Tax Day 2012: How The IRS Outdoes Shakespeare

April 17, 2012, is a date that does not mean much to most people around the world. But in the United States, it’s a dreaded, dark day: It is the date by or on which taxpayers must either file their returns for the previous year or apply for an extension.

As a British expatriate new to the country, I find the U.S. tax code to be a bit of a puzzlement. In the U.K., your employer pays the taxes for you directly out of your wages, and there are no annual forms to fill out to try to get any of it back. If you have paid too much tax, or need tax relief i.e. you have children or have just bought a house, the Inland Revenue have relatively straight forward forms to fill out for a reimbursement, year round.

And if you’re a freelancer, you fill out a relatively simple form once a year -- online, if you choose -- and in a few minutes you know what you owe and pay direct with a credit card. Done.

So, while I knew it was more complex to pay taxes in the U.S. than in the U.K., I wasn’t prepared for what I encountered upon printing out the documents I needed to duly file my return with the Internal Revenue Service.

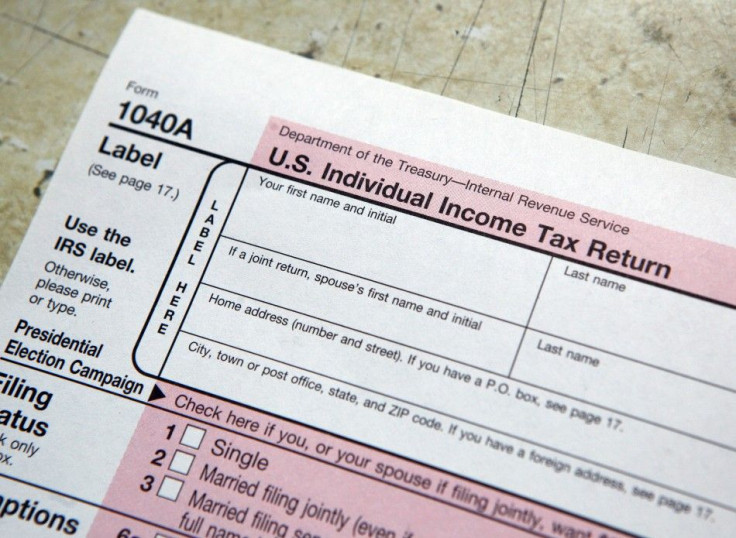

As the printer spat out Form 1040 and its byproducts, I couldn't believe my eyes -- page after double-sided page of calculations, Schedule Bs and Cs, tiny subclauses, and complex subtractions. I stood there, warm paper in hand, thinking: How can anyone be expected to fill this out?

And that's before I even heard about the mysterious world of deductions.

But, it seems, I'm not alone. Even hardened Americans find this whole process more than a bit daunting.

According to National Taxpayer Advocate Nina E. Olson, Americans waste a stunning 6.1 billion man-hours a year sorting, calculating, and filing the forms and receipts, so they can claw back every penny owed them by Uncle Sam.

That's the equivalent of more than 3 million workers (arguably, 900,000 more than the federal government employs) toiling away full time, all year, according to The Transaction Tax online site.

Actually, this shouldn’t be surprising when you consider the sheer size of the tax code itself. The code runs to a staggering 3.8 million words, according to Brett Arends at Smartmoney.com. That is longer than the complete works of William Shakespeare. A lot longer.

To put that in context, William Shakespeare only needed 900,000 words to say everything he had to say, Arends said. Hamlet. Othello. The history plays. The sonnets. The whole shebang. But the IRS needs four times as many words? Really?

Talk about much ado!

And, of course, it is not just the time spent fumbling with deductions that really taxes one's patience.

Estimates put the cost of maintaining tax records, filing taxes, and hiring accountants for individuals and companies at $430 billion a year.

That's roughly the size of the entire economy of Saudi Arabia.

A whole industry exists in the U.S. to help ordinary people pay what they owe to the government every year.

There are software packages designed to simplify the process, tax advocates, and walk-in centers just to talk the average person through a process that should be seamless and idiot-proof.

While this may appear normal to most Americans, to foreigners such as myself stumbling through their first U.S. tax year, the level of paperwork, waste, and expense is a bureaucratic nightmare.

Paying taxes is painful enough – but the time and additional money spent to tell the government what you owe it seems like, well, cruel and unusual punishment.

© Copyright IBTimes 2025. All rights reserved.