Starting A Business On A Loan? Here's What You Need To Do And What To Prepare For

When it comes to aspiring entrepreneurs that want to start their own businesses, one of the very first steps is to secure funding. While there are people who can definitely shell that amount straight from their pockets, the reality is most owners of startups need to look for that money somewhere else.

Enter loans, which is essentially one of the most common forms of financing solutions for entrepreneurs. You can use this loan to buy assets, support your cash flow, buy equipment, and essentially get your business up and running. It also gives you more security and a better game plan, as now you have more resources to alot to buying assets and running your business.

However, the usual problem for beginners is that business loans for startups can be particularly risky because neither you nor the bank will have any proof that your business will be successful and that you’ll be able to make a profit. As such, the process of securing a loan starts well before walking into the bank. Thankfully, there are other options today that can help you get started.

Here are some tips to help you walk through the entire process, as well as a company that can connect you to lenders:

1. Review Your Startup Costs

When starting a business, you have to list all of the expenses you will need. This usually includes equipment purchases, initial inventory purchases, business furniture, initial supplies, and permits and licenses.

Once these initial costs are paid for, ongoing payments like taxes, rent, mortgage, employee payroll and the like will come. Account for all of this, and you should be able to get an understanding of how much funding you’ll need.

2. Conduct Your Own Research

It is said that knowing is half the battle, and that bodes true especially in the world of business. Make sure that you do thorough research before you start a venture. This includes looking at industry reports, the type of businesses in your area, what your business sector is like, what the government statistics are, and what kind of trends and challenges are present in the industry. This lets you better gauge the chances of your own business surviving/thriving in that sector.

Lenders want entrepreneurs that are committed to their goals and willing to work for it, so show them your own insights, as well as the amount of work you’ve put into it.

3. Get Your Documents and Registrations Ready and At Hand

It may sound like a lot of boring paperwork, but any seasoned business owner will tell you that lenders will give you a better shot at securing your financing if you do some preparation. And if you’re asking yourself what that “preparation" entails, that usually starts with doing your own research, much like what we earlier mentioned. From there, start by making a well-thought-out and thorough business plan that would include your projections (future sales, demand, profits, cash flow, etc.) as well as your more qualitative goals.

After that, file your business officially with the necessary parties like your local government agency, as this will grant you the required licenses and permits that are needed to operate it. Then, prepare the documentation that you’ll need, which usually includes income statements, personal tax returns, resume, financial projections, etc.

It may be a time-consuming process, but doing this beforehand will save you a lot of time and trouble in the future.

4. Find a Lender

Now that you’ve done your research, made the necessary preparations, and filed the right paperwork, it’s time to find a lender and secure your funding. Usually, lenders come in the form of banks that will give you a business loan. The reality, however, is that even after doing the previous steps, it can still be hard to get a bank to approve your loans, especially if your credit score isn’t all that exemplary.

Thankfully, there are other financing options, and CyoGate is here to help you make it easier.

CyoGate helps provide credit card processing and business loan services to companies and startups that are based in the U.S.

Applying for a loan but find it hard to get approved because of a poor credit score? CyoGate is here to help you by connecting you with direct lenders that will focus on your business cash flow instead of the usual credit score. This helps you get your business loan approved in as quick as 48 hours, and get it funded in as fast as five days, complete with rates and terms that are competitive and helpful.

CyoGate understands how hard it is to get an approved loan, so it helps facilitate loans that range from anywhere between $5,000 to $2,000,000 depending on the type of program and the strength of the package that’s being presented.

And if you’re wary about the low rates, it’s because the lender’s risk is minimized thanks to the collateral and personal guarantee. Due to this, CyoGate is able to provide different options and alternatives, such as merchant cash advances and revenue-based loans, both of which have no personal guarantee required -- making it easier to qualify for them.

Best of all, CyoGate doesn’t charge business owners with a fee as the company earns by finding and presenting an approved deal with terms and pricing that the client will accept. All offers and approvals are also fully disclosed.

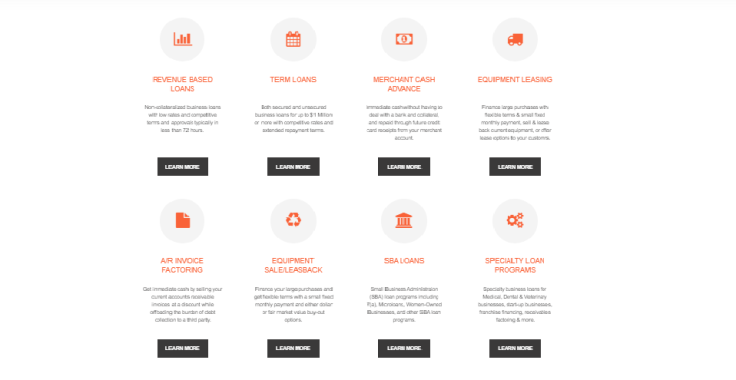

For any business owner interested in using CyoGate to find funding, the company currently offers revenue-based loans, term loans, merchant cash advances, equipment leasing, A/R voice factoring, equipment sale, SBA loans and specialty loan programs, and you may check more of their offers here.

To apply for a business loan, click here.

5. Apply

Now for the final step -- apply! After determining the type of lender, it’s time to apply using the documents you’ve gathered. Compare options by looking at the APR (annual percentage rate) as this will provide you with the best look at your total cost of borrowing for a year. It includes all of the loan fees along with the interest rate.

From there, the process should be smooth and straightforward, and you should see yourself running your business in no time.

Once over, remember that this is just the start, and running your own business will come with its own set of challenges, setbacks, and discipline that you need in order to keep it thriving.

Good luck!