Oil Prices Fall To Lowest Levels In Nearly Seven Years, Widening Rift Between OPEC Members

Oil prices Monday plunged to their lowest level in nearly seven years just days after OPEC members declined to reduce their near-record production of crude. The drop in prices widens the economic rift between Saudi Arabia and more fragile countries struggling to weather the oil-price slump.

Brent crude, the global benchmark, was down $1.94 at $41.06 a barrel by 11:29 a.m. EST, its lowest since Feb. 24, 2009. West Texas Intermediate, the U.S. benchmark for crude, fell $2.03 to $37.75 a barrel, a drop of more than 5 percent.

“A stronger dollar and the aftershock of Friday’s OPEC meeting are weighing on the oil market,” Tamas Varga, an oil analyst at brokerage PVM Oil Associates in London, told Reuters.

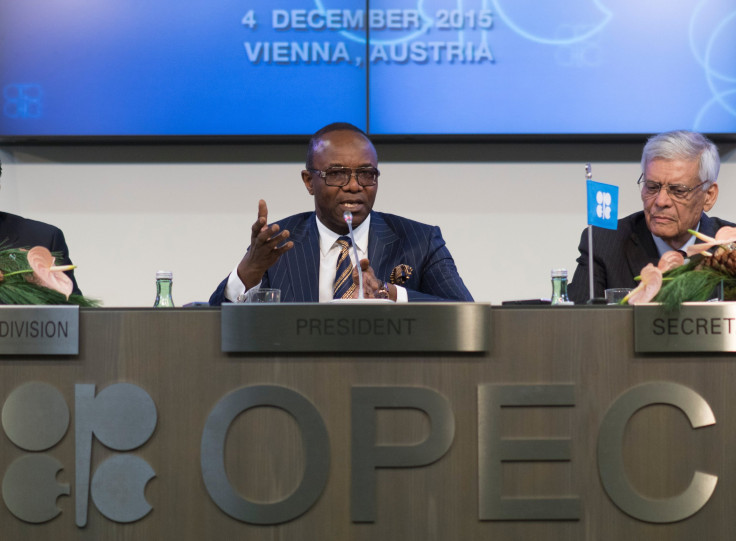

The Dec. 4 meeting at OPEC’s headquarters in Vienna was marked by deep divisions within the 13-nation organization. Venezuela and Iran led the calls to cut output, a move they said would help shrink the glut of global crude supplies and shore up oil prices. The lower prices -- down by more than 50 percent from a year and a half ago -- are plunging oil-dependent economies deeper into debt as billions of dollars in revenues from crude sales vanish.

OPEC members now produce about 31.5 million barrels of oil a day, well above the group’s 30 million-barrel ceiling for oil production.

Saudi Arabia, the United Arab Emirates and Kuwait refused at the meeting to curtail production unless every member of the cartel did the same. The standoff means the market imbalance could continue well into next year, especially if other major oil-producing nations -- namely the United States and Russia -- keep pumping crude at current levels.

Oil supplies have outstripped demand by as much as 2 million barrels a day this year, while stockpiles held by developed nations rose to a record of nearly 3 billion barrels a day by late September, the International Energy Agency reported.

Saudi Arabia, which accounts for about one-third of OPEC’s total production, is expected to withstand the oil price slump near-term, despite concerns that the Persian Gulf nation is suffering a massive debt hike and currency constraints.

“Saudi Arabia has a great deal of borrowing capacity,” Warren Gilman, chairman and CEO of CEF Holdings, told CNBC’s Capital Connection. “Whether it needs to defend its currency or whether it needs to borrow to make up for lost government revenues, it will do so, and I believe it has capacity to do that for several years to come.”

Meanwhile, Libya, Venezuela, Iraq and Nigeria are suffering the most from the latest dip in oil prices, said David Goldwyn, president of Goldwyn Global Strategies LLC, an energy consulting firm. “They really were already in a bad shape, and only have further to go,” he said in an interview. “They all have very little by way of foreign reserves, [oil] revenues are an extremely high portion of government revenues, and they all would otherwise be spending heavily for social stability -- or for defensive purposes, in the case of Iraq.”

Venezuela depends on crude for about 95 percent of its export revenue and more than half of its gross domestic product. The country could see its economy shrink by 10 percent this year -- more than any other nation in the world -- and by 6 percent in 2016 as oil prices empty government coffers, the International Monetary Fund projected in October.

War-embattled Libya, OPEC’s smallest producer, would need prices at $269 a barrel to balance its budget, the IMF has estimated. The North African nation faces greater risk of political instability and oil output disruptions in today’s oil market.

Yet even the more resilient OPEC nations will suffer if oil prices remain below $60 to $70 a barrel, analysts said. Of the 13 members, only Qatar will be able to balance its budget if Brent crude averages $57.60 a barrel next year, Bloomberg found in a Dec. 2 analysis. Seven countries, including Saudi Arabia, need prices higher than current levels to balance their budgets.

“The rising levels of debt are quite significant, even for the countries wealthy enough to survive this transition,” Goldwyn said. “That suggests this [output scenario] is not sustainable.”

© Copyright IBTimes 2025. All rights reserved.