Tesla Stock Downgraded: What You Need to Know

Every day, Wall Street analysts upgrade some stocks, downgrade others, and "initiate coverage" on a few more. But do these analysts even know what they're talking about? Today, we're taking one high-profile Wall Street pick and putting it under the microscope...

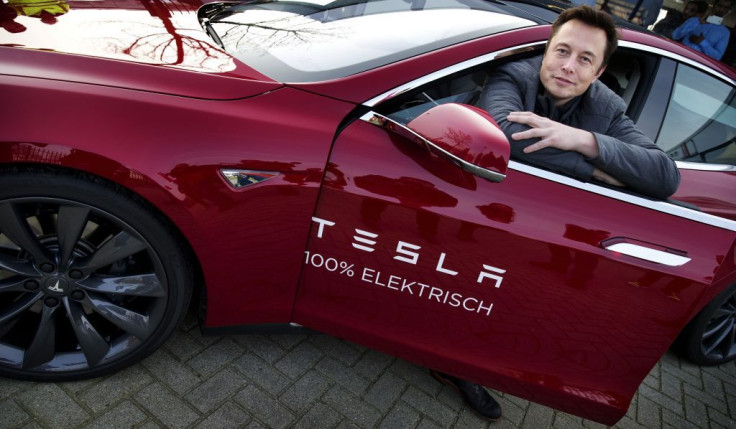

After slipping below $300 earlier this week on worries about Tesla's (NASDAQ:TSLA) decision to cut car prices by $2,000 and lay off 7% of its workers to further reduce costs, shares of the electric-auto maker were under pressure again this morning, falling more than 2% in pre-noon trading.

You can thank RBC Capital for that.

Downgrading Tesla

This morning, analysts at Canadian investment bank RBC announced they are cutting Tesla stock from sector perform to underperform and dropping their target price to $245, as described in a write-up on StreetInsider.com(subscription required).

The cut comes just days before Tesla is due to report Q4 earnings, which CEO Elon Musk has predicted will be profitable, but "less" so than the $312 million earnings quarter that Tesla reported three months ago. (How much less? Fool.com contributor Daniel Sparks is predicting a profit of between $0.80 and $1.50 per share, versus Q3's $1.75 in GAAP per-share earnings.)

For the record, that prediction doesn't faze RBC overmuch. To the contrary, RBC argues that Tesla getting more "tactful with messaging" is in fact "a long-term positive" that will temper expectations (and make it easier for the company to beat expectations, I might add). On the other hand, the fact that Tesla feels the need to lower its own bar suggests we're now seeing "downward pressure to growth expectations -- which in our view are too high."

High hopes, but are they too high?

Why might RBC worry that expectations for Tesla are too high? Let's run down the list.

In recent years, Musk has publicly predicted there will be demand for anywhere from 500,000 to 700,000 Model 3 sedans per year -- demand that Tesla will be able to supply. RBC, on the other hand, says "a reasonable max Model 3 production range for Tesla [is] 260[k]-312k" units. As the analyst explains, "[T]he $2k price cut and talk about having to lower cost further as federal tax incentives subside confirms our view that the bulk of demand is at a lower price point" than the near-$60,000 average price of Model 3s sold last year "that Tesla can't access yet profitably."

Accordingly, RBC is predicting Tesla will max out production at the 312,000-unit level.

A consensus is forming

Nor is RBC the only analyst sounding this warning. Reuters is quoting Greenlight Capital founder David Einhorn today, warning that analysts who last year mostly worried that Tesla might suffer a "shortage of supply" are now starting to worry that a "shortage of demand" will be the company's bigger problem.

Indeed, analysts at Needham & Co., who were already bearish on Tesla and remain so, doubled down on their underperform rating on shares today: "Tesla has essentially exhausted its highend Model 3 backlog," opines Needham, and "there is a strong possibility that the company may experience difficulty getting a sufficient number of new orders in the U.S. along with ramping internationally in order to remain profitable."

(Needham also worries that the company may have trouble shifting production of battery packs over from larger, extended-range batteries to its smaller "Standard Battery" configuration to satisfy an uptick in demand for Model 3s with shorter ranges and lower prices.)

What it means to Tesla investors

Are these valid concerns? They certainly could be.

Tesla ramped up hiring and production rates last quarter, and in so doing set new records for production and deliveries -- and earned its first quarterly profit in two years (and its second quarter of positive operating cash flow in a single year, according to data from S&P Global Market Intelligence). It did this, however, by capitalizing on pent-up demand for the Model 3, and by emphasizing production and sale of the model's most expensive (and profitable) variants.

Going forward, that's going to be harder to do if most of the demand for higher-trim Model 3s has now been satisfied -- which is what Tesla's moves to cut costs suggest here in the U.S. On the other hand, the company has just begun shipping Model 3s to Europe, where there's still untapped demand for the higher-trim models, and deliveries to China are slated for March. This suggests there's still hope for profits to continue going strong in the early part of 2019 at least.

Even if Tesla reports the anticipated decline in profits for Q4, strong guidance for the quarters to come could be sufficient to keep enthusiasm for the stock buoyant through earnings -- and prove today's naysayers wrong.

This article originally appeared in the Motley Fool.

Rich Smith has no position in any of the stocks mentioned. The Motley Fool owns shares of and recommends Tesla. The Motley Fool has a disclosure policy.