U.S. Retail Scene In Shake-Up As Costco (COST) Gains On Competitors: Deloitte

Costco Wholesale Corporation (NASDAQ:COST) grew sales the fastest by far among the world's top 10 retailers in 2012, more than doubling the yearly growth of Wal-Mart Stores Inc. (NYSE:WMT), according to a Deloitte LLP report released Monday.

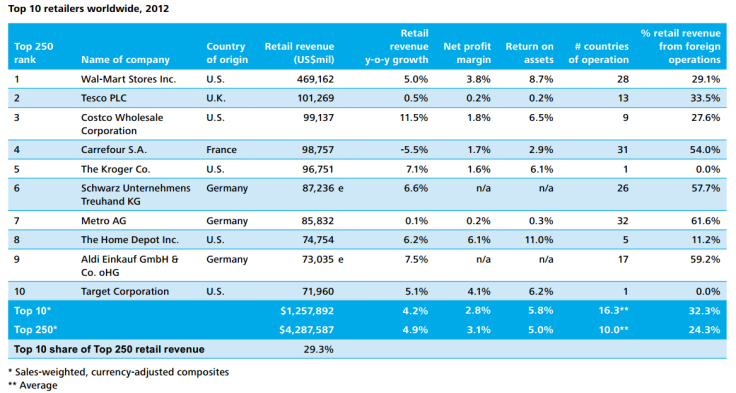

Costco enjoyed 11.5 percent retail revenue growth in 2012, beating out Wal-Mart's 5 percent, according to the Deloitte analysis. Wal-Mart still ranked as the world's top retailer by a wide margin, however, with $469 billion in annual revenue, compared to Costco's $99 billion.

European retailers fared badly in 2012, with the U.K.'s Tesco PLC (LON:TSCO) and Germany's Metro AG (FRA:MEO) inching revenue up by 0.5 percent and 0.1 percent, respectively. France's Carrefour SA (EPA:CA) actually saw sales revenue decline by 5.5 percent, making it the only global retailer in the top 10 whose sales contracted.

Carrefour used to be the world's second-largest retailer, and its fall to fourth place is partly due to its spinoff of the Dia discount chain in 2011. Tesco reported its first annual loss in almost 20 years in 2013 and has struggled to gain traction in the U.S. and China.

Costco jumped from sixth place in 2011 to third in 2012, thanks to a double-digit sales gain, according to the report. The Issaquah, Wash.-based company earned $2 billion in profits in its fiscal 2013, it said in October, with a 6 percent sales gain for the year.

Compare that to heavyweights like Wal-Mart, which saw U.S. same-store sales decline 0.3 percent in its latest quarter.

Shifts among the world's top retailers were far more pronounced this year than usual, with much movement within the rankings, said Deloitte chief global economist Ira Kalish at a New York retail conference on Monday.

"This is a very different list than it was just a couple years ago," said Kalish.

Europe's top retailers were dominated as usual by food retailers like Tesco and Carrefour, while big-box and diversified retailers ruled in U.S. markets, he said. European retailers saw a tough year as a stagnant regional economy slowed consumer spending, while Latin America retailers grew the fastest, with 14.7 percent sales growth. Asian retailers slowed from double-digit gains seen in recent years, while Africa and the Middle East seemed a promising global retail playground, with the second-strongest sales growth.

The world's top 250 retailers earned 24 percent of their retail revenue from foreign operations, up slightly from the past two years. European retailers remained the most dependent on foreign revenue, generating nearly 40 percent of total revenue from overseas operations. Japanese retailers were the leaest globalized, earning just 7.7 percent of revenue from foreign markets, less than half that of North American retailers (16.1 percent).

The report also ranked global e-retailers for the first time, though it excluded e-marketplaces like China's giant Alibaba Group Holding Limited or Japan's market leader Rakuten Inc. (TYO:4755)

Unsurprisingly, Amazon.com Inc. (NASDAQ:AMZN) ranked as the world's top e-tailer by a huge margin, with $51.7 billion in fiscal-year 2012 e-sales. Apple Inc. (NASDAQ:AAPL) came next, with $8.6 billion in e-sales, though this excludes an estimated $10 billion in app sales.

Wal-Mart came in third, though analysts have noted that its e-commerce business, as a percentage of total sales, is small relative to rivals'. Wal-Mart's e-commerce sales were 1.6 percent of its total revenues, according to Deloitte, compared to, say, 19.3 percent for Staples Inc. (NASDAQ:SPLS) or 7.2 percent at department stores like Macy's Inc. (NYSE:M).

The world's top 250 retailers earned revenues of $4.29 trillion in 2012, with yearly growth of 5 percent and average revenues of $17.5 billion. Deloitte counted only retailers with revenues above $3.8 billion.

U.S. retail sales statistics for the crucial December period are due out Tuesday from the U.S. government. ShopperTrak estimates that sales grew 2.7 percent for 2013's holiday season, though shopper traffic declined 14.6 percent.

The global retail industry is worth an estimated $15 trillion in annual revenues, though consumer spending has been hit in past years as developed economies suffered fallout from the 2008 financial crisis.

The Deloitte presentation happened as global retailers gathered in New York for the National Retail Federation's annual Big Show trade conference, expected to see some 30,000 attendees. The NRF in its latest annual report estimates that retail accounts for one-fifth of the U.S. economy.

© Copyright IBTimes 2025. All rights reserved.