Risk-averse real estate investors are flocking to multi-family dwellings to wait out the economic slump.

The timing of the acquisition suggests that Google's move was more an act of desperation rather than a planned strategic move

Half of the assets managed by the world?s largest money managers are now pension fund assets.

The statistic office indicated that while German exports grew, imports also sharply rose.

The largest gold fund players including hedge fund titan John Paulson stuck with their bullion bets in the second quarter, opting not to follow George Soros who further reduced his gold ETF holdings.

Gold prices rose on Tuesday as concerns over the financial health of the euro zone resurfaced ahead of a summit in Paris between French and German leaders, at which they will try to thrash out a solution to the bloc's debt crisis.

Samsung in the Netherlands is rolling out Galaxy Tab 10.1, which is otherwise banned in Europe after Apple won an injunction against Samsung for violating its intellectual rights to its iPad.

China's long-term plan to cut reliance on investment as a growth engine is clashing with its short-term need for protection against a worsening global outlook.

German gross domestic product growth slowed more than expected in the second quarter, weighed by a negative trade balance, flagging consumption and weak construction investment, the statistics office said.

Asian stock markets rose Tuesday after Wall Street shares climbed for a third straight session, but the euro slipped ahead of talks between French and German leaders on possible further measures to contain Europe's debt crisis.

Google's $12.5 billion acquisition of Motorola Mobility had wide-ranging impacts on Monday, notably on technology stocks. Motorola Mobility (NYSE:MMI), Nokia (NYSE:NOK), and Research in Motion (NYSE:RIMM) all saw big stock price jumps during Monday's trading.

Should I stay or should I go?

Boyce Greer was an investor in a kayaking gear company

The stock market made it three up days in a row Monday, thanks to slew of acquisitions that has observers wondering if Wall Street is getting back its Mojo.

Star bond fund manager Jeffrey Gundlach was in discussions to join Western Asset Management Co while he was employed at rival firm Trust Co of the West, he testified on Monday.

Institutional investors, turned off by a slow-growth economy that?s led to low-return stocks, piled in to oil, driving up its price, worsening the economic conditions that led them to invest in oil in the first place.

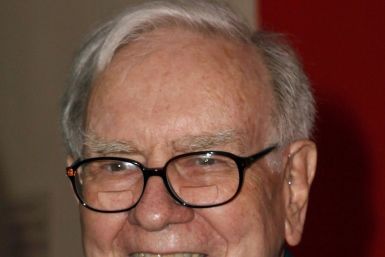

Warren Buffett is urging Congress to stop coddling America's rich people with tax loopholes.

Carl Icahn benefits from Motorola Mobility's sale. He has other tech investments.

S&P published a report today that shows how its ratings downgrade of America?s debt is affecting bond spreads, issuance volume, and the corporate default rate.

Silver prices and the shares of silver mining companies rose Monday along with the price of gold and the broader U.S. stock market.

Poland became the third most active retail investment market in Europe in the first half of 2011, with $1.73 billion transacted.

Tanzania plans to conclude negotiations with mining companies early next month to allow the government to raise royalty payments on gold exports to 4 percent from 3 percent.