US Central Bank Ponders Huge Rate Hike To Combat Price Surge

The US Federal Reserve is set to announce a sharp increase in borrowing costs on Wednesday amid the troubling acceleration of inflation, and forecasters now expect officials to opt for the biggest rate hike in nearly three decades.

Until recently, the central bank seemed set to again increase the benchmark interest rate by 0.5 percentage points, but a resurgence of consumer and producer prices in May has fueled growing speculation of a 75-basis-point hike.

Economists say the rapidly changing situation means the Fed is behind the curve and needs to react strongly to prove its resolve to combat inflation

"It is possible that by Wednesday the only way for the Fed to surprise markets would be to raise rates by 50 bp," Harvard economist and former White House advisor Jason Furman tweeted.

If policymakers decide on a giant step, it would be the first 75-basis-point increase since November 1994.

The Federal Open Market Committee resumed discussions on the second day of its policy meeting and is due to announce the rate decision at 1800 GMT.

Fed Chair Jerome Powell will hold a press conference after the meeting to provide more details on the central bank's plans, including signals on how aggressive policymakers will be in coming meetings.

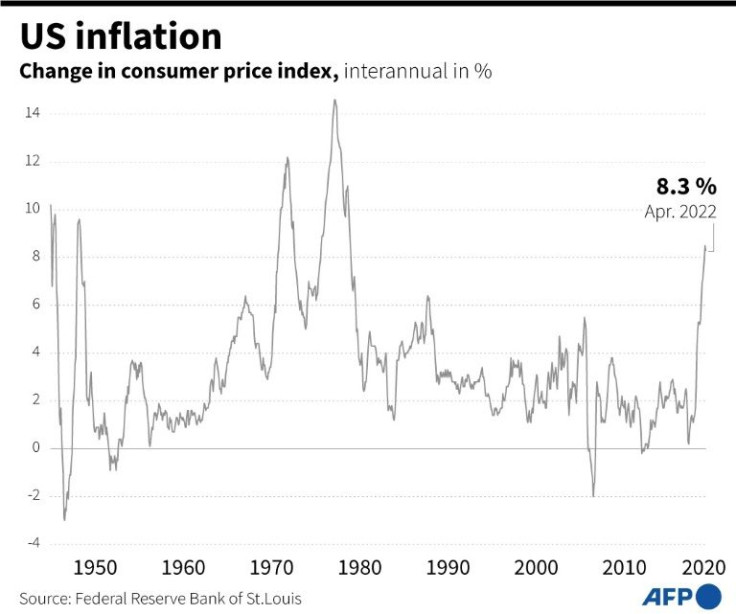

President Joe Biden has fully endorsed the Fed's battle against the steepest rise in prices in more than 40 years, as he watches inflation erode his popularity and deflect attention from other milestones, including a rapid recovery of the world's largest economy and record job growth.

US central bankers began raising interest rates off zero in March as buoyant demand from American consumers for homes, cars and other goods clashed with transportation and supply chain snarls in parts of the world where Covid-19 remained -- and remains -- a challenge.

That fueled inflation, which got dramatically worse after Russia invaded Ukraine in late February and Western nations imposed steep sanctions on Moscow, sending food and fuel prices up at a blistering rate.

US gasoline prices have topped $5.00 a gallon for the first time ever and are setting new records daily.

Economists thought March was the peak for consumer price hikes, but the rate spiked again in May, jumping 8.6 percent in the latest 12 months, and wholesale prices surged as well, almost entirely due to soaring costs for energy, especially gasoline.

The Fed was caught off guard with the speed of the price increases, and while policymakers usually prefer to clearly telegraph any policy shift to financial markets, the latest data likely changed the calculus.

Powell had indicated policymakers were poised to implement another half-point increase in the benchmark borrowing rate this week and yet another next month, aiming to douse red-hot inflation without tipping the economy into recession and avoid a bout of 1970s-style stagflation.

"The 75bp hike... will be about making people/markets believe that they're serious about continuing to have higher rates in 2023," Furman said.

However, the central bank cannot influence supply issues, and rate hikes only work by cooling demand and slowing the economy -- meaning policymakers are walking a fine line between having an impact and doing too much.

And the impact won't be immediate.

"Monetary policy operates with lags, today's inflation reflects decisions taken a year ago," said Adam Posen, head of the Peterson Institute for International Economics and a former central banker.

"Had Fed hiked in 2021Q2/Q3, then inflation now would be different -- not least (because) the current global shocks wouldn't be piling on already high inflation," he said on Twitter.

Biden has been scrambling to find a way to ease the pain on American families, including lambasting oil companies that are pulling in record profits.

In a letter to oil executives, he called the high windfall "unacceptable" and demanded ExxonMobil, Chevron and others "take immediate actions to increase the supply of gasoline, diesel, and other refined product," according to media reports.

Biden on Tuesday again blamed Russia for inflation, which is afflicting countries worldwide, and criticized Republicans for blocking his efforts to provide help to families bearing the brunt of the impact.

© Copyright AFP {{Year}}. All rights reserved.