Thursday's Stock Market Open: US Equities Drop As Coronavirus Spreads In China, Asian Markets Plunge

KEY POINTS

- The virus in China has now killed at least 17 people and infected 600 others.

- Chinese stock markets plunged overnight.

- The European Central Bank kept rates unchanged, as expected.

U.S. stocks traded lower on Thursday , following market plunges in Asia overnight, as Chinese authorities feared that a deadly coronavirus could spread during the upcoming long holiday. China has also placed the city of Wuhan under lockdown.

The Dow Jones Industrial Average dropped 171.9 points to 29,014.37 while the S&P 500 fell 12.26 points to 3,309.49 and the Nasdaq Composite Index tumbled 14.69 points to 9,369.08.

Overnight in Asia, markets dropped. China’s Shanghai Composite plunged 2.75%, while Hong Kong’s Hang Seng dropped 1.52%, and Japan’s Nikkei-225 fell 0.98%.

China’s Shanghai Composite Index saw the biggest ever drop of the last trading day before the Lunar New Year holiday in the benchmark’s three-decade history.

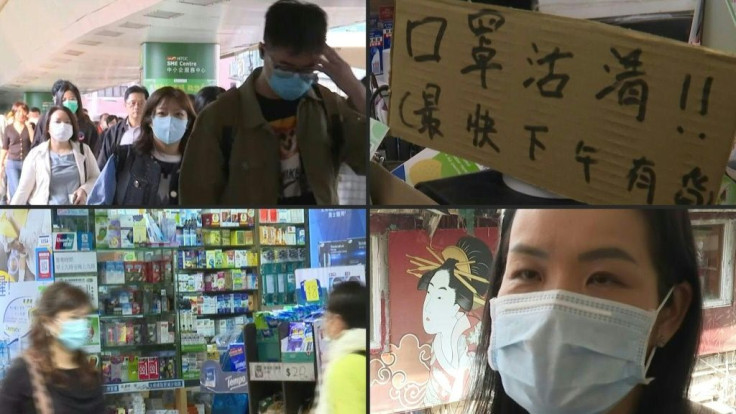

The outbreak of coronavirus, which has now killed at least 17 people and infected 600 others, has led to the quarantine of three large Chinese cities, including Wuhan, where the virus is believed to have originated. The virus has also spread to other countries, including Thailand, U.S., Taiwan, South Korea, and Japan

The World Health Organization reconvened Thursday to determine whether the outbreak should be considered a global health emergency.

Hundreds of millions of Chinese people will be traveling this week during the Spring Festival.

“The bad news is that the worst has yet to come, as the number of new infections is still on the rise,” warned Larry Hu, economist at Macquarie Capital. “The lesson from SARS suggests that the turning point for sentiment will come only after the number of new infections starts falling.”

David Roche of Independent Strategy said on Thursday: “we don’t really know the characteristics of this virus yet. In order to get a pandemic, you really have to have a virulent infection to be exponential ... many of these new cases are due to much tighter reporting, not necessarily a rate of infection. So we really don’t know to what extent the rate of contagion.”

“There is a notable degree of investor caution, albeit not [yet] risk capitulation across markets,” Simon Ballard, chief economist at First Abu Dhabi Bank, wrote in a note. “Until the data tells us otherwise, we will hope that the coronavirus does not become a repeat of 2003 [SARS outbreak] and that any meaningful sell-off in risk will be viewed by investors as a [selective] buying opportunity.”

The European Central Bank voted to keep its main deposit rate at a historic low of minus-0.5%, as expected. The bank also kept its marginal lending facility at 0.25% and the main refinancing operations rate unchanged at zero percent.

In a press conference, the new ECB president Christine Lagarde said the phase one trade agreement between China and U.S. was a “critical development” that will have consequences around the world. “It is something that our teams are looking at very carefully to examine what the impact [will be] on a net basis for the euro area,” she said.

Lagarde said climate change would be “an important matter” for the bank to examine.

In the U.S., initial jobless claims rose by 6,000 to a seasonally adjusted 211,000 for the week ended Jan. 18, the Labor Department said on Thursday. The increase was less than expected.

“Investors are wondering what will ultimately crack this stock market,” said Jim Paulsen, chief investment strategist at The Leuthold Group. “Even though a stock market correction is almost assured at some point, a sentiment refresh, alone, would not likely produce a sustained decline.

In the U.S., initial jobless claims rose by 6,000 to a seasonally adjusted 211,000 for the week ended Jan. 18, the Labor Department said on Thursday. The increase was less than expected.

The Conference Board Leading Economic Index declined 0.3% in December, following a 0.1% increase in November,

In Europe markets finished lower, as Britain’s FTSE-100 dropped 0.88%, France’s CAC-40 tumbled 0.71% and Germany’s DAX fell 0.94%.

Crude oil futures dropped 2.19% at $55.50 per barrel and Brent crude fell 2.04% at $61.92. Gold futures rose 0.49%.

The euro slipped 0.49% at $1.104 while the pound sterling fell 0.29% at $1.3104.

© Copyright IBTimes 2025. All rights reserved.