US Housing Has Peaked, No Fears Of Crash

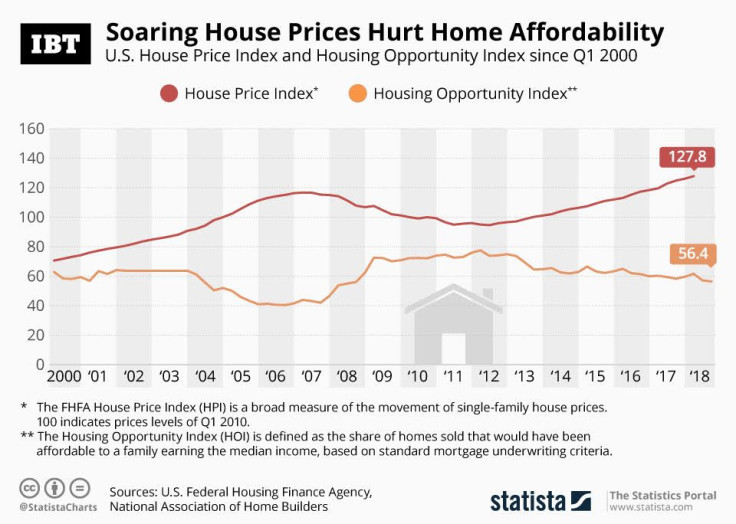

The U.S. housing market, where growth has ground to a halt from decreasing affordability, higher prices and a mindset change in potential home buyers, will take 2-3 years more to recover and contribute to the country’s growth.

At the same time, speaking to the International Business Times, analysts also dismissed talk of a housing bubble and allayed fears of a coming slowdown.

Perhaps the most striking contrast from 2008, and what has contributed to the current stagnation in the housing market, is what analysts call a mindset shift among potential buyers. They said homebuyers are not willing the way they were before the last bubble to extend themselves to a “very uncomfortable point.”

“It was previously believed that home values can only go up and it's the only way to build wealth, Yung-Yu Ma, Chief Investment Strategist at BMO Wealth Management said. “And everyone even if they had to stretch as far as was possible given their budgets, really wanted to make sure they purchase a home and got onto the home buying track. That mentality is much weaker today than it was in the past. There's not that sort of a strong drive for homebuyers to extend themselves.”

“It’s just a shift in thinking about housing in terms of shelter rather than in terms of an investment, which people are going to expect to make large capital gains on and try to use as a piggy bank to take money out of their house if the house appreciates enough,” he added.

Supply is tight too. “There's not a tremendous amount of supply being brought into the market and the home builders’ costs are increasing -- input and labor costs, and land is expensive. They are less interested in building some of the lower margin, entry-level homes because home builders are going to make less money on that,” Yung said.

The housing market saw the median house prices touch a high of $257,000 in April, 2006, from a low of $177,500 in September, 2002, during a period when the housing starts consistently ranged above 1.6 million. The recent data showed median housing prices at $309,700 in October, 2018. However supply remained just at 1.2 million.

Rising mortgage rates have also weighed on trade-up buying. “The idea that someone wants to move from, say, a $400,000 house to a $600,000 house maybe that they could afford it if the interest rates were the same, but now the interest rates have gone up a percent and a half since 2016,” Yung said.

The 30-year mortgage rate from Freddie Mac for October was 4.83 percent, up from the average 30-year mortgage rate of 3.66 percent in 2012. Separate data from the Census Bureau showed homes priced at $400,000 or more accounted for 28 percent of new homes sold in October, versus 33 percent in September, suggesting an increase in affordability concerns related of higher mortgage rates.

Yung said another 50 basis points rise in interest rates would hurt affordability and even with flat prices it would take a while for wage growth to catch up to the interest rate increases.

“It could get a little bit worse before it gets better if interest rates keep increasing,” he said. Yung expects interest rates to level off in mid-2019 and wage growth to continue in a way that “gradually affordability will come back in-line to make it a bit healthier housing market.”

The slow pace of wage growth is also taking a toll on affordability. Wages in the United States increased 4.6 percent in September, 2018, over the same month in the previous year. Wage growth in the U.S. averaged 6.22 percent from 1960 until 2018, reaching an all-time high of 13.78 percent in January of 1979, and a record low of -5.88 percent in March of 2009.

“We're not expecting a crash by any means, but a sort of stagnating market that's not adding to people's wealth, that's not adding to GDP growth, that could be with us for a couple of years. I would expect it's more of a 2-3 years issue and the market could balance itself over that time frame,” Yung added.

Yung expects a negligible home price appreciation for 2019 and said “a reasonably good outcome would be zero contribution to GDP growth,” but he does not expect it to turn down or create a negative wealth effect. “It is not a disastrous outcome for the economy or for homebuyers,” he said.

Jonas Goltermann, developed markets economist at ING, echoed the thought. “We see price growth falling, probably not hitting zero. I think we see mortgage rates obviously grinding higher, home sales probably flat or falling slightly, new unique construction similarly flat or falling slightly. So, it’s a story not of a collapse but a definite sort of stagnation in the housing market.”

Another dampening factor for the housing market is the changes in the tax law. Analysts think the new tax law has had a negative impact on the housing market and has added to the slowdown in the marketplace.

Yung explained two things that have happened with the tax law changes – first, the benefits of owning a home -- the deductions -- have come down. Second, there's been an increase in the standard deduction in taxes.

“You don't have to own a home to get a little bit bigger tax break and for owning a home -- the benefits to that have come down as well. So when people are netting all these things out the benefit of owning a home has actually decreased pretty meaningfully in terms of the tax benefit,” Yung said.

The tax law changes have resulted in a slight shift in the equilibrium between renting and owning a home, analysts said.

“If you have a choice between buying a home or renting, previously you would have had a stronger incentive to buy the house because you could offset some of your interest payments against your tax payment,” ING’s Jonas said. “Now there's still a case for some, but the tax cuts have sort of shifted the balance so that some people on average income won't take advantage of a mortgage deduction anymore. They will just use the standard deductions. They don't have as much of a trade-off between owning and renting.”

Yung cited the massive amount of student loan debt in the U.S. is another limiting factor for the housing market. In 2008, the total student loan debt was about $600 billion, but currently it is about $1.4 - $1.5 trillion. The total mortgage debt is only about $9 trillion.

“The student loan burden is very large and generally concentrated in the age range that might currently or soon be considering home purchases. That’s definitely another drag on the home buying market,” Yung said.

HOUSING BUBBLE?

Analysts do not think the current housing data suggests a housing bubble or is a precursor to a recession.

Compared to 2008 data, Yung said the current prices adjusted for GDP growth and the affordability index aren’t showing extreme values.

“More importantly the underwriting standards have been tightened up severely by banks since the pre-financial crisis time. So, people, by and large, can really afford the homes that they own,” Yung added.

He said the only thing that would point more toward the possibility of recession would be if there is really an expectation as took place in 2008-2009 for housing prices to really decline meaningfully.

“A decline of, say, 10 percent or more in housing prices would start to kick in that idea of a negative wealth effect where people start to curtail their spending because their overall wealth has gone down enough that they start cutting back in other ways,” Yung said. “But we just don't see that happening.”

“We certainly can understand that after the experience in 2008-2009 there're probably a lot of people that will have jitters and concerns because it did leave very deep scars during that time period,” he added.

© Copyright IBTimes 2025. All rights reserved.