy after extended periods of aggressive lockdowns. Economists and policy makers have been debating whether China's reengagement will drive up inflation pressures due to higher economic activity, or lower them by reducing the kinks supply chains have suffered over the last three years.

In the report, the New York Fed said the latest reduction in supply chain pressures was driven by many factors, but it noted the biggest contribution came from improved European economy delivery times.

In a blog posting from Feb. 21, New York Fed economists wrote both supply and demand forces have been helping ease supply chain pressures. Meanwhile, in a posting at the start of the year, bank analysts said issues in China had been a notable factor in creating the supply chain kinks seen up to that point in time.

© Copyright Thomson Reuters {{Year}}. All rights reserved.