US Consumer Confidence Rises; House Price Inflation Slows

U.S. consumer confidence unexpectedly increased in March, but Americans are becoming a bit anxious about the labor market and expect inflation to remain elevated over the next year.

The survey from the Conference Board on Tuesday, which was conducted nearly two weeks after the failure of two U.S. regional banks, also showed more consumers planned to buy motor vehicles and household appliances like refrigerators, washing machines and television sets over the next six months.

Consumers, however, planned to cut back discretionary spending, including on gambling, visits to amusement parks, going to the movies and dining out. But they intended to increase spending on healthcare, home or auto maintenance and repair, pet care as well as personal grooming.

Though the correlation between confidence and consumer spending has been weak, the survey suggested that consumption could continue to grow at a moderate clip and keep the overall economy afloat.

"Additional banks have not failed and consumers generally feel their money in the bank is safe for now," said Christopher Rupkey, chief economist at FWDBONDS in New York. "Consumer spending has slowed the last year, but it does not look like the consumer is about to batten down the hatches and prepare for the recession that has been forecast for over a year now."

The Conference Board's consumer confidence index rose to 104.2 this month from a reading of 103.4 in February. The cutoff date for the survey was March 20, 10 days after California-based Silicon Valley Bank collapsed. New York-based Signature Bank failed on March 12.

Economists polled by Reuters had forecast the index would be at 101.0. The rise in confidence was in contrast with a deterioration in sentiment reported earlier this month by the University of Michigan. It was driven by consumers under the age of 55 and households with annual income of $50,000 and more.

Pessimism persisted among Americans 55 years and older and households making below $50,000 a year.

The share of consumers viewing jobs as "plentiful" fell, while the proportion saying jobs were "not so plentiful" rose. But the share of those saying jobs were "hard to get" was little changed.

The survey's so-called labor market differential, derived from data on respondents' views on whether jobs are plentiful or hard to get, fell to a still-high 38.8 from 40.7 in February, remaining consistent with a tight labor market. This measure correlates to the unemployment rate from the U.S. Labor Department. The jobless rate was 3.6% in February.

Consumers' 12-month inflation expectations rose to 6.3% from 6.2% last month. The Federal Reserve last week raised its benchmark overnight interest rate by a quarter of a percentage point, but indicated it was on the verge of pausing further increases in a nod to financial market stress.

The U.S. central bank has hiked its policy rate by 475 basis points since last March from the near-zero level to the current 4.75%-5.00% range.

U.S. stocks were trading lower. The dollar slipped against a basket of currencies. U.S. Treasury prices rose.

TRADE FLOWS WEAKENING

Consumers' plans to buy a home over the next six months were unchanged in March. Housing affordability, which deteriorated as mortgage rates surged in response to the Fed's fight against inflation, is starting to gradually improve as house price gains continue to moderate.

The S&P CoreLogic Case-Shiller national home price index, covering all nine U.S. census divisions, increased 3.8% on a year-on-year basis in January, a separate report showed on Tuesday, marking the ninth straight month of decelerating annual home price gains. That followed a 5.6% advance in December.

Annual house price growth remained strong in the Southeast, with double-digit gains in Miami and Tampa. Solid price increases were also recorded in Atlanta and Charlotte. The South experienced an influx of people as companies offered workers the flexibility to work anywhere during the COVID-19 pandemic.

House prices continued to fall in the West. Annual house prices dropped in San Diego, Portland, San Francisco and Seattle. The region had experienced rapid house price increases in prior years.

The cooling in overall house price inflation was reinforced by a report from the Federal Housing Finance Agency on Tuesday showing home prices climbed 5.3% in the 12 months through January after rising 6.7% in the 12 months through December.

While the housing market appears to be finding a floor, trade flows are weakening.

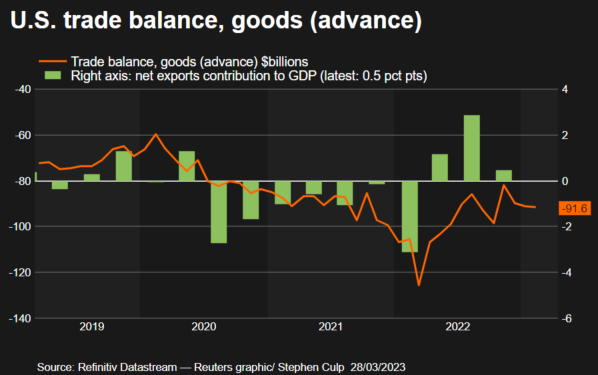

A report from the Commerce Department showed the trade deficit in goods increased 0.6% to $91.6 billion in February. That left the goods trade gap for the first two months of the first quarter above the October-December quarter's level.

Goods exports dropped 3.8% to $167.8 billion last month, led by an 11.9% plunge in motor vehicles and parts.

Imports of goods slipped 2.3% to $259.5 billion. Imports of motor vehicles and parts tumbled 7.1%, while those of consumer goods dropped 5.6%. Despite the overall decline in imports, businesses restocked goods at a steady pace in February.

(Graphic: Graphic-Goods trade balance -

)

The Commerce Department also reported that wholesale inventories rose 0.2% in February after falling 0.5% in January.

Stocks at retailers jumped 0.8% after gaining 0.1% in January. A smaller trade deficit and the piling up of unsold goods at businesses contributed to the economy's 2.7% annualized growth rate in the fourth quarter.

(Reporiting by Lucia Mutikani; Editing by Chizu Nomiyama and Paul Simao)

© Copyright Thomson Reuters 2024. All rights reserved.