US Oil Imports: Reliance On Top 5 Foreign Supplies Hits 15-Year High

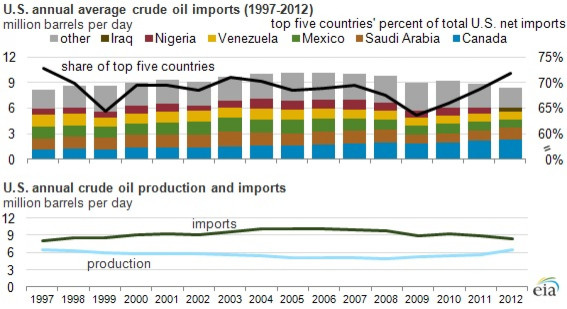

U.S. dependence on imported oil has declined sharply since peaking in 2005. However, the drop has not translated into diversification of supply sources. On the contrary, America’s reliance on the top five foreign suppliers has increased significantly over the past few years, rising in 2012 to a 15-year high.

Nearly 72 percent of all the oil imported by the U.S. last year came from these countries: Canada, Saudi Arabia, Mexico, Venezuela and Iraq, the Energy Information Administration said.

That share is up from around 64 percent in 2009, when the economic recession resulted in declining U.S. crude oil demand, and the highest share since reaching almost 73 percent in 1997. During 2012, Iraq replaced Nigeria as the fifth-largest supplier of U.S. crude oil imports.

The concentration comes even as the U.S. reduced its total crude oil imports in response to higher domestic oil production thanks to the shale revolution.

U.S. oil production topped 7 million barrels per day for the first time in two decades in February and is expected to "grow rapidly" through 2016, the EIA said. The EIA, in its short-term energy outlook, said monthly crude oil production could surpass net crude oil imports later this year.

Last year, the U.S. imported 8.49 million barrels a day of crude oil, the lowest since 1997 and down more than 16 percent from a peak of 10.12 million barrels a day recorded in 2005. Net crude imports from the top five countries averaged almost 6.1 million barrels a day in 2012.

The concentration is due to increasing reliance on Canada, Saudi Arabia and Iraq, while crude oil purchases from Mexico and Nigeria have dropped. Venezuela was stable. Canada sent, on average, a record 2.4 million barrels a day to the U.S. last year, which is 8 percent more than in 2011. Saudi Arabia imports averaged almost 1.4 million barrels a day in 2012, up 14 percent from the previous year and the highest level since 2008.

Mexican crude oil exports into the U.S. followed the opposite path, dropping below 1 million barrels a day for the first time since 1994, which reflects the steady decline in Mexico’s domestic production. Venezuela exported 4 percent more crude to the U.S. than the previous year, reaching 906,000 barrels a day on average in 2012 -- the first increase since 2007.

Iraq supplanted Nigeria as the No. 5 supplier during 2012. Iraqi crude imports averaged 474,000 barrels a day last year, up around 3 percent from 2011. Meanwhile, Nigeria suffered a 42 percent drop in crude oil exports to the U.S. to 0.4 million barrels per day, the lowest since 1985.

© Copyright IBTimes 2025. All rights reserved.