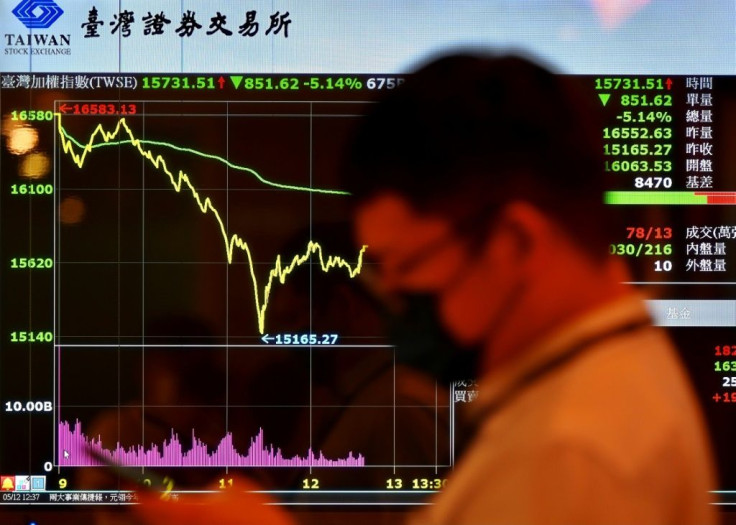

Taiwan Stocks Plummet On Virus Restrictions And Tech Selloff

Taiwan's stock exchange plunged more than eight percent on Wednesday as investors fretted over fresh coronavirus restrictions and a wider selloff in global tech stocks.

The Taiex -- one of Asia's best performers this year -- dropped as much as 8.6 percent in morning trade, extending losses from record highs in April to nearly 13 percent.

It picked up slightly closed 4.11 percent down by the end of the day.

Taiwan has been hailed as a global leader in containing the coronavirus with just 1,210 confirmed cases, 12 deaths and minimal social distancing needed once the initial outbreak was quelled.

The island's economy recorded 3.1 percent growth last year, the highest in Asia and the Taiex, as well as the local dollar, has been riding a wave of confidence.

But that came to an abrupt halt on Tuesday when authorities announced fresh restrictions on public gatherings following fears that a small cluster of coronavirus cases that began with airline pilots had spread locally.

Shares finished down 3.8 percent that day.

On Wednesday, officials said 16 new local cases had been discovered, all with known sources of transmission.

While the new social restrictions are a fraction of what countries battered by the virus have experienced over the past year, Taiwan has spent much of the pandemic operating as usual.

And the sudden emergence of a coronavirus cluster has combined with a wider global selloff in tech shares, particularly in the United States, as the global economic recovery lifts inflation expectations and fears that central banks will have to start hiking interest rates.

"Investor confidence in Taiex has collapsed now due to concerns over Covid-19 after the health minister said it's possible for Taiwan to escalate the alert level for Covid-19," Paul Cheng, president of MasterLink Securities Investment Advisory, told Bloomberg News.

"And there are some concerns over tech shares, especially for the second half outlook due to factors including rising manufacturing costs and lower margins."

Nowhere else on Earth has a stock exchange so dominated by tech companies.

One in particular -- Taiwan Semiconductor Manufacturing Company -- accounts for more than 30 percent of the total market capitalisation of the Taiwan Stock Exchange.

The firm's shares plunged more than nine percent at one point before recovering sharply to end the day less than two percent off.

Among other tech firms to take a hit were Hon Hai Precision and United Microelectronics, which both dived almost 10 percent before halving the losses by the close.

Taiwan is the go-to place for the semiconductors and microchips that power electronic devices. Its foundries build the world's smallest and fastest processors.

Demand has soared for chips during the pandemic to the point where there is now a global shortage.

© Copyright AFP {{Year}}. All rights reserved.