Borders Group has received approval from a bankruptcy judge to commence with the liquidation of its assets yesterday. The sales are starting today.

Jobless rates jumped in June from the month before in more than half of the U.S. states as sinking public employment reversed the trend of steadily improving labor conditions in the first half of 2011, Labor Department data released on Friday showed.

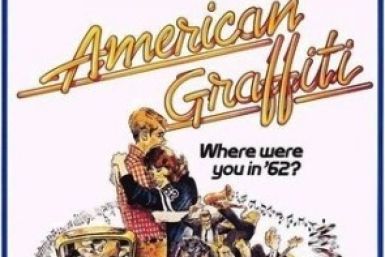

Simply, Director George Lucas' tribute to his teen years in the car culture of 1960s Modesto, California is a masterpiece, and is easily worth its DVD price.

June's unemployment numbers showed unemployment increased in 28 states plus the District of Columbia. Nevada had the highest unemployment rate of all states in June, at 12.4 percent.

There are troubling signs of discontent and frustration among the poor and middle-class.

Borders Group has received approval from a bankruptcy judge to commence with the liquidation of its assets.

Borders is closing. But it's not all bad news. Buzz about liquidation sales is mounting.

New U.S. claims for unemployment benefits rose more than expected last week, a government report showed on Thursday, pointing to a labor market that is struggling to regain momentum after job growth faltered in the last two months.

The number of Americans filing new claims for unemployment benefits rose more than expected last week, pointing to a labor market that is struggling to regain momentum.

Friends star, Jennifer Aniston has apparently decided to shed her girl-next door image for good as she dons a racy black number for the London Premiere of her new flick, Horrible Bosses.

In the poll, Mitt Romney still leads the Republican Party 2012 nomination race, but Bachmann has made significant gains.

A wave of Wisconsin recall elections beginning Tuesday will be closely watched as a gauge of the political climate and as a potential bellwether for 2012.

Borders is closing. But it's not all bad news. Buzz about liquidation sales are mounting.

If the Fed wades further into muddy stimulus waters, that will set the stage for a certain gold boom in the short to medium term. Historically, a dollar sell-off has been the biggest force behind a gold boom. If the Fed takes recourse to another round of easing in pursuit of its goal of propping up job creation and real growth, it will inadvertently cause a dollar sell-off and trigger, in turn, a gold super rally.

The setting is perfect for another gold boom cycle to kick in, perhaps pushing the yellow metal into a super cycle. There are several factors aiding gold's further push into higher price records, greater investment worth and long-term reign as a de facto currency. There are all sorts of classic factors supporting gold all the way, like the demand from China and India bursting at seams, continued worries for the US dollar and the worrisome prospect of sovereign default in some European countri...

Consumer sentiment dropped to its lowest reading since the Great recession, amid high unemployment and the federal government's inability to deal with its debt problem as a deadline to raise the debt ceiling looms.

Consumer sentiment deteriorated in early July to the lowest level since March 2009 on increasing pessimism over falling income and rising unemployment, a survey released on Friday showed.

The US economy is at an inflection point after the end of the second round of Quantitative Easing (QE2). Two rounds of monetary and fiscal stimulus since 2008 have had only limited impact on growth or unemployment. The question is,'What next?' will there be another round of monetary and fiscal policy easing? Analysts at American Enterprise Institute for Public Policy Research (AEI) are of the opinion that fiscal and monetary policies have reached their limits.

The number of Americans claiming initial unemployment benefits dropped last week, but remained elevated and retail sales barely rose, suggesting the economy would struggle to regain speed in the second half.

American voters believe former President George W. Bush is primarily responsible, not President Barack Obama, for the U.S. economy's poor condition, a poll released Thursday indicated. What's more, 48 percent of those polled said they would blame the Republicans if the debt ceiling is not raised, while 34 percent would blame the Democrats.

Longtime Federal Reserve antagonist U.S. Rep. Ron Paul, R-Texas, was at it again on Wednesday, criticizing Federal Reserve Chairman Ben Bernanke, the head of world's most powerful central bank, for a faltering economic recovery and suggested the country would be better off investing in gold.

Chairman Ben S. Bernanke's Semiannual Monetary Policy Report to the Congress Before the Committee on Financial Services, U.S. House of Representatives, Washington, D.C. July 13, 2011