Citigroup Inc is discussing a plan to shuffle Asian managers to reassure Japanese regulators as they prepare to sanction the bank for alleged lapses in disclosure related to the sale of financial products, the Wall Street Journal reported, citing people familiar with the situation.

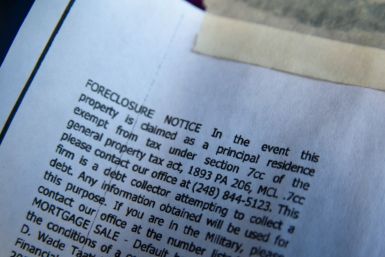

In the wake of a lawsuit filed by the Massachusetts attorney general, GMAC Mortgage, a subsidiary of Ally Financial, said on Friday that it would stop buying mortgage loans in the state after Dec. 5.

European shares rose on Friday at mid-day and were headed for their biggest weekly gain in three years on hopes of a bold solution to the euro zone debt crisis at a summit next week.

A bill to let U.S. spy agencies share intelligence on cyber threats with private companies was backed by a House of Representatives intelligence panel on Thursday.

From the time when a statement by Massachusetts' attorney-general announcing a lawsuit against five major banks began appearing on the newswires, shares of the financial institutions being sued actually went up slightly.

Suit targets nation's largest lenders

Recently, a top tech analyst predicted that Amazon is likely to release its own smartphone for under $200 next year. Citigroup analyst Mark Mahaney said in a research note that Amazon may sell the smartphone for as little as $170. Citing supply-chain channel checks in Asia, he said Amazon may release its first-ever smartphone by the fourth quarter of 2012.

The top after-market NASDAQ stock market gainers are: Magma Design Automation, Transcept Pharmaceuticals, Merge Healthcare, Yahoo and Exide Technologies. The top after-market NASDAQ stock market losers are: Semtech, Sonus Networks, Digital Generation, Prospect Capital and Connecticut Water Service.

U.S. stocks rose more than 3 percent on Wednesday as major central banks acted jointly to add liquidity to the global financial system, boosting appetite for risky assets.

Stocks were set to gain more than 2 percent at the open on Wednesday as a coordinated action by major central banks to provide liquidity to the global financial system boosted investors' appetite for risky assets.

Stock index futures soared on Wednesday as investors welcomed a coordinated action by major central banks to provide liquidity to the global financial system.

Stock index futures pointed to a weaker open for equities on Wall Street on Wednesday, with futures for the S&P 500, for the Dow Jones and for the Nasdaq 100 down 0.4-0.7 percent.

So far, it has been a tough week for the troubled Bank of America Corp. (BAC). The firm's stock hit a new 52-week low Tuesday, dropping more than 3 percent to $5.03 a share, the lowest level since March 12, 2009. After the market closed, more bad news came as Standard & Poor's downgraded the bank's long-term credit rating by a notch to A- from A.

Bank of America (NYSE:BAC) and Citigroup (NYSE:C) are among a group of 37 large financial institutions that were downgraded today by Standard & Poor's, according to Bloomberg News. The downgrades were somewhat expected, as S&P had announced earlier in the year it would be revising its methodology for rating banks in order to give more weight to those institutions' capital ratios.

Judge Jed Rakoff's refusal to accept a settlement between Citigroup and the U.S. Securities and Exchange Commission is most significant not as a rebuke of Citigroup but as a resounding statement of frustration with the Securities and Exchange Commission's perceived ineffectiveness.

AT&T, the No. 2 U.S. wireless carrier, may be trying to salvage its $39 billion deal to acquire T-Mobile by agreeing to sell assets to loss-ridden Leap Wireless International.

The top pre-market NASDAQ Stock Market gainers are: Magal Security Systems, Seagate Technology, Central European Distribution, Onyx Pharmaceuticals, Randgold Resources, and Research In Motion. The top pre-market NASDAQ Stock Market losers are: Tellabs, ASML Holding, Netflix, and Microsoft.

In a recently released report, Citigroup has negatively revised its earlier growth estimates for India, for the Fiscal Year 2011-12, amid a slowing global economy and domestic headwinds.

About $200 million in customer funds missing at MF Global may have surfaced at JP Morgan Chase in Britain, the New York Times said, citing people briefed on the matter.

A federal judge angrily threw out Citigroup Inc's proposed $285 million settlement over the sale of toxic mortgage debt, excoriating the top U.S. market regulator over how it reaches corporate fraud settlements.

U.S. District Court Judge Jed S. Rakoff issued an acerbic order blocking the U.S. Securities and Exchange Commission's proposed $285 million deal with Citigroup that is "neither fair, nor reasonable, nor adequate, nor in the public interest."

Bond insurer Assured Guaranty Ltd filed new claims against JPMorgan Chase & Co over a mortgage-backed security sold by Bear Stearns, saying more than 35 witnesses have come forward to testify about how loans in the $337 million transaction were misrepresented.