U.S. Weekly Jobless Claims Hit 8-month High; Producer Prices Come In Hot

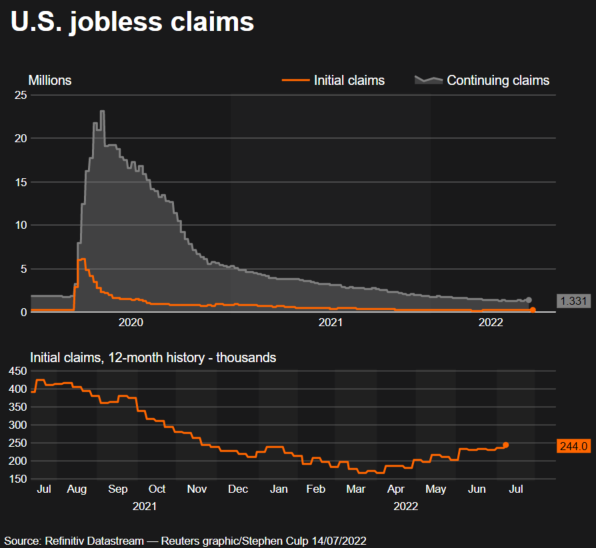

The number of Americans filing new claims for unemployment benefits increased to an eight-month high last week, suggesting some cooling in the labor market amid rising interest rates and tighter financial conditions.

Despite the second straight weekly rise in claims reported by the Labor Department on Thursday, labor market conditions remain tight, with very few people on unemployment rolls. The Federal Reserve is raising borrowing costs to dampen demand for workers and ultimately slow the overall economy as it battles to bring inflation down to its 2% target.

"The underlying direction has shifted from a downtrend to one of a gradual increase," said Rubeela Farooqi, chief U.S. economist at High Frequency Economics in White Plains, New York.

"The data are still signaling strength, with the economy continuing to create jobs at a solid pace. But Fed actions will reset demand for labor, which will not only slow hiring but will also likely result in layoff levels moving higher from here."

Initial claims for state unemployment benefits rose 9,000 to a seasonally adjusted 244,000 for the week ended July 9, the highest since mid-November 2021. Economists polled by Reuters had forecast 235,000 applications for the latest week. Claims had been hovering around 230,000 since June.

There have been reports of layoffs in the interest rate-sensitive housing and manufacturing industries.

Unadjusted claims jumped 21,384 to 241,314 last week. New York state reported a surge of 10,209 in its claims.

There were notable increases in Kentucky, Indiana, Ohio, Connecticut, Pennsylvania and Arizona, some of which could be related to the automobile industry. Auto manufacturers normally shut down assembly plants for annual retooling around this time of the year, though a global semiconductor shortage has forced many to adjust their schedules. California, Georgia and New Jersey reported significant declines in claims.

GRAPHIC: Jobless claims

Even with the loss of momentum, demand for labor remains fairly strong. There were 11.3 million job openings at the end of May, with nearly two job openings for every unemployed person.

U.S. stocks were trading lower. The dollar rallied against a basket of currencies. U.S. Treasury prices fell.

GLIMMERS OF HOPE ON INFLATION

The Fed's "Beige Book" report of anecdotal information on business activity collected from contacts nationwide showed on Wednesday that "most districts continued to report that employment rose at a modest to moderate pace and conditions remained tight overall" in early July.

But it noted "weaker demand for workers, particularly among manufacturing and construction contacts." Economists say weekly jobless claims need to increase above 250,000 on a sustained basis to raise concerns about the labor market's health.

The government reported last Friday that the economy created 372,000 jobs in June, with a broader measure of unemployment falling to a record low.

The number of people receiving benefits after an initial week of aid fell 41,000 to 1.331 million during the week ending July 2, the claims report showed. The so-called continuing claims, a proxy for hiring, are not too far from levels last seen in late 1969.

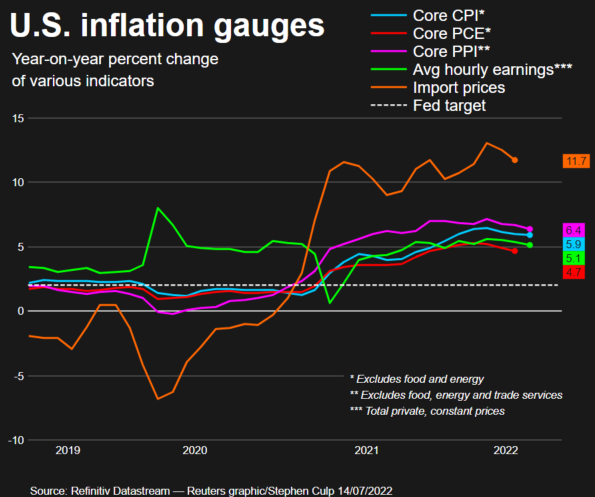

Expectations for the Fed to raise its policy rate by another 75 basis points at the end of this month were further bolstered by a separate report from the Labor Department showing an acceleration in producer prices in June. The report followed on the heels of news on Wednesday that annual consumer prices surged 9.1% in June, the largest increase since November 1981.

The U.S. central bank has hiked its overnight interest rate by 150 basis points since March.

The producer price index for final demand climbed 1.1% last month after rising 0.9% in May. Prices were boosted by a 10.0% jump in energy, which reflected higher costs for gasoline, diesel fuel, electric power and residential natural gas. Wholesale food prices edged up 0.1%. The cost of services rose 0.4% after climbing 0.6% in May.

GRAPHIC: Inflation gauges

But there are some glimmers of hope that price pressures could be nearing a peak. Crude oil prices have fallen sharply, with the global benchmark Brent trading below $100 per barrel after surging to $139 in March, which was close to the all-time high reached in 2008.

Other commodity prices are also coming off the boil.

Underlying wholesale inflation slowed in June. Excluding the volatile food, energy and trade services components, producer prices rose 0.3% in June.

The so-called core PPI increased 0.4% in May. In the 12 months through June, the core PPI advanced 6.4% after rising 6.7% in May. That marked three straight months of deceleration, which reflected an easing in supply chains.

"Cooler producer price pressures will start to make a difference, unless, of course, some new supply-side disaster unfolds," said Will Compernolle, a senior economist at FHN Financial in New York.

Compernolle also noted that spiking prices of essential goods were causing consumers to cut back on other products, slowing price increases of the related merchandise.

"That kind of decision making has been absent since the first pandemic rescue plan in the spring of 2020, but it appears to be making a comeback now. It is the first step to ultimately taming inflation," he said.

© Copyright Thomson Reuters {{Year}}. All rights reserved.